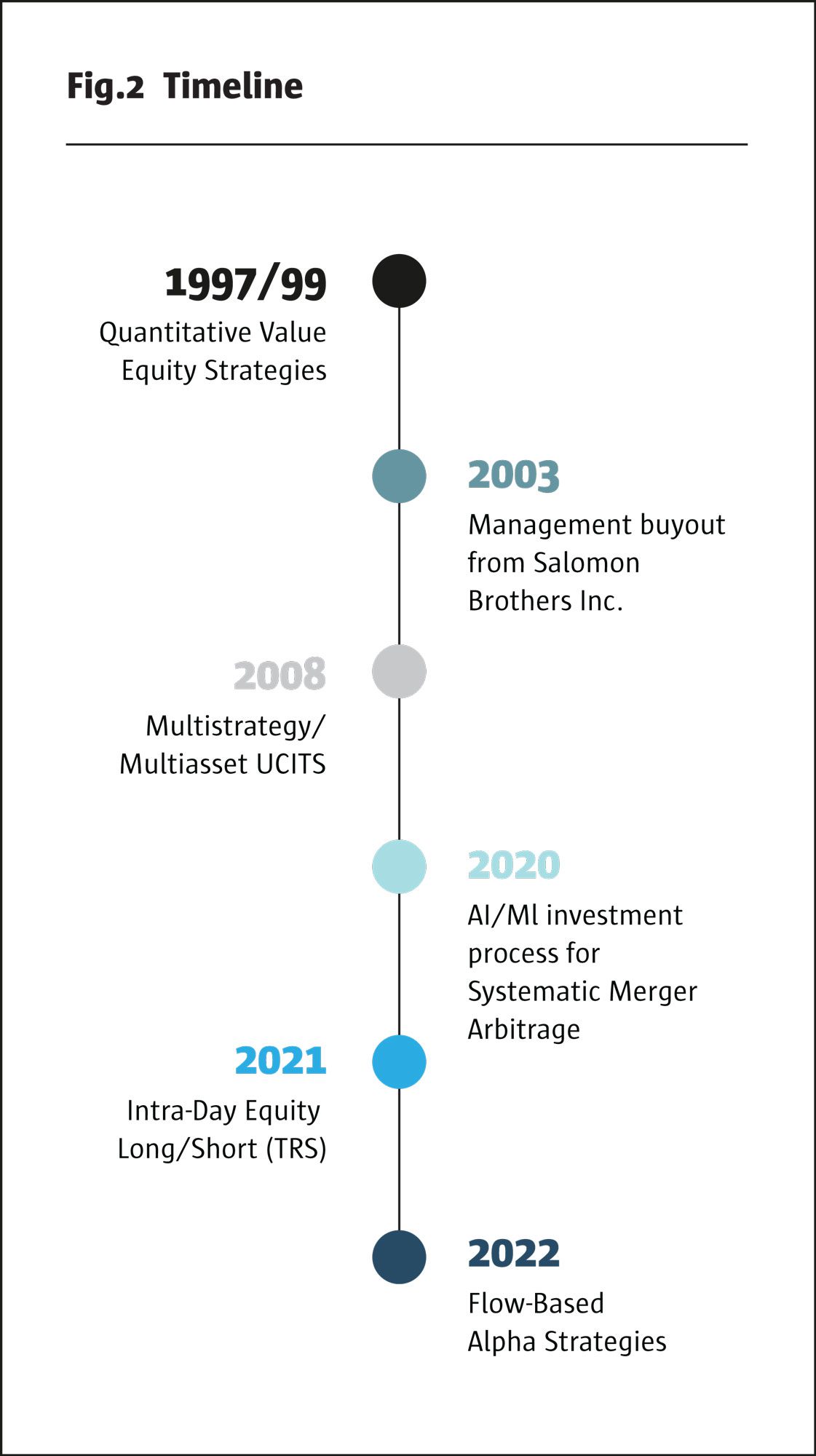

First Private Wealth A has received The Hedge Fund Journal’s UCITS Hedge 2024 award for best performing fund over 10 years ending December 2023, in the Quantitative Multi-Strategy category, based on risk-adjusted returns. The product was one of the first movers into the nascent dividend futures market after the GFC, demonstrating innovation from the start.

First Private co-founder, Martin Brueckner, who recently authored a note reflecting on 20 lessons from 20 years of investing, joined the Frankfurt office of Salomon Brothers Asset Management after graduating in 1999 and became a junior portfolio manager. An MBO of Salomon’s German unit, which ran strategies catering for local investors, gave birth to First Private Investment Management (FP).

We believe that retail and institutional flows drive prices in the short term. Both long only and statistical arbitrage or pairs trading flows can be relevant.

Martin Brueckner, Co-Founder, First Private

One area of expertise, value long only equities, did very well after the TMT bubble burst but suffered in the GFC when drawdowns over 50% spurred investors to search for new sources of diversification in FP’s multi-strategy product, which was seeded with partner and ‘friends and family’ capital in 2008. It later raised assets from wealth managers who sought a packaged solution combining beta and alpha exposure.

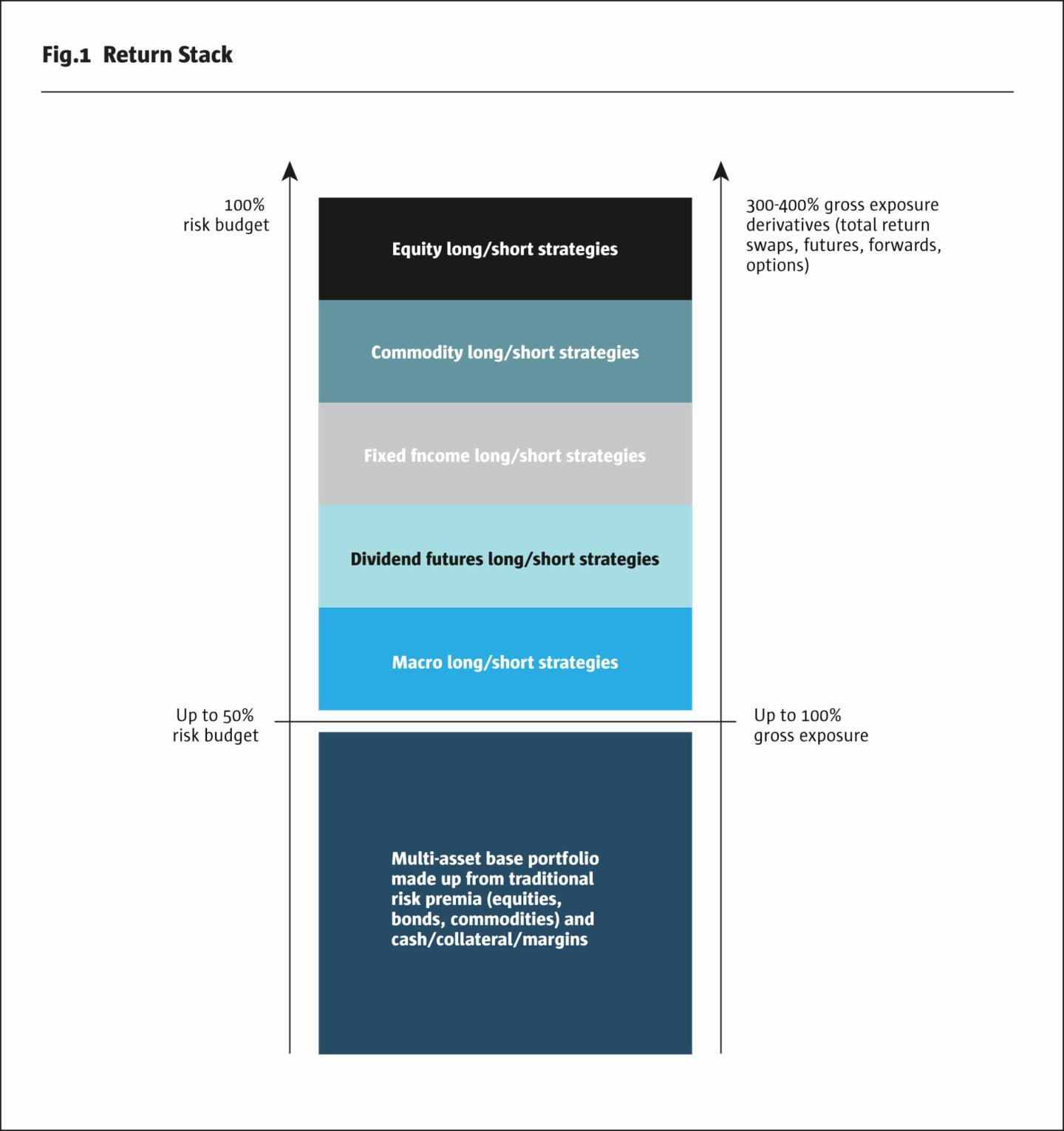

Return targets – alpha, diversification, beta, leverage

The return target is money market plus 3-4%, with a Sharpe ratio around one. With zero interest rates, the return target was 5%. But now rates are approaching 4% (applying to about 80% of the fund that is in cash), the return target is at least 7%, matching the volatility ceiling. The average long run Sharpe for individual strategies is around 0.5 but diversification benefits boost portfolio Sharpe. “Realized correlations between the strategies are very low, between minus 0.1 and plus 0.1, and there has never been any need to remove a strategy that became too correlated,” says Brueckner. Of course, Sharpes are cyclical and in any given year the Sharpe for an individual strategy might be negative or above one.

Martin Brueckner, Co-Founder, First Private

Leverage has usually been between 300% and 400% and has been capped at 550%. “The level of leverage is mainly a consequence of bottom-up strategy selection. For instance, commodity strategies with time spreads or fixed income strategies can use more leverage,” points out Brueckner.

Modest equity and bond beta

Over long horizons, alpha is expected to make two thirds of returns, and this has been achieved. “Now that alternative risk premia are relatively high, we expect this to continue and see a healthy contribution from exotic betas,” says Brueckner.

The strategic asset allocation is relatively fixed in a kind of risk parity framework, that avoids the leveraged bond exposure of many risk parity approaches.

Tactical asset allocation can take views on equity beta, which has ranged between about 0.1 and 0.4, and added about 1.5% per year to returns, contributing about 75% of beta returns versus 25% for fixed income beta. “The limited fixed income beta has been taken with more asymmetric option exposures and has been very opportunistic, owning bonds for just a few days each month around flow signals. Thus, fixed income betas average quite low, usually between two and four years, but can spike up for shorter periods,” says Brueckner. The team’s expertise in macroeconomics does not play a major role in asset allocation. “From the start there was very little interest rate duration exposure because the team were not sure if the GFC would end in a deflationary bust or an inflationary environment. It took a long time before rates rose and it was useful to have avoided rate exposure in 2022 and 2023. We still have no strong view on whether rates rise or return to pre-Covid lows.”

Idea generation

All the strategies are drawn from FP’s library of alpha signals, but only two of them are currently offered on a standalone basis in other UCITS funds: the commodity strategy and the systematic merger arbitrage strategy. “For most of our strategies, it makes sense to have them as part of the multi-strategy, to benefit from low correlation and leverage,” says Brueckner.

Most signals are alpha, but some in areas such as merger arbitrage can also be viewed as exotic beta. “We use a quant process in a very broad based and systematic way,” says Brueckner.

The majority of the alpha library signals, running into hundreds, relate to equities, and a narrower range around dozens of signals apply to macro, FX, fixed income and commodities.

Flows

Flow research, based on both academic studies and real-world investing, is one example of an ongoing research stream that feeds into multiple strategies across asset classes. “We believe that retail and institutional flows drive prices in the short term. Both long only and statistical arbitrage or pairs trading flows can be relevant. Rebalancing periods have become more frequent since the 1990s, moving from quarterly to weekly and now daily for equities,” says Brueckner.

The commodity strategy has one signal based on index roll dates. And currency strategies heed fixings when large volumes are traded. “These can lead to some price reversals, though they may not be big enough to exploit after allowing for transaction costs,” Brueckner points out. FP try to minimize market impact, and closely monitor their brokerage fees which Brueckner believes are very competitive rates. They also trade around closing auctions to avoid market impact.

Fixed income long short

The fixed income long/short strategy trades two alpha driven sub-strategies: Treasury auctions and event flow driven. The auction strategy puts on curve flatteners or steepeners, perhaps long or short the two-year against the opposite position in the ten-year, to trade around Treasury Bond auction schedules. “These trades are market neutral overall to focus exposure on the maturity point in the curve where auctions are taking place,” explains Brueckner. Meanwhile the event driven strategy is more about anticipating big flows from pension fund investors around month end. Treasury and European bund futures, rather than physical bonds, are traded to reduce costs.

Equities

The global equity market neutral strategy includes both equity market neutral and equity long/short strategies. They can range from very short-term intraday strategies in the US, to more factor oriented medium term strategies globally. Overall, the equity strategies are broadly factor neutral but some of them do use value signals. “For instance, November and December 2020 were some of the best months, but value is also balanced by exposure to other factors such as momentum and quality. Sometimes we have won on the value style but lost on the momentum style, and in other years both signals perform. It all depends on the regime. Value has been de-emphasized. Over the years we have tried to neutralize style exposures a bit more because value was quite painful for many years. Our long only equity funds in Germany remain quite value-oriented,” explains Brueckner.

Signals can also be layered on top of each other. “Even when a signal provides a very small amount of incremental added value, it is worth including, because transaction costs are already covered by other signals.”

(The product is partly structured for German tax efficiency, which implies at least 25% in physical equities, and there is usually around 30%. This exposure is hedged back with futures based on the implied repo rate and swaps are used for single name shorts.)

Dividend futures

The dividend futures long/short strategy currently trades a long/short dividend versus spot strategy, and a long/short regional strategy, using forecasts in the alpha signal library. Single name dividend futures trading ceased after 2020 because it was not diversified enough. Since 2020, dividend risk premia have expanded. “The European dividend futures markets are most liquid, but risk is spread across regions to benefit from different sector dynamics. For instance, tech companies in the US are often raising dividends, whereas some financials and insurance names in Europe have reduced dividends during crisis times. There is also some exposure to Japanese Nikkei 225 dividends and a very small exposure to Hong Kong.

Commodities

The First Private Commodities Long/Short strategy was created by Christian Schuster, who featured in The Hedge Fund Journal’s 2023 Tomorrow’s Titans report. It is based on four pillars of strategies: curve and carry, momentum, passive flows and seasonality. Its nickel exposure in 2022 emerged unscathed from the London Metal Exchange’s controversial actions. “The position was already up 30-40%, and went up the same again, so the cancellation of trades just gave back previous profits and did not impose any actual loss,” says Brueckner.

10YR

First Private Wealth A received The Hedge Fund Journal’s UCITS Hedge 2024 award for best performing fund over 10 years (ending December 2023) in the Quantitative Multi-Strategy category.

Macro

Macro long/short trades three asset classes: equity index futures, foreign exchange and volatility – long and short, while carbon and crypto exposures, traded since 2020, can switch between long and zero. Equity indices trades 24 futures on relative value, screened for liquidity.

Foreign exchange trades G20, developed market and emerging market forwards, including some of the larger emerging markets units like Mexico, Brazil and South Africa. Currency exposures in February 2024 include Icelandic Krona, South African Rand, New Zealand Dollar and Japanese Yen. These are part of the fixed income strategies, based on factors such as carry, value and trade surpluses. The Icelandic Krona is perceived as an emerging markets currency but is single A rated, has high interest rates and a current account surplus. Volatility trades the front month of VIX and VSTOXX futures on a relative value basis. Carbon trades the largest and most liquid EUA future, via ETCs, and crypto trades bitcoin via ETCs.

Evolving hedging portfolio

The hedging portfolio, referred to as the “safe haven” on the FP newsletters, has evolved over time, using different asset classes and instruments. It started out seeking substitutes for government bonds but has adapted to changing patterns of correlation in markets where rising rates were sometimes a driver of “risk off” behaviour. “Hedges historically included forwards on the Swiss Franc. This started to become very correlated to risk appetite during the sovereign European crisis. We also used long/short combinations such as long large cap, short small cap equity futures, or long gold and short oil,” recalls Brueckner.

Evolution and dividends

Indeed, adapting to new market climates is one of Brueckner’s 20 lessons that also applies to the strategies. The dividend strategy saw the biggest revision after the largest single monthly loss of 20% and single strategy loss of 13% came from the dividend futures in March 2020. The fund had long exposure to shorter term dividend futures that were viewed as being low risk and almost riskless. This position was wrong footed by an unprecedented ban on some companies distributing profits from the previous year. Losses were crystallized around the lows as the strategy dropped by 60-70%. Losses came mainly from European dividend futures and were partly recovered from US and Japanese exposure later in the year.

The dividend strategy was subsequently modified to a long/short strategy with a maximum of 10% net long exposure at the multi-strategy fund level. This change would have halved the 2020 losses to about 6.5% from the dividend strategy.

The index rebalancing strategy has also evolved over time. It started out with very straightforward index adds and deletes which had huge momentum factor exposure, which was later neutralized.

Machine learning development

Nearly all the strategies are run in-house, with one historical exception: machine learning equity long/short specialist, Artellium, which forms part of FP’s partner network, FP Investment Partners. FP Multistrategy needs full transparency to net all positions from transactions and optimize margins. “If we invested in an external strategy, we would not be able to see the live positions. Artellium has a UCITS on the First Private platform, which is implemented in partnership with us. Any other external allocations with the right strategy and capacity fit would also need to offer full look through transparency,” says Brueckner.

Supervised machine learning automation is the main factor to watch going forward, which uses artificial intelligence and new data sources to add more strategies and improve alpha. “There is some fluidity between the machine learning and quantitative concepts. Some would say we always used machine learning, with more computer power allowing for more data sources such as sentiment scores,” points out Brueckner.

Machine learning is starting to automatically update models. “For instance, the database of merger deals can add variables such as deal motivation, leverage, and size of acquirer or target to help determine how the risk profile of different deals has changed over the past 30 years,” explains Brueckner.

These techniques are playing an increasingly powerful role in mixing, blending and optimizing models: “We are now moving towards running multiple models, where dozens of signals and models all get averaged using an ensemble approach to cancel out noise and errors, and optimize to make more quant driven decisions, reducing discretionary input into models,” says Brueckner.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical