In 2013 we profiled Campbell & Company, a then 41 year-young firm, as it embarked into a new era. The leadership baton had been recently passed with two new co-leaders at the helm, and as one of the most tenured CTAs, it had caught a new wave of investor attention as research and product initiatives began to set the course for the emergence of Campbell as a leading innovator in the CTA industry.

Four years later, as the firm begins its 45th year, Campbell remains on the path of progression by being among the most active quantitative managers in terms of product innovation spanning hedge funds, quantitative equities and liquid alternatives (’40 Act and UCITS). We touch on all of these, but a 360 degree perspective on the firm shows that changes already in effect – and others in motion – are much broader and deeper than rolling out new strategies and distribution channels.

Mike Harris and Will Andrews, who have worked together at Campbell for 17 years and led the firm for the past five, indicate that a successful evolution is about much more than product launches. They’ve set out a multi-layered strategy with four broad themes focused on transformative growth: succession planning; client outreach and education; culture and talent; and product evolution. In each of these areas, tangible results are clearly visible.

Transparent Succession Planning and Inclusive Incentives

Andrews, who has spent 20 years at Campbell, makes his long-term vision clear by starting the conversation with succession planning. This is an afterthought for some firms and it can be opaque for others. Not so at Campbell. When he took the helm, Andrews set out uncompromising ambitions to founder Keith Campbell: zero tolerance for key man risk meant that succession plans had to be transparently predefined at every level of the firm, with an automatic game plan, which the firm has already started implementing. The policy started at the top: Harris and Andrews are “interchangeable, and this is the first time the firm has had two co-leaders,” reflects Andrews.

Harris acknowledges that many firms of Campbell’s age have greying leadership and have been through succession-planning processes, but Campbell is distinguished by having maintained 100% employee ownership, in accordance with the founder’s conviction from the outset in 1972. Andrews is also adamant that all key individuals – and not just the executive team – should be properly incentivised. To that end, he is pleased that “phantom equity or profitability participation was extended to a significant part of the firm at the beginning of 2015.”

While Campbell has created its Ownership Succession Plan without any external capital, a number of other managers have sold stakes to specialist investors or larger asset management firms whose business model is acquiring and trading these equity participations. Harris fully recognises the benefits that such alliances can bring in terms of relationships and distribution channels, but he also questions whether the interests of the new affiliates are always aligned with those of investors and employees. If strategy capacity constraints are not respected, such deals could potentially “degrade Sharpe ratios and performance if firms carry on raising capital until performance deteriorates,” Harris argues. Campbell runs around $4 billion and has capacity available.

Dr. Kevin Cole’s new role as Campbell’s Deputy Chief Research Officer exemplifies Campbell’s pre-emptive approach. “Good succession planning starts very early in the process and we are already developing the next layer of leadership so they will be trained when they step into the role,” Andrews points out. Campbell started by identifying five, and subsequently six, directors of investment strategies, who act as sub-heads reporting to Chief Research Officer, Dr. Xiaohua Hu. “We always had a very strong pool to choose from but it came to the point where we wanted to formally announce who would be the next head of research,” Harris explains. Indeed, Dr. Cole has been in the role of Deputy Head of Research since the start of 2016, with all research directors now reporting into him. Harris pays tribute to Dr. Hu’s 20 years of “phenomenal thought leadership in the firm and industry, including working very closely with Kevin for the past three to five years” and indeed, Hu is very much still part of the team. “There is no timeline for when Dr. Hu may retire or move to a more strategic role, but we are ready well ahead of that time,” Harris points out.

Andrews confirms that the same forward planning has taken place elsewhere in the firm.

This is natural for a systematic investment firm. In common with leading quantitative hedge funds, Campbell builds back-ups for its quantitative models and IT systems, to ensure a high level of ‘redundancy’ (meaning that one server or system can spring into action if another one goes down) and the same principles apply to human resources. The transparency around succession planning is also a defining feature of Campbell’s culture: “people cannot be expected to operate in the dark and they need transparency at all levels,” Andrews explains.

Empathetic Client Outreach and Expansive Education

Campbell has always taken pride in client service, but in 2013 Harris wanted to institute “truly a client-first culture because investors upped levels of due diligence and ongoing monitoring of managers for good reasons.” As he’d heard from investors, “scandals caused people to review processes and procedures.” Campbell resolved to set up three separate groups all working with the common goal of providing superior customer service. First, the Client Solutions Group provides just that – needs-based solutions – including customised products for institutional clients. Second, the Investor Relations team is completely focused on ensuring that the sophisticated needs of Campbell’s investors are met. This includes operating as the clients’ liaison within the firm by coordinating efforts across research, trading, and other key functions needed to deliver the transparency, education, ongoing reporting and service that modern investors demand. The third team is Marketing, whose charge is to expand Campbell’s brand and impact as a thought-leader across the industry. This spans multiple mediums of communication: websites, videos, white papers and articles. Campbell decided to hire dedicated people with varied financial services backgrounds including a blend of experience with hedge funds and more traditional asset managers. Campbell is making this extra effort because “hedge funds are now talked about on a daily basis in the financial media,” Harris observes, and the results are pleasing: already feedback shows that “the ramp-up of these three groups was crucial to our client-first culture.” As part of this drive, Campbell has continued to make strategic hires for outreach and education.

Outreach: New York Office

The most recent addition to Campbell’s team is Joe Kelly, who heads up the Client Solutions group, out of Campbell’s New York office. He is well-versed in alternative investments, having worked for Russell Investments on the West Coast, and been Head of Sales and Marketing for another North American CTA, Rotella Capital, after starting his career as an options trader in the pits in Chicago. His leadership from the New York office – which THFJ visited shortly after it opened – is paramount by allowing clients easy access to Campbell. It is also a base for video-conferences to expand the presence of the full Campbell team. “We have the right talent and the right resources in the right locations”, states Harris and New York is now the nerve centre for the institutional sales function. Though Campbell’s headquarters in Baltimore, Maryland is only 2.5 hours by train from New York, and allocators do visit when they get to the due diligence stage, investors at an earlier stage in their process historically struggled to escape from New York during a five day week. This meant Campbell had to do the legwork, commuting to and from New York to meet clients there. Now, advances in video-conferencing make it possible to link and join conference rooms between Baltimore and New York using jumbo-size screens covering the wall, providing an experience that truly rivals a face-to-face meeting. This relieves research staff of the need to take a whole day out of the office. Even within Campbell’s Baltimore office, Campbell’s Cisco phones all include built-in cameras to speak with their co-workers via video phone “to give a sense of inclusion and connection,” Harris adds.

Education and Thought Leadership

As Campbell reaches out to a wider audience of potential investors, “we have clients who know the CTA space and those who do not,” Harris observes. Therefore, education is now at a premium and hires including the likes of Dr. Katy Kaminski – whom we featured in The Hedge Fund Journal’s 2015 ‘50 Leading Women in Hedge Funds’ survey, sponsored by EY – is a renowned and widely published academic in the managed futures space. Harris is delighted that “with her prior experience at MIT and the Stockholm School of Economics, she is a natural teacher and the perfect person to educate investors.” Kaminski authors articles, white papers, and presents teach-ins focused not only on Campbell and its solutions, but on the broader managed futures industry. US investors, including pensions, insurance companies, endowments and foundations, are making strides into the systematic investing area. “Many of these allocators are trying to diversify for fear of future uncertainty, like 2008 – and many have read Kaminski’s historic CME Group paper on crisis alpha,” Harris hears as he and Kaminski tour the US – and some clients are looking at managed futures for the very first time. “Away from the biggest metropolitan areas, some of the smallest cities in America are waking up to the benefits of managed futures,” Harris reports.

Thought leadership for Campbell runs the gamut from one page articles anyone can understand to multi-page academic pieces. The objectives in all cases are transparency and clarity for clients. Campbell has addressed a range of topical questions. Given that the recent period has seen the first two Federal Reserve interest rate rises in a decade – and investors are braced for three more in 2017 – many allocators are revisiting Campbell’s 2013 paper ‘Prospects for CTAs in a Rising Interest Rate Environment’ that gauges how systematic strategies have historically performed during rising interest rates. This is particularly important since most of the industry’s existence has coincided with a multi-decade downtrend in interest rates. Authored by Susan Roberts, CFA, Product Specialist and Director of Investor Relations, Campbell’s research suggests that CTA strategies can profit from risingrates and the associated falling bond prices (and from the price moves in other asset classes during historical rising rate environments). And “the new administration’s fiscal and infrastructure spending could lead to an inflationary environment where the Fed becomes more aggressive in raising rates,” Harris suggests.

In another paper, ‘Deconstructing Futures Returns: The Role of Roll Yield’ Campbell clarifies the contribution made by an important building block of futures market returns: roll yield. Investors who have been disappointed by the returns of long oil ETFs in 2016 will appreciate that futures market returns can be very different from reported headline returns, based on spot markets. Campbell has dispelled a significant number of misconceptions around roll yield, and defined more precisely what it is.

Roll yield can be one component of carry, and ‘An Introduction to Global Carry’ is one of two papers that have laid the ground for product launches. If the concept of carry in currency markets is relatively well known, Campbell has broadened it to cover the major liquid asset classes, and has launched a strategy designed to capture this source of returns. Campbell’s latest paper, ‘The Taming of The Skew’, has also inspired the launch of a product: a trend following strategy with a dynamic risk target. This paper continues the ‘crisis alpha’ theme with thoughts on how CTAs can accentuate positive skew and deliver a ‘fat tail’ on the right hand side of the return distribution.

Attracting and Nurturing Talent in an Open Office Culture

These white papers can come from reverse enquiry, client requests, or may spring from internal debates within the research team. Campbell strikes a balance in maintaining a research culture that is both “collaborative and competitive.” Campbell does not inhabit the “concentrated idea pool of city centres such as New York and London and our people come from a wide variety of backgrounds,” Andrews stresses. He sums up the approach as: “We give our talent everything they need to be productive while enjoying their time in the office.”

Talent is one of four dimensions that Andrews uses to define culture, with the others being performance, client outreach and efficiency. “We do not just acquire talent, we also want to support, engage and educate our people,” he says. Andrews wants to make his mark on the culture at Campbell. “Though there were no problems, we can always continually improve,” he stresses. “As the market and our strategies evolve, so must our culture.”

Andrews is well aware that Campbell is part of a very competitive environment with plenty of world class employers vying to hire the best talent. Harris thinks that the advent of remote-working means that Campbell is also now competing with Silicon Valley firms, such as Facebook, Amazon and Google, for scientists, technology engineers and the like. So in 2013, Campbell hired a Director of Human Resources who was given a mandate to make Campbell a more attractive employer, and “create a more transparent, approachable workplace in terms of health, physical and financial wellness.”

Campbell’s cultural sensitivity is seen in Harris’s view that ‘millennials’ put a premium on the culture, social environment and wellness of their employers – as well as remuneration. Campbell’s efforts have twice been recognised with awards in Pensions and Investments’ annual ‘Best Places to Work in Money Management’ survey.

Harris explains how a large multi-purpose room is now a dedicated classroom and training centre that can accommodate the entire company; it has audio and video-conferencing equipment, can record seminars, internal or external speeches, and broadcast to New York or beyond. At Campbell University, new staff is educated on how and why Campbell does what it does. “Quants teach graduate level classes, we bring in outside speakers, and facilitate meetings within the firm,” he adds. Once again demonstrating the dislike of siloes, this is not just for research staff; everyone in the firm is encouraged to listen in and understand how futures markets work and how Campbell seizes opportunities. Unusually, the Investment Committee is also visible to the entire firm. Andrews and Harris sit on the committee, which meets daily and monitors all portfolio risk metrics in an open forum where all resident staff can sit in, while those located elsewhere, such as salespeople on the road, can tune into live broadcasts. Thus portfolio management is a transparent goldfish bowl at Campbell.

Work-Life Balance, Socialising, and Exercising

More informally, an on-site café makes fresh coffee all day long and doubles up as a bar at night, where teams can celebrate client wins, discuss projects, or congregate for informal trivia quizzes. “It is important in companies to get people in different departments to know each other socially,” stresses Harris. A gym inside the office is another prerequisite, inspired by a survey that found many staff were not using the external gym memberships that Campbell paid for. “Healthcare costs are rising in the US and a healthier employee is both more productive and happier,” notes Harris. Hence, Campbell has a state of the art fitness centre, with trainers brought in to teach classes and team-based workouts available throughout the week. Campbell staff have flexibility over what time of day they exercise. Certain staff like a morning session, some choose a lunchtime workout and others exercise in the evening, after work. This speaks to another important feature of the Campbell culture: flexibility. Though traders need to work market hours, and there are traders in the office around the clock, it’s understood that work-life balance is highly regarded, therefore staff is offered the stress-free flexibility in their schedules to account for it when necessary. Everyone is pulling their weight, however: “there is no feeling of doers and do-nots riding on them. The entire company is doers,” says Andrews.

Evolving Strategies and Diversifying Distribution Channels

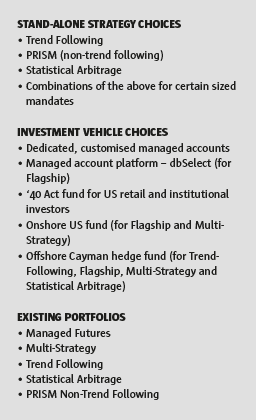

Product evolution for Campbell, at a high level, is “about providing the right access points and structures. The mission is always to enhance and expand offerings wherever alpha lies,” Harris makes clear. Though Campbell offers a growing suite of strategies, the firm’s genesis in trend following remains one of the most important and well known strategies. “The biggest area of new launches has been in trend following, as new investors are embracing these strategies,” Harris observes. Indeed, several systematic managers – including GAM Systematic (formerly Cantab), Fulcrum, GSA and Aspect Capital – have launched low-cost trend following products.

Reconfiguring Trend Models

Some CTAs have diversified away from trend following to the point where it makes up the minority of their portfolios, and they are sometimes described as multi-strategy quantitative funds. Campbell continues to overweight trend in its flagship programmes, and has innovated by broadening the scope of how it defines trend following. “We are going beyond market-based trends and looking for sector and factor differentiators,” Harris explains. This initiative is grounded in modern finance theory, such as Grinold and Kahn’s Fundamental Law of Active Management, which calculates the information ratio (or alpha) as the information coefficient (or skill) multiplied by the number of independent investment opportunities. Heightened correlation between markets, reducing the numberof independent opportunities, has led some CTAs (such as Man Group or Transtrend) to trade more markets in the search for diversification. Campbell’s response has been to recalibrate markets as clusters of associated markets, rather than single markets, for some models. This is because the firm’s research has shown that trends within groups of markets – defined by sectors or factor exposures or both – have often remained more robust than those exhibited by individual markets.

Trend following CTAs are also categorised by the lookback periods over which they measure trends. “The industry still has a big focus on long-term trend following, which is at the core of what we do, but short-term strategies add tremendous diversity and differentiates us from other managers,” says Harris. The best compliment Campbell has received from an investor was that the firm is “one of the most nimble trend followers in the multi-billion category based on how fast positioning can change,” he reveals. For instance Harris cites 2013 as showing how Campbell navigated the taper tantrum well, cutting and reversing to a short stance in bonds, and outperforming other CTAs over that episode. Similarly, the bond reversal seen in 2016 after Trump’s election has prompted Campbell’s models to switch out of long bond positions.

Redefining Non-Trend

As well as differentiating its approach to trend following, Campbell is articulating more clearly what its non-trend strategies are. “Non-trend is a large bucket and it is difficult to describe something as what it is not instead of exactly what it is,” Harris acknowledges. So Campbell has now categorised its non-trend models into two buckets: systematic macro and short term. Systematic macro includes strategies based on fundamental data and cross-asset relationships, as well as carry applied to all asset classes. Meanwhile, short term is a real differentiator which includes mean reversion and faster moving momentum strategies. The flagship managed futures programme, which accounts for most of Campbell’s assets, allocates to trend, systematic macro and short term (and any of these can be invested in on a standalone basis subject to capacity considerations, as can carry, which is a subset of systematic macro).

Augmenting Equity Market Neutral Signals

Campbell’s fourth strategy bucket is quantitative equities, which trades cash equities. Campbell is among a number of quantitative managers (including Systematica) that made their first foray into single stock equities through statistical arbitrage: a strategy based on short-term mean reversion and generally using only technical inputs in the form of price history. Over the past two years, Campbell has diversified its suite of signals to include classic fundamental style factors beyond mean reversion, such as value, growth, quality, as well as momentum (i.e., trend following). These can be defined and applied in many ways, and within each broad factor Campbell has built out a whole host of sub-strategies. “The programme is now more like a traditional equity market neutral approach,” says Harris, and Campbell’s absolute return strategy (formerly named multi-strategy) includes the equity strategies, in addition to the three sleeves in the flagship.

Harris sees a strong appetite for equity market neutral approaches and Campbell is aiming to launch an equity market neutral product in 2017. “Though we have seen a rally post-election, many are concerned that the rally is long in the tooth and so want to rotate out of traditional long-only or long-biased long/short strategies, into market neutral approaches.” For instance, cyclically-adjusted measures of US equity valuation (such as the Shiller PE) have reached high levels as corporate profits make up a vast share of the US economy.

Campbell expects to start the equity market neutral strategy in 2017 and envisages capacity at between $1 and $2 billion. This may seem conservative compared with some peer group strategies, but Campbell is cognisant of the capacity constraints applying to the relatively short-term statistical arbitrage segment, and views capacity on a firm-wide basis. Campbell also needs to reserve capacity for the Absolute Return strategy to maintain its sub-allocation to the quantitative equities strategy.

Dynamic Risk Targeting

Some other strategies are potentially much more scalable. Recently Campbell has moved into the lower-cost systematic investing space. including ’40 Act wrappers with flat fee structures. The investment thesis for the Multi-Asset Carry strategies are articulated in Campbell’s carry paper, while its Dynamic Trend strategies, trend following with a dynamic risk target, are grounded in Campbell’s skew paper.

In common with many CTAs, Campbell’s flagship programmes have constant risk targets as Harris reflects “you always need to have oars in the water as you never know when opportunity pops up.” Campbell views this as an option for a broad range of investors’ utility functions, with the aim of maximising long-term Sharpe ratios. But where investors are particularly concerned about their long equity exposure and seeking diversification benefits during periods of market stress and ‘crisis alpha’ to complement their portfolios, variable risk targets may be more germane. Hence, Dr. Katy Kaminski and Dr. Brendan Hoffman’s paper on skewness makes the case for dynamic risk targeting. Explains Harris “This approach varies the level of risk based on how much diversity the trend portfolio is offering, when compared to current equity market volatility. So for instance, early in 2016 tremendous diversification benefits warranted taking more risk for better returns.” Through full market cycles, traditional CTA strategies have sometimes been positively correlated and sometimes negatively correlated to traditional asset classes, but have averaged near zero correlation. These strategies aim to provide long-term portfolio diversification across those market cycles and are still the core of Campbell’s strategy set. However Harris notes that “we recognised that some investors needed to address more tactical needs in their portfolios and are therefore really excited about this new form of opportunistic risk management.” Harris thinks that Campbell’s offering could be distinguished from other lower-cost trend products by its more negative correlation to equities and a more positively-skewed return profile. Campbell’s Dynamic Trend strategies are attracting inflows and have already garnered some pension fund mandates.

Liquid Alternatives: UCITS, ’40 Act

In addition to building out the suite of strategies it offers, Campbell also recognises the need for the right access points. The firm continues to offer separately managed accounts and several types of comingled vehicles, and recently expanded the product set to include a clutch of other products in the liquid alternatives space. A Luxembourg-domiciled UCITS has just launched on Goldman Sachs’ growing UCITS platform. Unlike some CTA UCITS, Campbell’s product is structured to maintain exposure to commodities and is intended to be very similar to Campbell’s flagship managed futures strategy. Campbell’s first foray into liquid alternatives was a ’40 Act mutual fund in partnership with Equinox. It has built on that successful mutual fund by offering other ’40 Act vehicles.

Looking Forward to the Next 45

At the corporate level, Andrews reiterates Campbell’s “desire to be an employer of choice, and never get away from being client-first driven.” Responsiveness to client feedback and transparency to clients are vital as he thinks Campbell’s strategies are still not well understood amongst some investor groups, which aligns with Andrews’ strategic focus on education. From an efficiency standpoint, Campbell is seeking to automate certain processes, but in a very measured way. “Automation has to be done very thoughtfully, as we do not want to lose our high touch customer service components,” Andrews stresses. Specific initiatives for 2017 have been communicated internally and to clients.

At the investment level, Campbell aims for continued evolution driven by research innovation and client needs. Campbell is unique among its peers in that it has seen multiple macro environments and regime shifts firsthand since its inception in the early 1970s. Harris ventures that the rise of populist politics is another shift, with the Brexit vote, Trump victory, potentially extreme outcomes (with both far right and far left parties gaining support in various countries) in multiple European elections, the Euro’s slump to a 14-year low, and renewed fears that the Euro may not survive this political turmoil, all signs of the shift. “This brave new world and its unknowns are scary for most people but we see it as a potential opportunity as a lot of repricing could need to happen. A dramatic drop in correlation between asset classes and markets improves opportunities. Markets are slow to price in changes, which often leads to trends. We can capture large moves, whether up or down,” Harris reminds us.

Introducing Kevin Cole: Campbell’s new Deputy Chief Research Officer

Introducing Kevin Cole: Campbell’s new Deputy Chief Research Officer

Straight after university, Cole joined the Federal Reserve Bank of New York as a researcher in the Capital Markets group, which he says “gave him real-world exposure to the linkages between policy and markets.” In December 1994, the ‘Tequila Crisis’ Mexican Peso devaluation gave Cole “a front row seat to an unfolding currency crisis and a powerful lesson that markets are not always well-behaved.” Later, he began researching equity valuation, which was famously pronounced “irrationally exuberant” by Alan Greenspan in December 1996. Of course equities got more exuberant for a further three years and this gave Cole “respect for price momentum and not having too rigid a framework for looking at markets”. Leaving the Fed for doctoral Economics study, Cole loved his time at the University of California at Berkeley, meeting his wife there and being “surrounded by brilliant people.” The PhD studies, including a dissertation on investor sentiment and asset prices, taught him that he enjoyed empirical, data-driven study more than theoretical economics. A job at Mellon Capital in San Francisco, in the depths of the bubble rubble, helped to cement Cole’s real world financial market views.

Cole then joined Campbell in 2003. With 13 multi-faceted and collaborative years at the firm he has “learned from colleagues and been involved in all parts of the investment process, including development of our systematic macro and trend following strategies, as well as portfolio construction and risk management.” Campbell follows a hypothesis-driven research process – seeking to understand the drivers behind why a model should make money – and Cole found his background helped to answer these questions.

Constantly changing financial markets have made Cole’s career “exciting, as it offers a constant set of new challenges.” September and October 2008, leading into the global financial crisis, was a defining period that reinforced Cole’s conviction in “the value of the systematic process and the importance of taking emotional reactions out of the equation, particularly at times of market stress.” Key market climate shifts include “the zero interest rate environment, which was seen as a lower bound, but we now know that is not true” while “QE is pretty profound and we need to account for that in the behaviour of markets.” On the other hand, High Frequency Trading is an example of a new development that has not had a fundamental impact over Campbell’s time horizons of identifying trends over one to twelve months. Cole reflects that “in spite of all this change some things stay the same – trends persist, fundamentals of markets and macro opportunities persist, and we need to be sophisticated to identify opportunities and manage associated risks.”

Over 40 years, Campbell has consistently taken a measured approach to what the industry deems buzzworthy, focusing on learning how to extract the best components of each concept and deploying what has real impact. For example, machine learning and artificial intelligence have recently become buzzwords among investors. Cole is cautious about the immediate applicability of these techniques to finance. “Areas such as image classification and speech recognition, defined by massive amounts of data and repeatable processes, have been revolutionized by machine learning,” he observes, whereas finance has not yet for two reasons. “Firstly, though potentially endless data points can be used as predictors, the series we’re trying to predict – market returns – are actually quite limited. Using an individual market’s daily price series as an example, if we’re examining 20 years of data, that’s only about 5,000 data points, meaning we must be careful about drawing spurious inferences. Secondly, markets are not stationary, and may break down when regimes change so we need a clearly defined investment thesis and are cautious about feeding data into a black box.” Cole recognises the potential for future opportunities in machine learning, but as with most technologies or investment strategies also sees the need for additional maturation before all the applications can be realised in an impactful and sustainable manner.

As Campbell’s process has always been evolutionary, and the succession plan is designed to ensure smooth transition for all roles, Cole feels that the team process is more important than any individual idea he may have. Therefore, Cole’s role is “mainly accepting a baton, and I am honoured to continue working with Dr. Hu to ensure consistency of style over the next 40 years.” Cole is taking on more day-to-day oversight of research, freeing up Hu to take a more strategic role. Both of them sit on the Investment Committee and participate in client outreach and education initiatives.

Cole is assuming the leadership of an already well-established team with a wide range of backgrounds and skill-sets. The diversity of models and strategies that Campbell applies reflect the diversity of the team, with graduates in mathematics, chemistry, physics, operations research, computer science, economics, and finance all part of the team. “Each brings a unique perspective, making outcomes stronger. Common traits include curiosity, healthy scepticism, tenacity and mutual respect”. Ultimately, “diversity in background and consistency in values” are what the teams bring to the process.

Caption for main image (L-R):Xiaohua Hu, Chief Research Officer; Kevin Cole, Deputy Chief Research Officer; Will Andrews, CEO; Tansu Demirbilek, Director Investment Strategies; Brian Meloon, Director Cash Equities Strategies; Brendan Hoffman, Director Investment Strategies; Kathryn Kaminski, Director Investment Strategies; Grace Lo, Director Risk & Portfolio Management; Rick Durand, Director Investment Strategies; Mike Harris, President.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical