Aquantum Active Range (AAR) has received The Hedge Fund Journal’s UCITS Hedge 2024 award for best performing fund over two years ending in December 2023, in the Volatility Trader category.

Aquantum GmbH was founded in 2012 by ex-Winton senior scientist Thomas Morrow and Christian Schneider, a former lawyer and investment banker. Aquantum is a specialized developer and manager of systematic investment strategies, licensed and regulated in the EU and an NFA registered CTA.

Partner, portfolio manager and board member, Carina Polzer, who joined the firm soon after in 2012, co-manages the commodity spread seasonality program and AAR. Maik Kaminski came on board to launch AAR in July 2021, an unusual US equity market strategy trading only S&P 500 put options. Kaminski, Polzer, Max Noller and Fabian Roth co-manage the strategy, which Kaminski could have taken to other companies or platforms. Instead, he decided to partner with Aquantum for various reasons: “I was very impressed by the due diligence they did into the strategy. I appreciate the diverse skillsets and different qualities within the team. And aged 52, I am confident with the longer-term succession planning”.

I was very impressed by the due diligence they did into the strategy. I appreciate the diverse skillsets and different qualities within the team.

Maik Kaminski

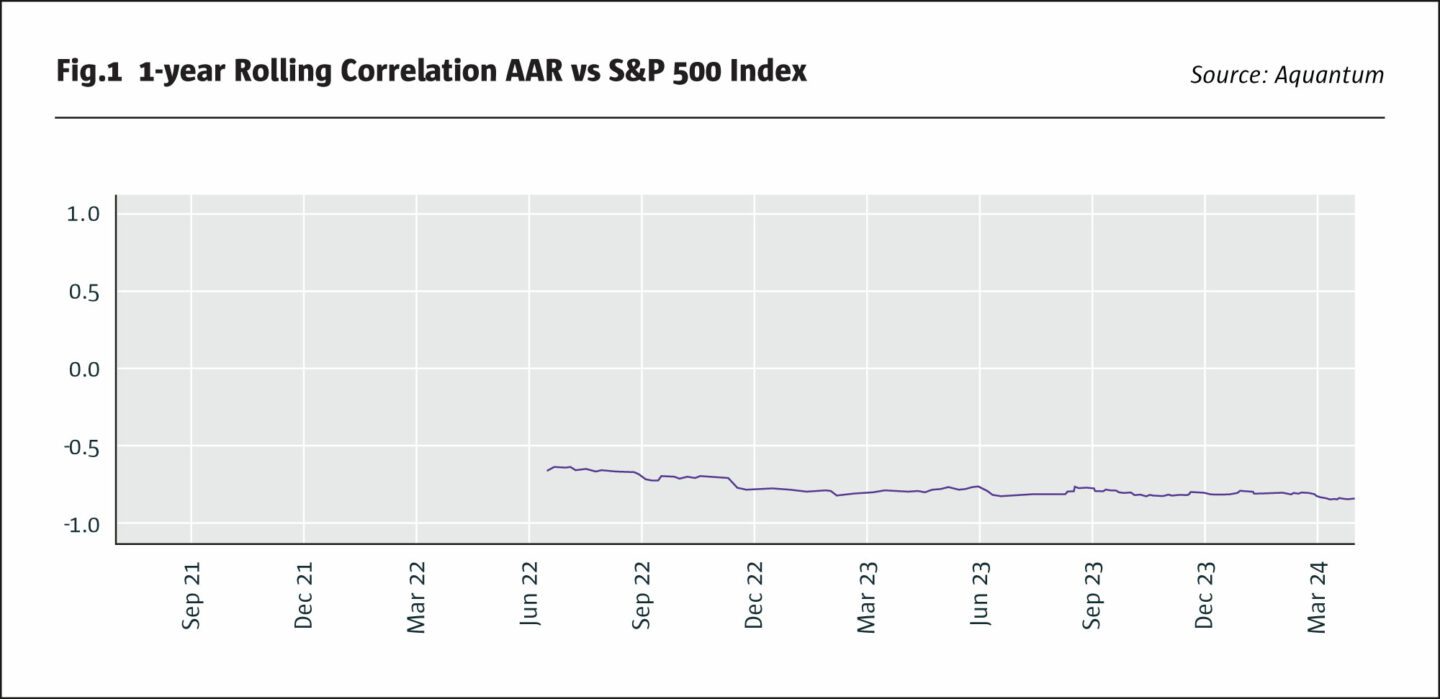

Negative correlation

The target return is 6-10% from option trading, on top of cash returns. This is a relatively high-performance aim for a UCITS trading volatility, but the return profile is more unusual. Thus far, the strategy has delivered a unique return pattern: a correlation of minus 0.7 to the S&P 500, while profiting in the up year of 2023 as well as the down year of 2022. The beta is usually around minus 0.2. Aquantum cannot find another fund in the RiskMetrics or Eurekahedge databases with the same return profile; most funds with a persistent negative correlation, such as various tail risk strategies, lost money in 2023.

From a portfolio diversification perspective, AAR could work well with many volatility risk premium funds, which are short volatility and have an explicit or implicit positive equity market correlation. “We think the combination of AAR and FERI OptoFlex would be complementary,” argues Kaminski, who worked with the current OptoFlex manager, Rico Hoentschel, at CCPM.

Monetizing pullbacks

AAR uses proprietary option spread structures to monetize pullbacks in the S&P 500 while reducing negative carry costs and controlling tail risk.

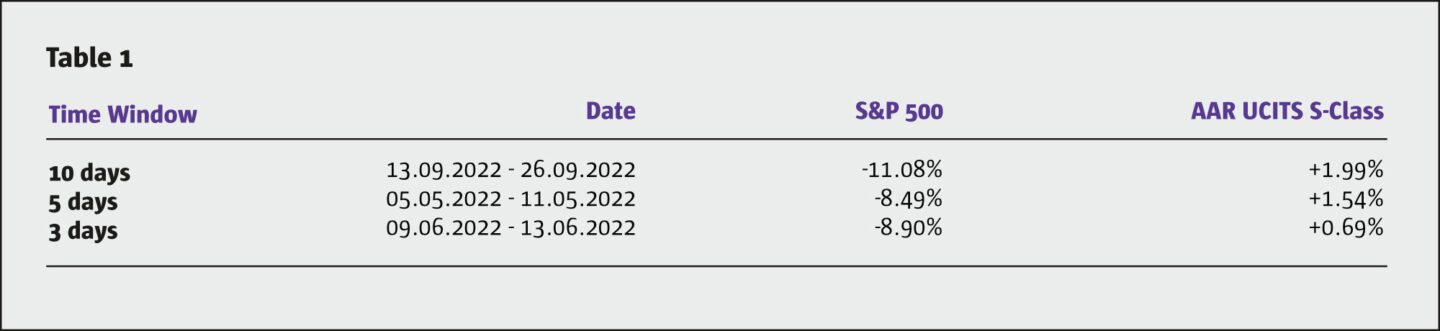

In 2022 the strategy was profitable during three S&P 500 drawdowns above 5%, as shown in Table 1 below.

It does not require a bear market however and performed well in 2023 thanks to agile trading of pullbacks. “In 2023 there were 36 up weeks, 8 weeks losing around half a percent and 8 weeks losing 1, 2 or 3 percent,” says Kaminski.

Yet 2023 also saw AAR’s largest drawdown since inception: between March and July 2023 there were no material pullbacks that were big enough for the strategy to monetize. Between October and February 2024, there has been another small setback for the same reason: the market has been up for 15/17 weeks, for the first time since 1989.

Indeed, pullbacks need to be above a certain threshold to be monetized by the strategy, which could also profit during a sideways, rangebound kind of market. “Most pullbacks have been between 4% and 7% and the strategy expects to monetize profits between these levels,” says Kaminski.

However, the quantum and equity sensitivity of its exposures can vary with considerations including skew in the volatility surface, recent market direction, the level of implied and realized volatility, and seasonality.

(L-R): Max Noller, Christian Schneider, Maik Kaminski, Carina Polzer, Thomas Morrow, Fabian Roth, Andre Scherer

Skew and optimizing spreads

Kaminski has developed three types of proprietary spreads involving various mixes and ratios of nearer long puts and more distant short puts. “Calls are never traded partly because the volatility surface of calls does not allow for efficient structuring of spreads,” he argues. The fund partly optimizes the blend of the spreads according to the volatility surface, but generally has some balance between the three sorts of spreads.

Patterns of skew in option markets can influence both the deltas of the spreads and the ratios between long and short puts. “Higher skew cheapens the spreads, and lower skew increases premium costs. The distance of the bear put option spreads balances premium costs against potential for positive payoff. A high “smile” or skewness pattern with higher out of the money volatility increases the case for selling puts further out,” says Polzer.

Short delta and positive gamma

The structures are designed to maintain short delta equity market exposure and positive gamma, but these are moving targets, and the spreads may need to be rolled up or down to keep the desired exposures and pullback sensitivities. Rebalancing is generally done daily and would not be done repeatedly intraday in a choppy range bound market, to avoid excessive costs.

In some cases, a large market move is riskier if it occurs “overnight”, which in practice means outside trading hours, because this could delay the usual rebalancing. Markets are normally closed between 2300 and 0000 German time. The U.S. session is 1530 to 2200 German time, but sometimes trades are placed outside these hours, for instance if economic data releases at 1430 German time have moved the market. Execution is thus available 23 hours on weekdays, apart from some holidays.

“The September 11, 2011, scenario would have been positive. The market shut on Tuesday September 11th and reopened on Monday September 17th, with a loss of 4.91%,” says Kaminski.

Stress testing worst cases

In fact, the theoretical out of hours shock does not feature in a historical stress test exercise, where stress testing the strategy for worst case losses – and its profit potential – involves some degree of path dependency, because the exposures dynamically adjust according to the recent equity market direction and level of volatility.

“If a crash is preceded by negative equity market performance and a spike in volatility, the strategy will have monetized some profits, and spreads will have been rolled down to much wider levels that greatly reduce the amount of tail risk,” says Noller. A higher VIX lets the strategy put on a wider spread with acceptable cost. This sort of positioning is also unlikely to make much profit from a small further decline in markets, “At a VIX of 40, a market drop of 12-15% would be needed to generate a 5% profit,” estimates Kaminski. A high VIX (and higher skewness) leads to a lower ratio between short and long puts. “The rules adjust flexibly to the volatility and market environments,” says Polzer.

It is a shock out of the blue in a low volatility environment – defined as one without a prior equity market loss above 5%, nor a spike in volatility – that might pose the greatest risks, since a sufficiently sudden and violent move (either a gap during market opening hours, or between closing and reopening over a weekend or holiday) could reverse the option spread exposures into being long delta and short gamma. “The worst stress test for this might be a 10-15% loss and is regularly disclosed to investors, but is viewed as a very remote risk,” says Kaminski. Historical analysis suggests that this would have been a very rare occurrence.

Noller has produced a more detailed explanation of this in response to due diligence by a sovereign wealth fund. He applies a series of filters to demonstrate progressively smaller numbers of days would have been dangerous, and potential investors may wish to review the full research paper. The conclusion Noller determines is that only 11 days out of 25,070 since 1929 would have been “statistically out of the blue” with no prior warning from either equity market declines or volatility or both. (A 200-day realized volatility measure is used as a proxy for the VIX before 1990.)

However, the range of scenarios is wider than any single stress test can allow for, because exposures can also vary for reasons other than the very recent equity market direction and volatility.

2012

Aquantum GmbH was founded in 2012 by ex-Winton senior scientist Thomas Morrow and Christian Schneider, a former lawyer and investment banker.

Leverage variation

A longer-term lookback of volatility can also vary leverage. “For instance, in 2022 the strategy employed roughly two times leverage, based on notional value of positions. In 2023, a lower volatility climate generally allowed for leverage around four times,” says Kaminski.

Seasonality nuances

Patterns of seasonality can have some influence over sizing of exposures. “Heeding the typically positive calendar effect in November, exposures might be a bit reduced at that time. Conversely, a correction has historically been statistically more likely between mid-February and mid-March, when the strategy may spend a bit more on premium,” points out Kaminski.

30 years in volatility

These nuances are informed by Kaminski’s 30 years of trading volatility since 1989, starting under Hans Metzler at Dean Witter Reynolds before it was taken over by Morgan Stanley. He was a partner and co-owner of Conservative Concept Portfolio Management (CCPM), which later became LeanVal Asset Management. Between 2002 and March 2012, he was lead manager for CCPM’s option spread strategy with some conceptual similarity to the Aquantum one, though it is not fully comparable since only monthly frequencies were available at that time. Kaminski has developed his own spread structures, position types and risk management approach, based on the weekly frequencies. The AAR strategy was partly incubated with trading personal capital for three years between 2018 and 2020, and this track record can be shared with potential investors.

Back testing considerations

The strategy cannot however be comprehensively back tested over Kaminski’s career or a longer period for two reasons: there is a lack of tick data for some periods, and some discretion around intraday decisions. The risk management is 100% systematic, and hard coded, while position management is 70% systematic and 30% discretionary. The risk system is coded up in real time, indicating when to close or add or rebalance spreads. There are colour coded risk flag alerts. Red means reduce or close completely and yellow puts it on a watchlist.

Execution

A large specialist options broker in Chicago, XFA, the biggest execution broker in S&P 500 options, trading over a million S&P 500 options a day, is used and accessing abundant liquidity is helpful in synchronizing the multiple legs of the various spreads. “This broker is much bigger than Goldman Sachs or JP Morgan in options trading,” says Kaminski. Under stressed conditions it is still possible to trade S&P 500 options. “Even on days in 2008 and 2020, when the S&P 500 went ‘limit down’, options could still be traded, though they might not have had fair prices,” he recalls.

Cash and margin

Cash is kept in overnight deposits, earning a bit less than some other cash management instruments. Aquantum is keen not to take on additional risk with bonds, as they are convinced that they will achieve sufficient returns with AAR alone. In 2008, February to April 2020, and in 2022, this approach has clearly paid off. Margin to equity is usually 20-25%, averaging 22%. “Margin could increase if the portfolio was not rebalanced in a declining market, and conversely can decrease if the strategy is profitable, when margin can be swept back,” Kaminski explains. He judges that 25% gives enough comfort in case margin requirements are increased by the exchange and/or broker. The clearer is UniCredit.

Vehicles and platforms

The investor base includes Family Offices, Volksbanken and savings banks, and some of the largest asset managers and allocators in Germany. Most assets so far have been raised in Europe, but there is about USD 30 million from the US, sitting in Cayman vehicles on the Kettera platform.

Strategy assets are EUR 650 million as of March 2024. Kaminski estimates strategy capacity at USD 5 billion but would probably soft close around USD 2.5 billion to review the situation and give existing investors more space to invest more before a hard close.

There is so far one managed account from a Swiss family office. Aquantum are open to other managed accounts, which may use different brokers, but their base case would be running the strategy pari passu.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical