Starbucks (SBUX): Will Management Achieve Their Long-Term Growth Goals?

Originally published on 05 June 2017

Last December, Starbucks management laid out its longer-term growth plans. Central to these plans were targets of high-single digit store growth and mid-single digit comparable store sales growth. How do these targets compare to what analysts are currently modeling for the company?

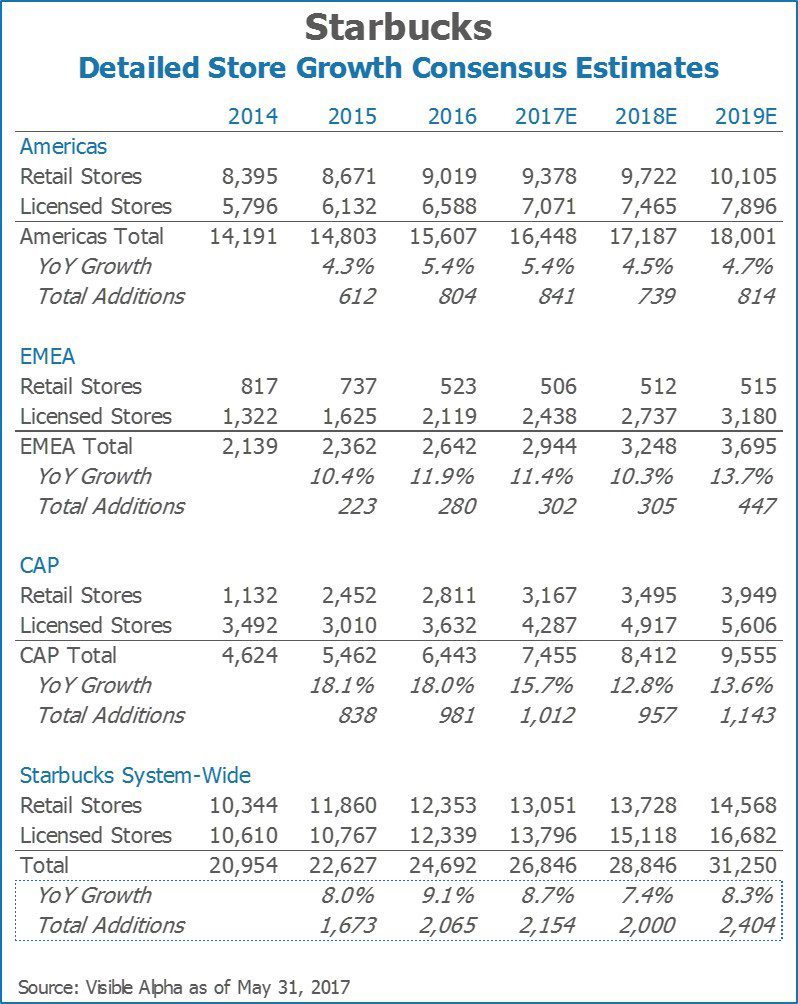

Store Growth

Visible Alpha’s data shows that analysts expect Starbucks to open 7-8% more stores each year into 2019, which is in-line with senior management’s longer-term guidance. Digging further, we find that consensus estimates have the majority of the store growth coming from the CAP region, which is expected to add about 1,000 stores per year. The region has been a major focus for senior management and a key component of the bull thesis. Additionally, roughly ⅔ of the store growth in the region is expected to come from licensed stores as opposed to retail stores.

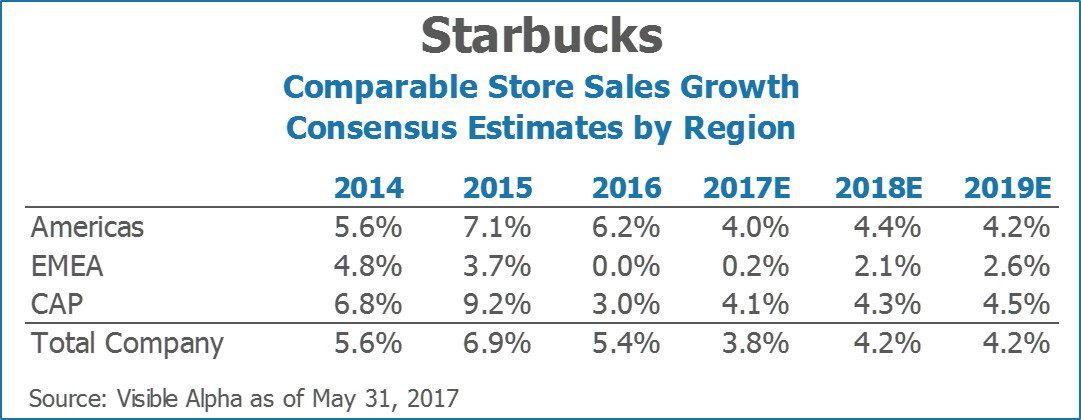

Comparable Store Sales

Consensus estimates for comparable store sales over the next three years are at roughly the low-end of management’s mid-single digit longer-term guidance. Looking by region, analysts are expecting roughly similar growth in the Americas and CAP regions, and lower (but accelerating) growth in the EMEA region.

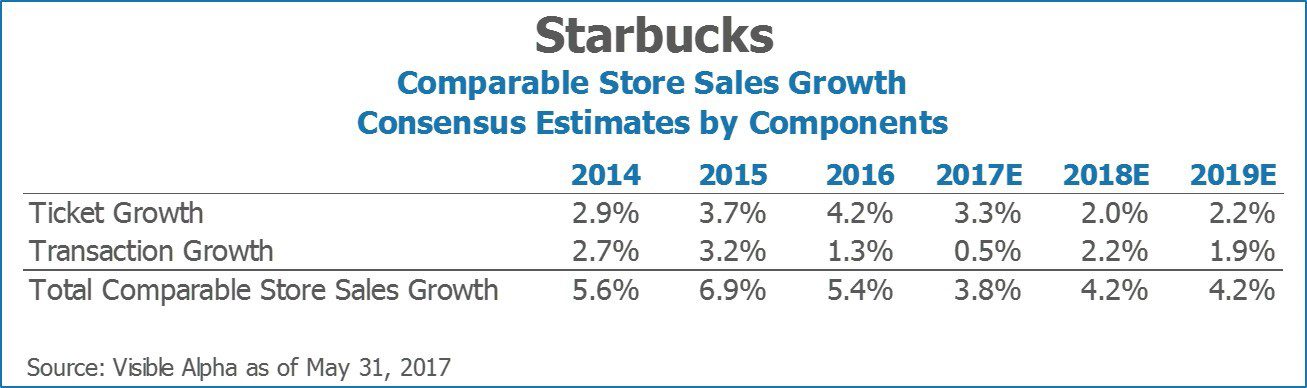

Looking at comparable store sales growth by ticket and transaction, Visible Alpha estimates show that analysts expect the majority of comparable store sales growth to come from ticket growth this year, but expect the mix to shift to an even balance of ticket and transaction growth in 2018 and 2019.

This blog post was originally published by Visible Alpha. Visible Alpha is a data and analytics platform with comparableforecast models and data from equity analysts around the world.

- Explore Categories

- Corporate

- Funds

- People

- Regulatory

- Technology