Disney: Cable Networks Consensus Estimates Continue Downward

Originally published on 16 May 2017

Disney reported fiscal 2Q17 results last week that exceeded consensus earnings estimates but missed consensus revenue estimates. The revenue miss largely came from Disney’s Media segment, which made up 30% of the company’s overall revenue and 45% of total operating income in 2016.

Zooming in even further, the miss was largely due to the Cable Networks subsegment (the largest component of the Media segment), which reported revenue growth of 2.7% vs. consensus estimates of 4.4%. According to Visible Alpha’s consensus data, this represented the fifth consecutive revenue miss for the subsegment. ESPN and other cable channels were a large reason for the miss, as management noted subscriber growth declined 3%.

Subscriber growth continues to be impacted from traditional service losses as consumers “cut the cord” and cancel their cable TV subscriptions. As a result, consensus estimates for 2017 and 2018 show that investors expect only modest, low-single digit growth going forward for the Cable Networks subsegment. Additionally, revision data shows that analyst estimates for this subsegment have moved down over the last three months.

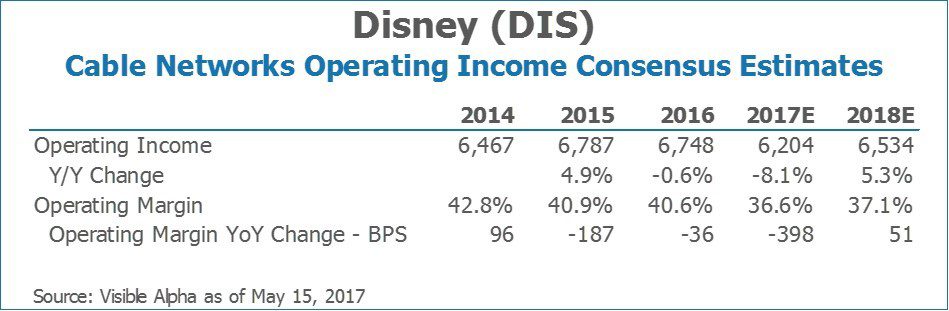

A look at consensus operating income show more negative expectations. Analysts expect a sharp decline in 2017 operating margin driven by higher programming cost growth and the above-mentioned lower revenue estimates.

This blog post was originally published by Visible Alpha. Visible Alpha is a data and analytics platform with comparable forecast models and data from equity analysts around the world.

- Explore Categories

- Corporate

- Funds

- People

- Regulatory

- Technology