Since 2001, Theta Capital Management has exclusively focused on hedge fund manager selection. Launching in September 2001 might have beena baptism of fire for some investment strategies but the month demonstrated the resilience of hedge funds relative to conventional asset classes, reflects Theta Capital director, Tijo van Marle. Theta started with friends and family capital invested via segregated accounts, but since 2010 has offered investors two ways to invest alongside renowned hedge fund managers that boast some of the longest and strongest track records.

Theta caters for the full spectrum of investors from the largest institutions to high net worth individuals – including some founders of leading private equity firms in Europe – and retail investors. Larger investors are still offered bespoke individual accounts, housed on Northern Trust’s custody platform, while investors of almost any size can gain exposure to Theta’s favourite hedge funds (most of which are normally closed to investment) through a daily dealing, exchange-listed vehicle.

The perils of performance chasing

Though investors can benefit from the ability to trade the Legends fund of funds daily, and even intra-daily, Theta advocates much longer average holding periods for hedge fund investing: “investors should think in terms of a ten-year horizon,” says Portfolio Manager, Ruud Smets. If high frequency trading and ETFs may be fashionable, Theta has taken a Warren Buffet approach and historically held onto hedge funds for multi-year periods. Indeed, some holdings have been owned from the very start back in 2001, illustrating the long term relationships that Theta has forged with many luminaries of the industry.

Smets believes in a long-haul approach because he observes that most investors are not good at timing allocations and thinks “the number one mistake of hedge fund investing is performance chasing”. It is well known that the money-weighted return on most investment funds is far below the time-weighted return, because more investors buy near the top and sell close to the bottom than do the reverse. Maintaining stable allocations would have served most investors better. Smets freely admits that he is not immune to fretting about short term performance, but, heeding the lessons of behavioural finance, Theta Capital has quantified this potential source of bias by carrying out an audit trail of its own history of allocation decisions. “Where performance was the main reason for subscribing or redeeming, the new fund subsequently under-performed the allocation it replaced by 6-8%,” Smets observes.

This is partly because, with hedge funds, the costs of getting the timing wrong have historically been much larger due to fee structures that typically crystallize performance fees each calendar year (and sometimes even quarterly). Though institutional investors are now starting to obtain clawback provisions (according to recent reports from bodies including AIMA), investors selling hedge funds at a loss after performance fees are levied, have very rarely been able to recover any of the performance fee – nor carry the high water mark (HWM) over to a new vehicle run by the same manager, let alone by a different manager. The case where investors in Pierre Andurand’s commodity trading fund, Bluegold, were permitted to transport their HWM to his next firm, Andurand Capital, is still very unusual. Therefore, selling at the wrong time locks in a loss, and often means investors miss out on what can effectively be a ‘free ride’ back up to the HWM without paying performance fees, while they start paying performance fees immediately at the fund that is replacing the holding.

Though Theta in general adopts a buy and hold approach, Smets does see some scope for selective – and often contrarian – market timing. “Every manager goes through a rough time at some point, and often that is the best time to add to positions,” says Smets. “A deep qualitative understanding can allow you to invest and withdraw at the right times,”he adds. For example, after four years of performance famine, trend-following CTAs feasted in 2014, and made an important contribution to returns in Theta portfolios that year. Most investors that had joined on the back of stellar returns in 2008 had already left again by that time. Similarly, after a three-year rout in many emerging markets asset classes, early 2016 saw Theta add to Richard Deitz’s VR Global and Robert Gibbins’ Autonomy Capital, managers Theta has known and invested with for well over 10 years. Smets explains how “these managers saw great opportunities in countries like Argentina, Brazil, Venezuela, Ukraine and Greece. There is real value to be found in yields away from countries with zero interest rate policies”. An example of the type of dislocation that such managers might seek to exploit could be a liquidity crisis in a country, such as Venezuela, that is basically solvent. In 2016 year to date, as of late October, Venezuelan government debt has returned close to 50%. But in general, Theta is timing managers rather than strategies. “Most strategies are impossible to time except in hindsight, with the possible exception of distressed debt where a great supply of assets trading at distressed prices can make it a good time to invest,” Smets clarifies. “Also, liquidity terms don’t allow for swift allocation shifts. It is much more effective to make sure your selected managers are in a position to capitalize on opportunities as they occur,” he adds.

What makes a “Legend”?

As Theta typically expects to be invested for 10 years or longer in its investee managers, there has to be a good match in the first place. Theta’s criteria for a “Legend” are so demanding that most of the industry’s 10,000 managers would not make the first chorus line. Smets estimates that only 30 or 40 names would find their way onto Theta’s Legends long list, but some of these, such as Jim Simons’ Medallion or David Tepper’s Appaloosa, have effectively turned into family offices or remain hard closed at all times.

A ten-year minimum track record is non-negotiable for the Legends Fund, and the average Legends manager track record is 19 years (Theta’s Individual accounts have more flexibility to invest in newer funds). ‘Skin in the game’ is also vital: on average 25% of Legends’ manager assets are internal, proprietary capital, from founders, most of whom are now billionaires. ‘Eating their own cooking’ is seen as a precondition of good risk management, but these large firms also need to demonstrate institutional quality infrastructure and risk management processes. Avoiding the business risk of start-ups is an over-riding risk management requirement for Theta, partly as Smets has found that “business continuity risk is the key risk during periods of underperformance”. Smets is anyway “sceptical about research suggesting that emerging managers outperform, due to a lack of data and biases in the data”. He does not find fee savings from newer managers compensate for this risk, claiming that “you often pay the same 1.5 and 17% average price for well-established or new managers”.

Portfolio construction

Broadly speaking, for its Legends Fund Theta equally weights the four major strategy groups – global macro, long/short equity, event driven, and relative value – on a risk-adjusted basis. This implies a slightly lower than 25% weighting for event driven, which has the highest beta and volatility, while global macro, with its low to negative correlation, is somewhat above 25%. The Legends Fund sticks to plain vanilla hedge fund strategies and does not invest in areas such as volatility arbitrage, insurance linked securities or catastrophe bonds. Theta occasionally makes bold calls on particular asset classes or strategies. Smets recalls how convertible arbitrage became over-crowded in 2004as investors chased its attractive returns. Then, in 2006 Theta started to get nervous about the credit markets, and redeemed from long-biased credit managers while adding some short-biased exposure. “Our discussions with managers revealed these risks and opportunities,” Smets remembers. “This continuous dialogue with some of the smartest investors in the world gives us our research edge.”

But these critical turning points in markets do not happen every year and may only occur two or three times every decade. As Theta is, to a large degree, delegating asset allocation and market timing decisions to its managers, they also need the flexibility and opportunistic instincts to allocate across geographies and asset classes – and crucially to vary long and short exposures. Theta is quite content to see managers printing minimal or subdued returns for extended periods, so long as they capitalise on opportunities when they arise. “This profile of preserving capital when opportunities are lacking and aggressively capitalizing on opportunities when they occur is what provides the attractive correlation profile that investors are looking for,” Smets explains. “This approach is preferable to inherently uncorrelated strategies that often don’t give you attractive returns”, Smets says. An important pre-requisite for delivering such a profile is that managers have enough staying power, highlighting again the emphasis Theta puts on established firms with significant internal capital.

Theta runs a concentrated, high conviction portfolio with typically ten to fifteen managers and is not keen on more diversified approaches. “If you have 50 line items in a fund of funds it is very easy to add another one,” says Smets, but Theta wants to make every position matter. “Diversification with hedge funds, due to their fee schedule, does not always turn out to be a free lunch. Also, if you effectively avoid business risks, the case for diversification, besides for adding different areas of opportunity, is much less clear,” he sums up.

Accessing closed funds

Theta also finds that well-aligned managers are honest about their capacity and, as a result, most of the managers in the Legends Fund are normally closed to new investment. Theta has several ways of obtaining capacity. Smets reveals that even hard-closed managers will often replace redemptions, and have a waiting list to do so. Theta’s long standing relationships with managers make it well positioned to fill up this spare capacity. Theta could also acquire positions on the secondary market (but has not done so for the Legends Fund). Exchange-listed closed ended funds can be another avenue for investing in otherwise closed managers and Theta is opportunistic in taking advantage of situations where such vehicles trade at a discount to NAV. For instance, Legends has bought into the LSE-listed Brevan Howard Macro trust, which recently announced fee cuts, at a discount of around 10%. “The discount tends not to exceed 10% due to the buy-back rule,” explains Smets.

Listed vehicles can also widen the Legends Fund’s choice of investible managers. The effective two year liquidity terms on Pershing Square’s private funds were not liquid enough for the Legends Fund, so the listing of Pershing Square Holdings, on the Amsterdam exchange, allowed Legends to access a more liquid version.

Daily valuation and dealing

The Legends Fund distinguishes itself from most funds of funds in that it has daily net asset values, independently calculated by an administrator, based on estimates from underlying managers. “It allows for investors to include their hedge fund exposure in their overall portfolio on a daily basis,” says Smets. Investors can also trade the fund daily through its Euronext listing. Its main market-maker is Dutch merchant bank, NIBC, which can trade up to 10% of the assets per month (with lower thresholds per day and per week) on a daily basis. This framework has neatly sidestepped the discounts to NAV that plague many listed investment vehicles as the market maker limits the bid/offer spread to up to 1% of NAV. “Our structure is set up to provide transparency and liquidity without concessions to the quality of the underlying portfolio, like restricting yourselves to UCITS funds,” says Smets. Being listed in Amsterdam also means that no stamp duty applies to the shares. For amounts of at least EUR 100,000, it is possible to deal directly with the manager, subscribe daily, and redeem with 90 days’ notice, at NAV. In practice, turnover in the Legends Fund has been quite low, not least because around 25% of the assets are owned by Theta staff. Externally, “the typical client is a (multi-) family office,” says Smets.

For now, Legends Fund is denominated in Euros, but has had a USD class before. A USD or other currency share class could be re-created in response to demand and Smets is receiving enquiries from some US brokers. Theta is diligent about avoiding currency risk at the fund level. Euro share classes are invested in where possible and non-Euro share classes are hedged back to Euros. To free up cash for hedge collateral, Theta has invested in some share classes that have a higher volatility target and therefore offer more cash efficiency.

The line-up of the Legends

Theta provides full transparency on its holdings on its website www.legends-fund.com. Some of the Legends Fund’s managers, including Stuart Roden of Lansdowne, and Harold de Boer of Transtrend, were present at the September 2016 Legends4Legends conference held in Amsterdam, which raised EUR 70,000 for the A4C (Alternatives for Children) charity.

Smets gives us a whistle stop tour of the eleven managers currently in the Legends Fund. In equity long/short, Lansdowne Developed Markets, founded in 2001 and run by Peter Davies and Jonathan Regis, “makes very good thematic calls that tend to win out in the end although they can be too early. They are very good at understanding and quantifying risks, which, combined with their stable capital, allows them to stay the course without being forced to close positions,” says Smets. Egerton, founded in 1994 by John Armitage, who remains the portfolio manager of the Egerton funds today, “is a fantastic stock-picker with a stable business who has stuck to his knitting for over 20 years now. Egerton’s positioning worked well in 2015 but is recently facing some headwinds. Its performance will come back and the fund is not making any drastic changes,” Smets notes.

In event driven, the pullback in healthcare equities has proved to be a headwind for both Glenview Capital, founded in 2001 by Larry Robbins, and Paulson Enhanced, founded in 1994 by John Paulson. Both managers “have run low net exposure, and should have big opportunities when the sector normalises,” Smets expects. They also have substantial internal capital and support from their client bases, making for stable businesses. Pershing Square, founded in 2004 by Bill Ackman, benefits from the same steady capital base, given its permanent capital vehicle, Pershing Square Holdings, and substantial internal investments. For Smets, the thus far disastrous investment in Valeant demonstrates Ackman’s tenacity. “Even after these losses, Ackman got a board seat and is actively trying to turn things around. Also he recently announced a new large activist position in Chipotle Mexican Grill,” Smets observes. ”Pershing Square is a great example of a fund that is set up for the very long run. And there is no better way than that to be sure to overcome the inevitable periods of difficult performance and to be able to continue to operate from a position of strength,” he underscores.

Both of Theta’s global macro funds have been somewhat frustrated by QE, which resulted in “incipient trends being arrested by central bank activity,” recalls Smets, but Theta retains conviction in them. Moore Global Investments, founded in 1989 by Louis Moore Bacon, “has great risk management to cut losses when trends are not persisting,” Smets has noticed over the years. Meanwhile, Brevan Howard, founded in 2003 by Alan Howard, “has clearly had a tough period with asset outflows but it is one of the few hedge funds that are consistently negatively correlated to other strategies, and always has a long volatility bias,” Smets reflects. He expects that “when interest rate volatility comes back they may profit and we could see outsized gains in both a deflationary or inflationary surprise”. Trump’s November election is a case in point with Brevan Howard posting a banner month, beating almost any other fund by a wide margin, according to Smets. As recently as November 1st, Legends Fund started to build a new position with Robert Citrone’s Discovery Capital Management. “We see great opportunities for macro investing in emerging markets,” Smets notes. “We have known Citrone for a long time and we believe he has built a great edge in trading these markets across asset classes. Also with him being significantly smaller these days we expect him to do well in these more capacity constrained markets”. Smets does not view Theta’s CTA, Transtrend Diversified Trend Programme, founded in 1991, as necessarily offering portfolio insurance in current markets. “In a capitulation phase, CTAs are good at capturing the trend but very recently CTAs were long of equities and bonds and were therefore very much exposed to the risk of rising interest rates and falling equities. However they are adapting to the new market environment as it occurs and this is changing as we speak,” Smets observes. Additionally, Transtrend is much more diversified than are many CTAs, trading over 300 markets, so Smets expects the manager “may capture trends that are not related to general financial market movements”.

In the relative value bucket, Israel Englander’s Millennium International, founded in 1989, “has around 200 portfolio teams and has done very well over the past few years,” Smets has seen. King Street Capital, founded in 1995 by O. Francis Biondi, Jr. and Brian J. Higgins, “made money in 2008 and is currently eking out returns from idiosyncratic situations while keeping cash to take advantage of the distressed cycle later on, which should generate better returns,” Smets expects. VR Global, founded in 1999, has been the star in this space, exploiting special situations “in places neglected by other managers, such as Argentina, Greece and Ukraine,” Smets points out.

Theta Individual accounts

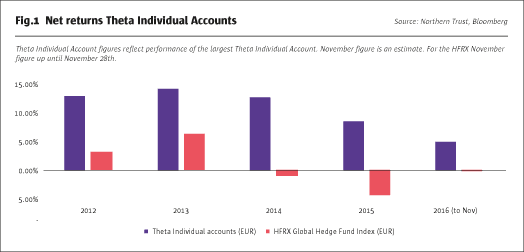

Through its Individual accounts, Theta offers investors control, customization and transparency. The approach avoids disappointment when investing in hedge funds as its implementation truly matches each investor’s expectations and restrictions. In Smets’ view, “while it’s not for everybody – one needs a certain size and a multi-year investment horizon – it is the best way to achieve strong long term results investing in hedge funds. It is validated by Theta’s remarkable track record through this setup.” (See Fig.1).

Smets views segregated accounts as a solution to the liquidity mismatch problem that can arise where investors have different timeframes. With individual accounts, each investor sets their own liquidity tolerances and Theta selects funds with liquidity appropriate for each strategy. For instance “we would not be tempted to invest in a distressed debt fund with monthly liquidity, but we might choose one with annual liquidity,” Smets explains. “As a result you get liquidity you can actually count on, and in market dislocations you are more likely to be in a position to capitalize on the opportunities that arise,” he adds. The individually managed accounts can gain exposure to more esoteric areas than might be appropriate for the Legends Fund. “Some of our clients have invested in single country funds such as one that profited from Iceland’s recovery and another one seeking to buy up beaten down assets in Venezuela,” Smets points out. Individually managed accounts negotiate their own fees with Theta Capital.

Performance History and Outlook

A historical, hypothetical (often known as ‘proforma’) portfolio of the current Legends Fund managers would have annualised at 11.8% with volatility of 7.5% and a Sharpe ratio of 1.2, since 1997 (after Theta’s fees). Legends charges a management fee of 0.625% but Smets estimates that roughly half of this is defrayed by rebates or discounts obtained from managers, for instance in “friends and family” or other legacy share classes that offer lower fees. There is also a performance fee of 5% with a high water mark and no hurdle.

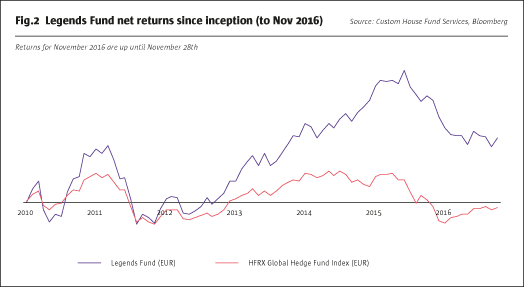

Over the past five years, performance for hedge funds in general has been lower. Though Legends has outperformed the hedge fund indices (as shown in Fig.2), returns have averaged a single digit percentage. But Theta Capital is upbeat on an improving climate for hedge fund strategies, for multiple reasons.

Smets reflects “First and foremost, the election of Donald Trump is a true game changer for hedge funds. It accelerates the return of interest rate volatility that our Global Macro managers have been waiting for. Already, his election has resulted in large moves in bond markets. The mere rise of interest rates provides a boost to value investors who have had a tough time as markets have been flooded with liquidity and any available yield was being chased by investors. With conditions tightening there are lots of areas that make for great shorting opportunities. A Trump administration is also much more likely to operate more business-like. One situation where an expedited resolution could be very profitable is in the cases of Freddie Mac and Fannie Mae where three of our Legends hold positions, both in preferreds and common shares”. All in all the extremely high correlations between and within asset classes that characterised the QE era, are giving way to more discriminating markets that throw up wider dispersion in the markets – increasing the potential for alpha generation.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical