Alternative investments are still not fully de-stigmatized by many investors, despite the fact that their inclusion in balanced portfolios has proven their merit at least twice during the previous decade. The purpose of this series of reports is to demystify some of the misconceptions still surrounding alternative investments.

Equities were once an alternative asset class too. And then along came Harry Markowitz. The concept Markowitz developed in the 1950s to deal with the investors’ trade-offs transformed the practice of investment management beyond recognition. Markowitz assumed investors were risk-averse. Volatility was used as the metric for risk.

And then along came Daniel Kahneman and Amos Tversky. The two psychologists developed prospect theory and the concept of loss aversion in the 1970s. Prospect theory proposes a descriptive framework for the way people make decisions under conditions of risk and uncertainty and embodies a richer behavioural framework than that of many traditional economic models where it is generally assumed we behave and think like Mr Spock.

Loss aversion is based on the idea that the mental penalty associated with a given loss is greater than the mental reward from a gain of the same size. However, the perception of losses varies over time; it declines in bull markets.

Many investors started to look into hedge funds as a viable investment when markets had peaked in 2000. Falling equity markets put hedge funds and funds of hedge funds on the agenda of many private as well as institutional investors. Why? Because hedge funds have an absolute returns approach while the traditional investment management industry does not.

Under the absolute returns approach, there is an investment process for the upside (return-seeking by taking risk) and for the downside (some sort of contingency plan if something unexpectedly goes wrong or circumstances change). Changing circumstances and the flexibility that comes with an absolute returns mandate are key differentiating factors when compared to traditional asset management.

Investors are loss-averse

The idea of investing in equities was quite a freak idea in the 1950s. By 1952, stocks in the United States had not yet recovered from their losses from the Great Depression 20 years earlier. Stock ownership was considered so risky that the stocks of some of the best companies were paying dividends nearly three times the interest being paid on savings accounts. Investors’ scars from the Great Depression and World War II were still too great for equities to become a legitimate investment alternative. Many investors and the general public all perceived the stock market as little more than a playground for speculators. In essence, equities were once an alternative asset class too.

Harry Markowitz, arguably the founder of MPT, once mused that he got the Nobel Prize in 1990 for elegance. What he meant was that his idea of diversification and the trade-off between risk and return wasn’t particularly original. The idea of diversification can be traced back thousands of years; literally. Markowitz’s Portfolio Selection is nothing more than a formal confirmation of two old rules of investing: 1. Nothing ventured, nothing gained; 2. Don’t put all your eggs in one basket. With elegance he meant that he was the one who proved the idea of diversification mathematically. If something can be proven mathematically, it is considered as pure elegance, more scientific, and therefore to be taken more seriously.

For theorems to be proven mathematically, the various variables need to be measurable. Return is easily measurable. If something rises from 100 to 110, that’s a 10% (nominal) return. However, measuring risk is more difficult. The idea of losing one’s shirt wasn’t precise enough for academic pursuits. What Harry Markowitz did was to equate risk as the standard deviation of returns, or, in its annualized form, the volatility. This was consistent with the thinking in academia of the time. Returns of securities that trade in perfect and frictionless markets were considered to be normally distributed around a mean. The deviation from the mean was considered the measure for risk. Investors needed to be compensated for bearing risk — that is, the wobblier a security or asset class, the higher the return ought to be. And then Monday 19th October 1987 happened, a 25 standard deviation event, and the whole idea of equating volatility to risk flew out of the window. Nassim Taleb, the author of Fooled by Randomness and The Black Swan, made an entire career by ridiculing the idea of applying the normal distribution to the world of social sciences, including finance.

Nevertheless, the concept Markowitz developed to deal with the investors’ trade-offs transformed the practice of investment management beyond recognition. Mean-variance optimisation put some sense and some system into the haphazard manner in which most investors were assembling portfolios. The literature on investing up to 1952 had either ignored the interplay between risk and return or had treated it in the most casual manner. Portfolio Selection moved away from the idea of portfolio concentration and formed the foundation of all subsequent theories on how financial markets work and how risk can be quantified. Contemporary concepts such as Value at Risk (VaR) and all regulatory funding requirements for institutional investors including banks are descendants from a 25-year-old musing about the trade-offs of life in the 1950s. And then Kahneman and Tversky came along; and then there was light.

Prospect theory and loss aversion

Prospect theory and the idea of investors being loss-averse rather than risk-averse go back to Daniel Kahneman and Amos Tversky (1937-1996). The two started collaborating in the 1970s in the field of psychology which back then wasn’t part of economics. Today, behavioral economics is indeed part of economics and the idea of investors being loss-averse rather than risk-averse is more or less accepted. The stamp of approval was given in 2002 when Daniel Kahneman was awarded the Nobel Memorial Prize in Economics for his work in prospect theory; an honour Amor Tversky would have shared, had he still been alive at that time.

Prospect theory proposes a descriptive framework for the way people make decisions under conditions of risk and uncertainty and embodies a richer behavioural framework than that of subjective expected utilitytheory which underlies many traditional economic models and thinking. The key concepts are loss aversion, regret aversion, mental accounting and self-control. Loss aversion is based on the idea that the mental penalty associated with a given loss is greater than the mental reward from a gain of the same size. Whenever we advocate the absolute return investment philosophy we keep falling back to the simple notion that losing money hurts. The cyclical element of this notion is that in bear markets more people seem to agree with this idea.

Prospect theory has three features that distinguish it from classical economic analysis. First, it is defined in terms of gains and losses rather than in terms of asset position, or wealth. This approach reflects the observation that economic agents think of outcomes in terms of gains and losses relative to some reference point, such as the status quo, rather than in terms of final asset position. Because people cannot lose what they do not have, classical economic theory does not address losses. The language of losses presupposes that people evaluate things relative to some reference point. The second feature is that people are maximally sensitive to changes near the reference point. The third feature is that it is asymmetrical. The loss appears larger to most people than a gain of equal size. This characteristic is called loss aversion. Humorist Will Rogers, therefore, was a loss-averse investor. Losing capital was more relevant than fluctuations in the returns on the capital.

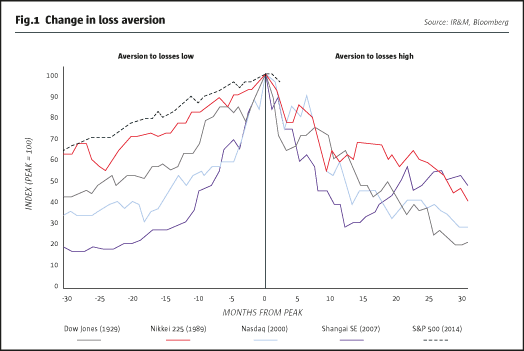

The aversion towards losses varies over time. Fig.1 shows four equity market peaks and the current S&P 500 that has peaked in November 2014 when measured on month-end levels.

The whole concept of losses is arguably different on the way up than it is on the way down. Many investors started to look into hedge funds as a viable investment when markets had peaked in 2000. Prior to 2000, the hedge fund industry was quite small with only some institutional pioneer investors and very early adopters invested in hedge funds. Falling equity markets changed that. Falling equity markets, in essence, put hedge funds and funds of hedge funds on the agenda of many private as well as institutional investors. Why? Because hedge funds have an absolute returns approach while the traditional investment management industry does not.

Absolute-return investing implies loss aversion

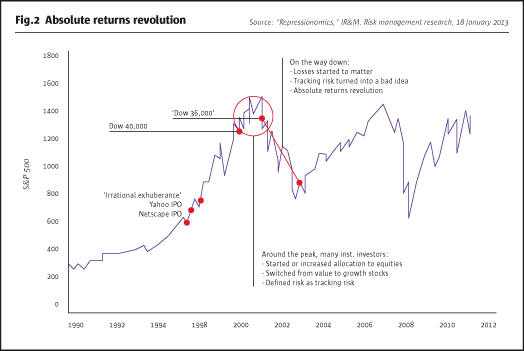

When the losses became a real experience, it transpired that all investors are actually loss-averse (see Fig.2). It’s just that it is not as apparent in a bull market as it is when the losses are real, i.e., in the ensuing bear market.

Even institutional investors, who often embrace benchmarks, experienced in the last two equity bear markets that they are not indifferent to losses. Generally, the return objective of a traditional relative return manager is determined by a benchmark. A benchmarked long-only manager tries to beat the benchmark. The return objective is defined relative to a benchmark. Hedge funds do not aim to beat a market index. The goal is to achieve absolute returns by exploiting investment opportunities while trying to stay alive, i.e., avoid the loss of capital.

At the peak perceptions are different than at the trough. Calling an active mandate with a tracking error constraint of 1-2% was perfectly normal during the bull market of the late 1990s. Absolute returns weren’t even a thought among many long-only asset managers and their clientele. However, this started to change as share prices started their descent. The assumed indifference to losses slowly but steadily turned out to be ill advised. It is this reality kick that put hedge funds on the agenda of many investors.

Concluding remarks

Put simply, under the absolute returns approach, there is an investment process for the upside (return-seeking by taking risk) and for the downside (some sort of contingency plan if something unexpectedly goes wrong or circumstances change). Changing circumstances and the flexibility that comes with an absolute returns mandate are key differentiating factors when compared to traditional asset management. The change could be a sudden exogenous or endogenous market impact, excess valuations, heavily overbought market conditions, a concentration of capital at risk, a change in liquidity, and so on. Absolute return investing, therefore, means thinking not only about the entry into a risky position, but also about the exit. Absolute return strategies, as executed by hedge funds, could be viewed as the opposite of benchmark hugging and long-only buy-and-hold strategies. The former is designed to avoid losses during market turmoil; the latter isn’t. It is not entirely unreasonable to believe that historical returns sell. It is also generally acknowledged that past returns might not be a good indicator of future returns. An investment philosophy, on the other hand, tells us today how risk will be managed in the future.

The aim of an absolute return strategy is to have fairly constant positive returns, ideally irrespective of stock market direction. The absolute returns investment philosophy is targeted at loss-averse investors, that is, investors who are not indifferent to losses. Potentially that’s everyone.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 103

Myth: Investors Are Risk-Averse

Alternative investments demystified

ALEXANDER INEICHEN, INEICHEN RESEARCH & MANAGEMENT, part of a series with VIRTUS INVESTMENT PARTNERS

Originally published in the April 2015 issue