With all the uncertainty we are seeing in global equity markets at the moment, it is often helpful to corral some of the best investment brains under one roof to provide some perspective, including how fund managers

should respond.

Volatility in equity markets is likely to continue during 2016: that was the predominant feeling among fund managers, asset allocators and hedge fund selectors attending an Alternatives Seminar hosted by Old Mutual Global Investors (OMGI), which manages £7.4 billion in alternatives, and held at the Corpus Christi College, Oxford on 13-14 April. Asked whether they expected that the higher levels of equity market volatility over the last 12 months would persist during this year, the majority responded yes, in a straw poll taken at the event.

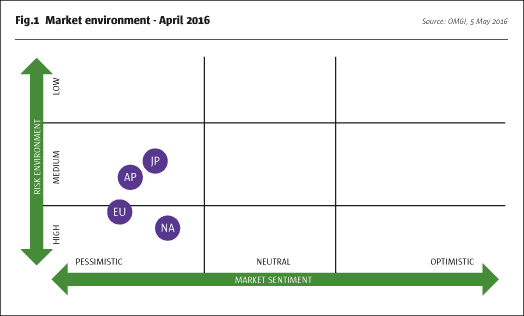

Though an informal survey, it was supported by detailed studies of market sentiment undertaken by the OMGI Global Equities team, led by Dr Ian Heslop, who spoke at the event. North America, Europe, Asia Pacific and Japan are all positioned in pessimistic sentiment territory (see Fig. 1), according to the team’s proprietary market environment indicators.

“World equity markets have been unstable and challenging, swinging wildly,” he said. “Volatility has increased and market sentiment has worsened across all regions.”

Going short

Simon Murphy, Manager of the Old Mutual UK Opportunities Fund, which takes long and short positions and expresses a directional view on markets, gave several fundamental reasons why the rally in equities over recent weeks could well prove short lived.

“Economic growth is slowing, corporate earnings are going backwards, market price valuations such as price earnings ratios are high, corporate leverage is high, and there is a growing loss of faith in central bankers,” he said.

Murphy recently expressed his bearish view by taking the Old Mutual UK Opportunities Fund to a 40% net short position.

By contrast, Tim Service, who spoke on the same panel at the conference as Murphy, manages the Old Mutual UK Specialist Equity Fund, a recently-launched Ucits fund, with a near to market neutral net position, in order to focus on generating alpha through stock selection.

“A low net exposure means we have the potential to deliver steady returns with low correlation to UK equity markets. We can focus on stockpicking, adding value through short positions as well as long,” he said.

Macro moves

Edgar Senior, of Senior Family Office, argued that macro managers had it tough. “You have to predict not only the economy, but also central banks, and also how markets will react,” he said. “The levels of decision making make it hard for even the best connected, smartest macro guys to make money.”

Russ Oxley, head of rates & LDI, OMGI, disagreed. “Prospects for global macro are greatas we move to a more divergent policy regime,” he said. “The opportunities for global macro are many and varied. For macro, a steady eye on the middle distance is what’s required.”

Oxley also drew a strong distinction between equity and rates markets. “In rates the upside of the view is truncated. It is not like stocks. A lot of managers are overwhelmed by the opportunity set, and often overpay for limited loss strategies,” he said.

The Old Mutual Absolute Return Government Bond Fund, managed by Oxley, has recently had profitable positions from long positions in US inflation.

“We have been bullish of US inflation, with specific positioning in the short to medium term maturities,” Oxley said.

Central banks losing their grip

According to Oxley, the swaps market place has been fundamentally changed by the reduced role of investment bank proprietary trading. “Banks have shrunk prop desk trading outlay, and shrunk risk,” he said. “This has changed the market place. The market has become more reactive in the short term, providing an opportunity to longer term funds.”

Senior agreed that the market had changed, and argued that leadership had passed from large hedge funds to central banks. “Back then everyone could feel the weight of Brevan Howard in the market,” he said. “Nowadays it’s Janet Yellen [chair of the US Federal Reserve].”

Ned Naylor-Leyland, Manager of the Old Mutual Gold & Silver Fund, argued that central banks had lost control of the economy. He also suggested that many investors were aware of this but dared not say it out loud. “History shows that once you get to this stage in the debt supercycle, it’s just a case of what the new monetary system will look like,” he said.

He argued that asset allocators should use gold as a hedge against monetary instability. “Gold is a currency not a commodity,” he said. “It is sold in US dollars but should be seen as a global trade-weighted currency.”

Naylor-Leyland also said that the central banks of G20 nations currently hold 18% on average of their reserve position in gold bars. By contrast, asset allocators and individuals have record low positions in both gold and gold mining shares, he pointed out.

Data, data everywhere

Sarbjit Nahal, Managing Director and head of the thematic investing strategy team at Bank of America Merrill Lynch, argued for being long stocks like Hitachi, Amazon, Google and IBM, as likely beneficiaries of the revolution in intelligent robotics.

“The next industrial revolution is upon us: the rise of the intelligent machines,” he said.

Heslop was asked what he felt when he was accused of ‘just looking at data.’

“It makes me really annoyed,” he said. “Everyone looks at data. Show me someone who doesn’t.”

Cédric Kohler, Head of Hedge Fund advisory, Fundana SA, speaking in the context of managing risk, warned that data was not enough if it creates a sense of false confidence in risk managers. “It is dangerous to have too much data,” he said. But he was also open to the possibilities of intelligent robotics. “Maybe machines could be used to train investment managers, either using past data, or by creating additional scenarios,” he suggested.

Leif Cussen, Portfolio Manager at OMGI, warned that it was important for investors to understand the limitations of machine learning in the context of forecasting risk in financial markets. “Given the lack of transparency inherent in some machine learning approaches, we should remain mindful of the old adage: when models turn on, brains turn off.”

Mark Greenwood of the Rates & LDI team, OMGI, agreed. “Deep learning networks have many nodes, making it difficult to understand how they arrive at their results,” he said.

Professor Mark Salmon, of the University of Cambridge, said that data problems in finance often stemmed from the fact that controlled experiments, as practiced in many branches of science, were not practicable.

“In finance our data are drawn from one single experiment,” he said. Many approaches used by hedge funds could be prone to statistical errors such as overfitting, data snooping, spurious inference and backtesting failures, he warned. He recommended that practitioners take advantage of theoretical advances by using recently released statistical packages implemented in packages for the R language, such as Multtest, sgof, mutoss, multcomp, HybridMTest, qvalue, and stats.

Professor Ian Marsh of Cass Business School showed detailed statistical research spanning decades, investigating why the carry trade – borrowing in low interest rate currencies and investing in high – and momentum trading have been able to deliver excess returns.

Lee Freeman-Shor, who runs more than $3 billion in assets as a portfolio manager at OMGI, argued that a disciplined approach to execution of investment ideas can add significant value. He developed software called Wingman to systematise good execution, and gave as an example how it helped him turn a loss on a long position in Royal Dutch Shell into a substantial profit by increasing the stake after a fall.

“With buy and hold we would have lost -1.04% on our investment in Royal Dutch Shell. But the return using Wingman was 23.24% – massive added value,” he said. “Add in the dividends, an additional 2.71%, and we have made 25.95%.”

Freeman-Shor also revealed how he coached a number of the world’s most famous fund managers who run concentrated long-only portfolios in sleeves of his Best Ideas funds.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 113

Market Sentiment Pessimistic

Old Mutual conference tackles equity market turbulence

DONALD PEPPER, MANAGING DIRECTOR OF ALTERNATIVES AND INSTITUTIONAL, OLD MUTUAL GLOBAL INVESTORS

Originally published in the April | May 2016 issue