Two years ago we wrote in this publication about our conviction in Japanese hedge funds, due to their track record of generating consistent alpha and managing risk during down periods in the markets. Similarly, we explained how these managers had, over the course of almost two decades, acquired a unique set of skills which had helped them to navigate through tough market conditions and deliver attractive long-term risk adjusted returns. We discussed how the size and depth of the Japanese stock markets, coupled with low research coverage compared to other developed markets, provide the right investment framework for home-grown hedge fund managers to develop an edge over foreign institutional allocators as well as local retail investors, and how these managers were able to uncover mispricing opportunities.

We also looked into how a range of idiosyncratic factors such as cultural differences and the language barrier have made it harder for foreign investors to participate in the market, and have allowed local managers to be alpha generators. Our conclusion at the time was that while the changed macro outlook for Japan had triggered increased flows from global long only allocators, investors should challenge the prevailing wisdom that the main reason for betting on Japanese equities was the turnaround of a protracted Japanese bear market, and instead focus on the alpha generation opportunities available in this unique market based on identifying investment ideas generated and executed by the most experienced local managers.

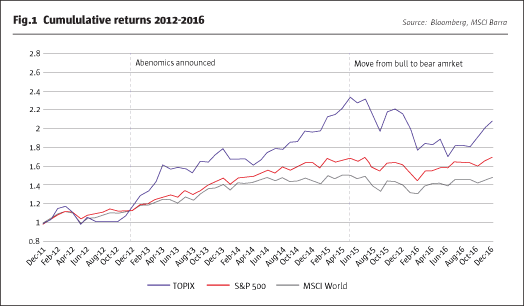

Since that article was published, market events in Japan have further supported our arguments as we shall explore in this follow-on article. The five-year period running from January 2012 to December 2016 can be split into two market periods. From January 2012 through May 2015, the Japanese stock market, represented by the Topix Index, experienced one of the past few decades’ strongest rallies. However, this market momentum did not last and was followed by a severe downward move between June 2015 and December 2016, resulting in an 18 month bear market.

Crucially, however, we have also seen that the seasoned hedge fund managers we were advocating in our last article have continued to deliver on their objectives of generating attractive risk-adjusted, as well as absolute returns. Overall these changes in market direction and risk factors, such as heightened volatility, were well handled by local hedge funds. They didn’t play the market’s beta but instead looked for uncorrelated investment ideas, often times with very low net exposures, thereby generating sustained alpha while managing downside risk in an exemplary manner.

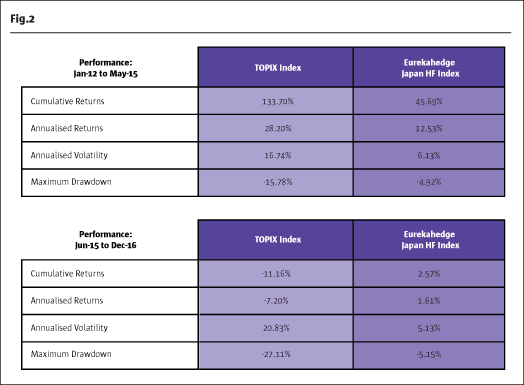

On average these managers have delivered absolute returns of +2.5% with a volatility of 5% for the period from June 2015 to December 2016. Over the same timeframe a long only investor in the Topix Index would have lost -11% and suffered a volatility of 20%. While the Topix Index gained 134% during the period of January 2012 through May 2015, Japanese hedge funds measured by the Eurekahedge Japan Hedge Fund Index, gained 50% but with a volatility of only 6% compared with 17% for the Topix Index, and they did so with much lower net exposures, and hence lower overall risk and beta. Conversely, in the second period, the bear market, the Topix Index suffered a maximum drawdown of approximately -27%, while Japanese hedge funds, according to Eurekahedge, lost only a fraction of that, with a maximum drawdown of approximately -5%.

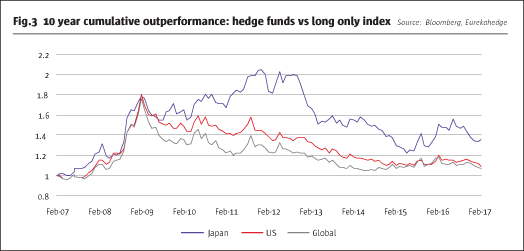

If we expand the timeframe to 10 years, we can see that the recent outperformance of Japanese hedge funds is not a temporary phenomenon and that alpha has been generated consistently over a long-term period; looking at the outperformance of Japanese hedge funds represented by the Eurekahedge Japan Hedge Fund Index over the Topix Index, we see that despite a challenging market environment, which has resulted in higher drawdowns and volatility for Japanese equities compared to other global equity markets, Japanese hedge funds were able to control risk and adapt remarkably well.

As a result, the outperformance by Japanese hedge funds over their long-only equity benchmark has been superior to the that of US and global hedge funds against their respective long-only equity benchmarks. While US and global hedge funds, measured by the Eurekahedge North America Hedge Fund Index and the Eurekahedge Hedge Fund Index, have outperformed their regional equity benchmarks by 40% and 42% respectively, the Eurekahedge Japan Hedge Fund Index outperformed the Topix Index by 68% over the same period hence generating significant alpha for investors.

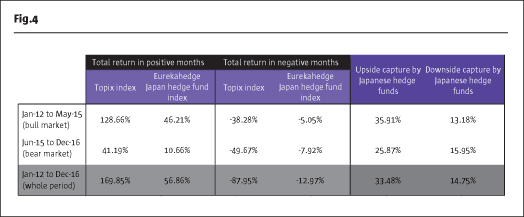

How can we explain the ability of Japanese hedge funds to generate more alpha than their US and globally-focusedpeers? The first clue to this can be found in the exceptional upside versus downside capture that the Japanese hedge fund industry displays. Over the five-year period we have been looking at, the upside and down side capture delivered by Japanese hedge funds was 33% and 15% respectively, very much in keeping with their long-term goal of providing superior risk-adjusted returns through downside protection. In comparison, US and global funds had capture ratios to their long-only benchmarks of 60% and 38% for US funds and 68% and 34% for global funds respectively. In other words, over the last five years, despite the tough market conditions Japanese hedge funds have outperformed US and global hedge funds on a risk adjusted basis by an important margin mainly owing to their superior ability to minimize their downside capture resulting in a reduction of drawdown risk by more than half.

This, in turn, can be attributed to two factors: the unique properties and opportunities presented by the Japanese market for a long/short manager with in depth and on the ground research capabilities, and a culture of strong diversification and disciplined risk management.

One primary factor that creates unique conditions in this market for value style stock pickers has been the low level of crowdedness amongst allocators to Japanese stocks. The limited number of analysts covering small and mid-cap stocks and smaller number of sophisticated investors chasing them makes these categories less efficiently priced than in other developed markets, creating more opportunities for skilled stock pickers. The outflows experienced by the Japanese hedge fund industry in 2003 and 2008 further led to a situation where the playing field for the survivors has been left wide open and where crowded trades are few and far between, unlike in the US and Europe where overcrowding of trades is a frequent complaint. To illustrate the scale of the difference, as of February 2017 the collective AuM of US hedge funds is an estimated 4.4% of the country’s total market capitalisation, and the equivalent figure for Europe is 6.36%. In contrast, Japanese hedge fund assets are estimated at only 0.84% of the market capitalisation. Hedge fund managers with the ability to engage in in-depth fundamental value research on under-researched companies hold a discernible edge over long-only investors in Japan which doesn’t exist to the same degree in the US or Europe.

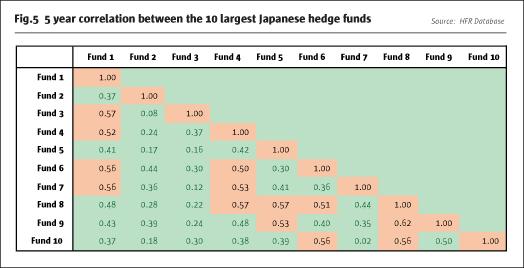

The range of opportunities and relative lack of competitors for a trade is most clearly demonstrated by the low correlation between Japanese hedge funds. Table 3 shows the correlations between the top 10 largest managers in Japan by AuM, based on data provided by HFR. Notably, most managers in this group exhibited correlations below 0.5 with each other which is unexpected given that most of these hedge funds’ assets are invested in equities and are hence heavily exposed to the same markets albeit to different capitalisation segments. This further supports the notion that the Japanese market is somewhat different and unique, and that managers are able to generate alpha from a diverse range of investment ideas unlike in other developed markets. Given the low level of hedge fund versus other types of capital, it certainly appears to be the case that the opportunity set for managers to continue pursuing uncrowded ideas remains high, and that this isn’t going to change anytime soon.

As an aside on this subject, we also believe that the best opportunity for Japanese managers is probably in the small and mid-cap space. Following from this, and unlike in many other regions, we have recently seen many of the best managers close to newinvestors at comparatively speaking relatively modest levels of AuM ($300m-1bn), in order to maintain their flexibility and alpha generation potential going forward. Japanese managers we speak to are acutely aware of the need for liquidity and are fiercely focused on this after having learned from past crisis that illiquidity can quickly lead to the end of a fund.

The unusually high level of diversification within Japanese hedge funds, with many of the top funds having 200+ positions in their portfolio, is partly a reflection of the broad opportunity set, but also of the very disciplined approach to risk management honed by Japanese managers who have survived decades of trading choppy and falling markets, which has shaped the strict adherence in most cases to significant portfolio diversification. Very concentrated portfolios are few and far between, with those managers who do run concentrated portfolios going to extreme lengths to understand their investments, significantly beyond what we have seen elsewhere. Portfolio returns are most commonly generated through consistent alpha which is harvested from a wide range of compelling trades on both the long and the short sides, rather than from a limited amount of outsized bets. Individual trade ideas tend to be more unique to each manager than would be expected in a US fund for example, and they typically have a low correlation to other underlying positions in the portfolio.

The high value placed on risk management by Japanese managers, typically combined with low gross and net exposures, and hence a low beta approach to return generation, has so far enabled these managers to avoid being swept up in negative macro events, such as the massive outflow of foreign capital experienced in the first half of 2016. Through this diversified, alpha-driven approach to investing, Japanese hedge fund managers have been consistently able to handle changes in market direction and risk factors, and continue to generate positive returns while at the same time being able to protect effectively against drawdowns during unfavourable market conditions.

It is quite rare to find both superior alpha generation and risk management skills in one portfolio manager. However, all the elements described here support our view that Japanese hedge fund managers have consistently demonstrated both by generating attractive risk adjusted returns with low correlations, and consistent alpha during bull and bear markets. This to us is the purpose of a true hedge fund, and the ability demonstrated by the Japanese hedge fund industry so far means investors should seriously consider their inclusion in a portfolio not for macro reasons but for the alpha they are able to consistently provide.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 122

Japanese Hedge Funds

Delivering strong alpha while efficiently protecting the downside

PABLO URRETA, SENIOR PARTNER & HEAD OF RESEARCH AND PATRICK GHALI, MANAGING PARTNER, BOTH SUSSEX PARTNERS

Originally published in the April | May 2017 issue