With the Dutch elections over, the Euro has breathed a sigh of relief. As Geert Wilders’ nationalist Freedom Party fell short in the parliamentary elections on March 15, the euro gained nearly one percent against the US dollar, albeit on a day when most currencies strengthened versus the greenback. While Wilder’s party suffered a spectacular collapse in polls in the immediate run up to the election, there was never any serious concern that he would be running the Dutch government. By contrast, the upcoming French Presidential election in April has the potential to be a much bigger source of volatility for the euro, as well as other currencies, equities and bonds.

France votes in two rounds. Round one takes place on Sunday, April 23, and the top two vote getters will proceed to the second round on Sunday, May 7. On both days, the French government will issue an exit poll at 8:00 pm Paris time (7:00 pm London, 2:00 pm New York and 1:00 pm Chicago) with a preliminary projection of the winner. It appears likely that one of those two top vote getters will be Marine Le Pen of the National Front who promises, among many other things, to hold a referendum on France’s memberships in the European Union (EU) and in the Euro currency that spans 19 countries. As such, a Le Pen victory holds the potential to roil the markets in the way that the surprise Brexit vote did in 2016.

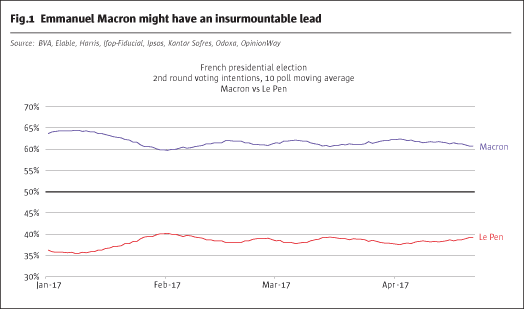

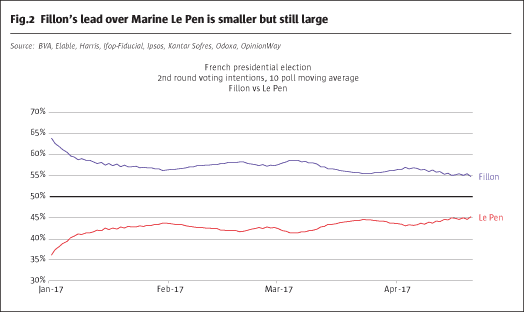

On the face of it, she seems unlikely to win. Recent polls have put her at 20-30% behind her most likely second round opponent, the pro-European centrist Emmanuel Macron (Fig.1). She trails her next most likely second round opponent, the center-right Francois Fillon, a former Prime Minister, by a 10-20% margin (Fig.2). Fillon is also pro-Europe.

Despite her trailing so badly in the polls, oddsmakers at Predictit.org still give her a 32% probability of winning on May 7 – about the same odds as they gave a Brexit vote, and to Donald Trump winning the US elections. Participants in these markets judge Macron to be the most likely winner with a 58% chance of moving into the Palais Elysée presidential residence, while scandal-plagued former front- runner Francois Fillon has about a 9% chance of winning. Finally, the beleaguered Benoit Hamon of the ruling Socialist Party has only a 1% chance of winning.

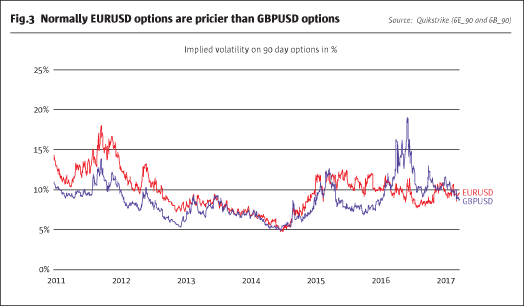

One curious disconnect: while oddsmakers give Le Pen a 32% chance of winning, the currency options market seems almost entirely unconcerned. Euro-US dollar (EURUSD) options are inexpensive relative to historical values and when compared to options of the same maturity on the British pound. Up until Brexit, euro options were normally more expensive than pound options (Fig.3).

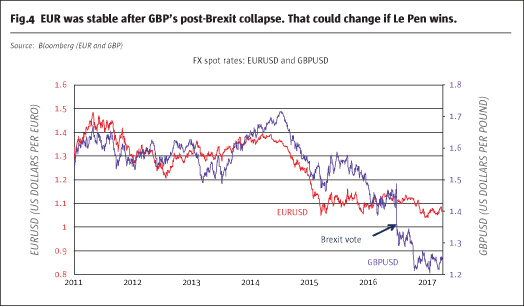

A Le Pen victory could create chaos among European banks, and could cause the collapse of the Euro versus the US dollar much like the British pound falling 20% after the Brexit referendum unexpectedly passed (Fig.4).

If Le Pen wins, it might create an expectation among bank depositors that the Euro will break up. This in turn could cause French, Greek, Irish, Italian, Portuguese and Spanish depositors to move their money to German banks in the expectation that a new Deutsche Mark would be stronger than the new currencies of the aforementioned countries in the event of a euro break up. In reality, such a risk is probably overblown. Polls show that the French overwhelmingly favor remaining in the Euro. As such, even if Le Pen wins and calls a referendum on the subject of Euro membership, French voters might still choose to remain within the common currency and the EU. Even so, additional strains on the European banking system could come as an unwelcome shock to an economy that is growing slowly after years of lethargy.

If Le Pen loses, which at the time of this writing appears to be the most likely scenario, the Euro could get a much bigger boost than it did on the back of the Dutch election on March 15. Under a Macron or Fillon victory, the currency could easily work its way up to 1.16 or so against the US Dollar, which has been in the upper bound of its range for the past two years. Working up past 1.16 might require some additional evidence that the European economy is continuing to strengthen, the European Central Bank (ECB) is ready to curtail its easy monetary policy or, on the other side of the EURUSD exchange rate, that the US economy is slowing in a manner that will prevent the Federal Reserve from tightening further.

A Macron victory wouldn’t necessarily support the Euro in the long term. After the Presidential election in May, France will have two rounds of voting for the National Assembly in June. Macron’s own political movement, En Marche, is a new organization that is mainly a vehicle for his Presidential candidacy and won’t necessarily be in a position to compete effectively in many of France’s 577 National Assembly districts. As such, he would likely have to piece together a governing coalition and may experience a great deal of difficulty governing.

The same could be said for a Le Pen win. In the 2012 election, she took 18% of the vote in the first round but her National Front party won only three of 577 seats in the National Assembly. Even if she wins the Presidency, it defies credulity to think that her party could win anything close to an outright majority. Unlike the US Presidency, the French President can call referendums, thereby bypassing the National Assembly to get laws enacted. Even so, most referendums proposed under the Fifth Republic, France’s current system of government established by Charles de Gaulle in 1958, have gone down to defeat. The ability to propose a referendum isn’t the same thing as the ability to convince the public to approve what the President wants.

Only under a Fillon victory would it be likely that the President would have a majority in the National Assembly. For the moment, Fillon is significantly behind in the polls as a result of being under a formal investigation for having created fictitious jobs for his wife, Penelope, and children, paying them nearly one million Euros over a period of two decades for work that they allegedly never performed. Nevertheless, a Fillon win can’t be ruled out. He came from behind to win the nomination of his party against former President Nicolas Sarkozy and former Prime Minister Alain Juppé. With the possibility that Europe will wind up with a more fractured political landscape after this fall’s German elections, a Fillon win might be the most bullish outcome for the Euro.

While the polls show Le Pen way behind, it’s important to remember that if polls were right, the U.K. would have voted “remain” instead of choosing to leave the EU, and Hillary Clinton would have been President of the United States. Macron has gotten off to a good start but his platform is vague and he is untested as a politician. This is his first presidential election. Plus, he’s a former Rothschild banker and served in President Francois Hollande’s deeply unpopular administration.

Fillon will do his best to exploit these weaknesses to overtake Macron for the number two slot in the runoff. However, Fillon has other weaknesses beyond the Penelope-gate scandal. He is socially conservative on issues like abortion and same-sex marriage in a country that isn’t. Moreover, he favors Thatcherite economic reforms that, if enacted, would threaten government benefits and the job security of many voters. While Fillon’s economic strategy might be good medicine for what ails the French economy, cutting government benefits can make for bad electoral politics. This is probably why Le Pen maintains that she can preserve the French welfare state and will reduce costs by making sure that immigrants can’t get benefits. Her arguments might be specious but a nervous and economically insecure electorate might find them more appealing than FIllon’s bitter pill or even Macron’s vague promises to liberalize the labor market by making it easier for employers to fire employees.

As such, the oddsmakers are right not place too low a probability on a Le Pen victory. The currency options markets might be wise to ignore the public opinion polls and follow the oddsmakers’ lead. Following the release of the exit polls at 8:00 pm Paris time on Sunday, May 7, the markets could be in for some big moves.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author(s) and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 121

French Elections

Euro hangs in the balance?

ERIK NORLAND, CME

Originally published in the March 2017 issue