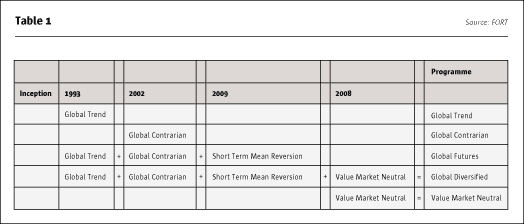

Among CTAs, Washington DC area and New York-based FORT is highly unusual in that its absolute performance since 2008 has been very similar to its numbers in the 15 years from 1993 to 2008, when expressed as a spread over risk free rates. This persistent outperformance has propelled the strategy’s returns further ahead of the SG CTA index (of which FORT Global Contrarian has been a constituent since 2016). What is more distinctive is that FORT’s absolute risk-adjusted returns have actually been higher post-crisis than pre-crisis. “It cannot just be luck to have outperformed the CTA index on average for more than 20 years,” says co-founder, Dr Sanjiv Kumar. Part of the superior returns are attributable to FORT’s somewhat differentiated trend following strategies having outpaced most others, but FORT has also developed trend-anticipating and non-trend strategies that contribute to its various multi-strategy offerings. A summary of the standard program suite is shown in Table 1 (other combinations can be customised).

Though FORT’s strategies are 100% systematic and quantitative, Kumar argues that the founders’ heritage in discretionary macro provides a different perspective from the mainly Chicago-oriented exchanges and brokerages that spawned many CTAs. Kumar, and co-founder Dr Yves Balcer, managed $25 billion fixed income portfolios for the World Bank, employing a discretionary macro approach. A background in academia isanother differentiator, as both founders pursued PhDs before moving into portfolio management.

The limits of statistics

The doctoral research was less formative than the real world experience however. Some systematic and quantitative firms set great store by using the latest and most advanced statistical techniques, but Kumar thinks that the defining quality of FORT’s model-building mind-set is adaptation rather than statistical methods. “Our PhDs provided a useful foundation of knowledge and broad training in maths, stats and economics that was critical in starting the company. But we also realise the limits of this knowledge – you must know what you don’t know,” says Kumar.

Specifically, FORT has found that “it is much harder to use complex statistics in financial markets as there is too much estimation and markets are changing all the time. Physical phenomena can be reasonably stable but markets cannot have the stable distribution that many statistical models assume. So we have to have a process that keeps updating the models, adding and subtracting strategies, and re-estimating parameters,” explains Kumar. Rather than wholesale shifts, the changes are evolutionary with decisions connected to the past. Balcer finds that individual US equity names – an area FORT has branched out into over the past decade – are more amenable to complex statistics and big data because “there is a rich universe of elements that are reasonably comparable.” But he still “has a hard time imagining that sophisticated statistics will get you much further in directional macro markets that exhibit so much noise around the data. This creates a danger of reading too much from the data and overfitting models.”

A classic test of a model’s predictive power is how out-of-sample performance compares with in-sample simulation. Overfitted models rarely sustain their simulated returns, but FORT’s modelling parameters seem realistic. “Our realised Sharpe ratios of 0.7 to 1 are slightly better than our models’ Sharpes so we feel comfortable that reality matches the models,” says Balcer.

Four guiding principles apply to building models. First, models must be fully systematic (a nuance here is that algorithmic execution does require some degree of manual monitoring). Second, only liquid markets are traded as they provide richer data for quants and Kumar is alert that “the risk of markets freezing up is underestimated and we do not want the money to be stuck on those rare occasions.” Consequently, FORT trades fewer markets than some CTAs. Third, models should show a low or zero correlation to equity markets because “we are in business to add value so we do not want to keep replicating,” he says. Kumar is also conscious that equity markets have sometimes failed to deliver positive returns for extended periods. The fourth criterion is what most significantly distinguishes FORT from many other systematic managers: models need some kind of Bayesian or adaptive process.

Adaptation

“Our biggest edge is to keep adapting as the world keeps changing,” says Kumar. One of the most interesting model changes occurred 15 years ago: the birth of the Contrarian program. FORT started out only trend-following but currently the largest strategy, with assets of $1.86 billion, is trend-anticipating, which launched in 2002. “While trend-followers will be late getting in and late getting out, our Contrarian strategy participates in trends by seeking to get in early before the trend has started,” he says. “This strategy has a unique signal as usually discretionary macro traders are the ones trying to find disequilibrium and turning points. Very few systematic traders are trying to get into a trade when markets are moving in the opposite direction,”he adds.

But adaptation has not always entailed new models as the models are inherently reactive and adaptive. Trend, mean reversion and value are persistent inefficiencies but they are manifested in different markets at different times so the models need to emphasise the more opportune trade types. The models adapt according to a Bayesian process that applies larger weightings to those asset classes or time frames that have recently shown greater predictive power. FORT’s models can also adjust margin to equity and thereby volatility.

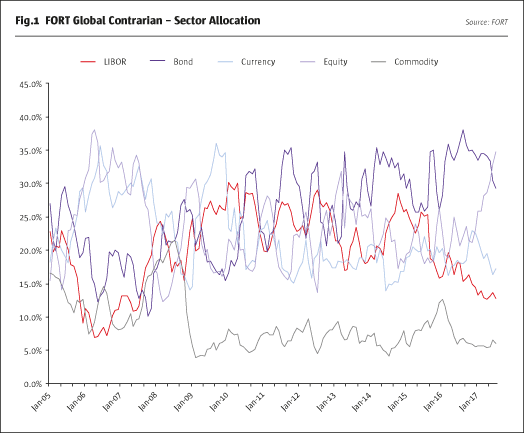

Currencies: from heyday to nadir

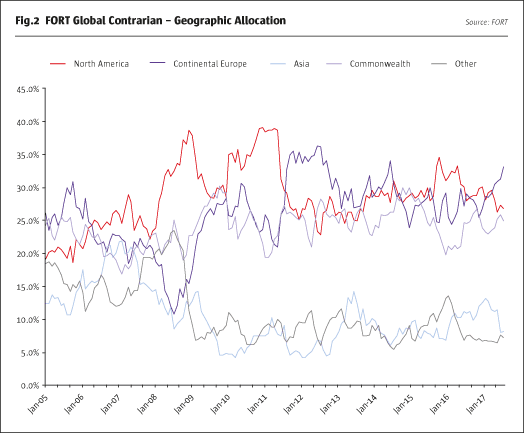

“In the long run asset class weightings have been the most important in differentiating our returns,” says Balcer. FORT has in recent years scaled back the weighting of foreign exchange because Kumar argues “it has been difficult to make money trading foreign exchange over the past 8-10 years. You need to go where the action is but the natural source of movement – from central banks and economies following different cycles – went away after 2008.” There is no prejudice against currencies and FORT might in the future increase their weighting. For Kumar, the heyday of FX trading was “from 1985 to 2000. There was lots of volatility in many markets and there were more markets before the Euro with multiple currencies.” FORT has increased its weighting in bonds, short term interest rates and equities. The charts below are illustrations of the contrarian strategy’s dynamic asset allocation among sectors, geography, and interest rate allocations.

FORT Global Contrarian strategy has also moved its asset class and geographic weightings around, as shown in Fig.1 and Fig.2.

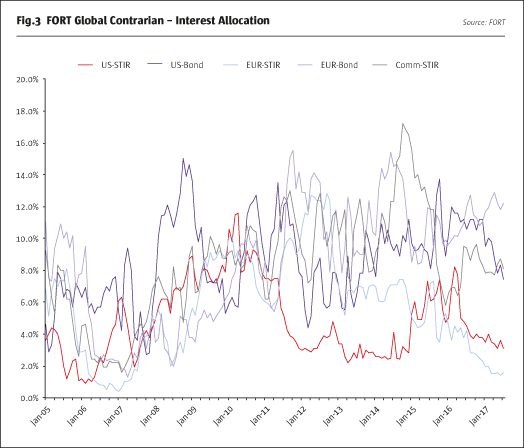

Drilling down into interest rates, the geographic allocations within this asset class have also varied over time, as detailed in Fig.3.

Over multi-year periods, adjusting holding periods has been less important than varying asset class weightings. But in certain individual years, the choice of time frame can have a substantial impact on returns. As FORT dynamically adjusts time frames, the firm cannot be easily bucketed as a short term trader or medium term trend follower, and it is the longer term time horizons that have been more useful recently. Given the ‘Risk On/Risk Off’ market behaviour, FORT has identified stronger trends over longer term time horizons, post-crisis. “There have been significant trends in bonds, equities and energy but many CTAs and macro funds have not participated in them because they have become more risk averse in their style of trading,” Kumar surmises.

No return without risk

Though most CTAs had a very strong 2008, the drawdowns in some strategies in 2008 saw many hedge funds have their first ever negative year and led to pressure to control risk from shell-shocked investors. This, in turn, exacerbated the ‘Risk On/Risk Off’ market action with many traders entering and exiting at similar times, leading to synchronised market moves. Some CTAs have also reduced their volatility target for various reasons. FORT does not directly target volatility but maximum margin to equity levels in practice place some ceiling on strategy volatility. FORT has not cut its average margin nor volatility levels and its typical range of margin to equity has been consistent with double digit volatility. Balcer reckons that “oneyear in five there might have been some benefit in reducing volatility but it would have sacrificed returns longer term.” Some allocators seek both lower returns and lower risk from hedge funds, but FORT’s aim is to keep pace with long run average stock-market returns. FORT aims to match the equity risk premium over 7-10 year periods with more consistency and lower volatility. “You cannot just focus on the risk and then hope that the return will happen. You must first aim for returns and then work to an acceptable level of risk,” says Kumar.

Searching for novelty

The search for lowly correlated return streams is not an easy one with so many competitors poring over the same data. Research at FORT can have a multi-year gestation period and FORT is patient in allowing time for ideas to flourish. “It is very difficult to come up with original ideas so there is no pressure to do something new. Researchers can take their time,” says Kumar. “Ultimately we are looking for new ideas rather than tinkering because real value comes from looking at and developing new ideas,” he makes clear.

For instance, “while the closing price is most relevant for trend-followers, historical intraday trading ranges of highs and lows are informative for some strategies. This is because there is no constant market clearing price. The process of price discovery means that markets push higher until they find sellers, and lower until they find buyers. These price levels are often being ignored but they reflect the underlying supply and demand curves.” Avenues being explored now include complementing price data with volumes, implied volatility, trader positioning, and analyst sentiment, to get interesting insights into the markets. FORT may also increase the universe of mean reversion strategies. Other research is underway to broaden out the equity market neutral strategy and to make it more robust.

Collegiate research

To drive forward this independent and differentiated research effort, FORT seek people who are creative, collegiate and who do not always have the most typical academic or professional background. “We are hiring more on the imagination and market experience side, as opposed to hiring physicists who are experts in the advanced statistics used in particle physics,” Balcer explains. “There are so many smart people in the markets that it is very difficult to make money consistently, so we seek creative people who can think outside the box. It is risky to replicate what others are doing as you get stuck in crowded trades and then need to be the fastest to exit,” says Kumar. For example, factor-based investing is becoming very fashionable but this is not something FORT is pursuing. Kumar argues “it is flawed as there is no such thing as a golden rule for all times, because markets change and some factors may go away after a while. This is a weakness of smart beta.” FORT is open minded about hiring people without a scientific or financial academic training, including those who have not studied beyond undergraduate level. “We have hired people from other industries who made investment their passion and hobby over many years. They may lack the discipline to make a strategy robust and stable but we can take their creativity and make it robust,” explains Kumar. “We hire people with experience of trading, who might not have succeeded as business people, but have a germ of an idea that is exciting, and could, if we can harness it, provide some insight different to what is commonly believed,” adds Balcer.

The potential to polish these ‘rough diamonds’ comes partly from FORT’s collegiate culture. “Siloes reduce the ability to work together so we need people who accept that others can help them and are not so enamoured with themselves. They work with me and Yves and increasingly amongst each other,” Kumar points out.

FORT champions diversity and Managing Director and Head of Business Development, David Barrett, recently participated in a client seminar on the topic. “A more diverse team is better as we do not want to replicate the same blind spots,” acknowledges Kumar. FORT is diverse in terms of country origins. Kumar comes from India, Balcer from French Canada, and other staff from countries and regions including France, Greece, the UK, Middle East, China and Ukraine.

There is much overlap between research and technology because “if you define a new technique, it is highly dependent on technology,” explains Balcer. Some people do both things, so that the headline headcount numbers (in research and in technology) are somewhat fluid (and the technology team also straddles both research and operations). Research and technology together make up half of the firm. Many of the researchers are also good programmers, who have used languages such as C, C++, VB, Matlab and R. “Whenever a research idea is generated it goes to the programming group who can make quicker calculations. We may rewrite code in a different language. A vetting check is for a second person to independently write the code to check it for flaws. Then an extensive testing process begins,” explains Kumar.

Trade execution

Execution algorithms are also reviewed regularly. FORT’s approach to execution has adapted with market change and technology. For instance, “the median trade size of S&P Mini contracts has plummeted from 20 contracts to one, but overall volumes have increased. The increase in electronic trading lets you hide orders better through smaller trades,” says Kumar. Still, trade execution consumes fewer resources than the investment model-building because FORT garners most of its returns from medium term market moves rather than from fine tuning intraday execution. The objective of FORT’s execution is to preserve, rather than add, alpha. Execution efficiency can be measured relative to bid and asks prevailing at the time the trade was placed, and a fill at the mid would imply zero slippage. As this is very unlikely, some costs are built into models and FORT ranks algorithms according to how well they do. FORT has been collecting tick data for over 20 years, and this can be used to simulate execution performance. Actual performance has slightly beaten simulations, but execution costs are fairly marginal. Kumar estimates that the strategies incur costs of around 0.75% for both execution and clearing with roughly half of that down to execution. Balcer points out that FORT “trades highly liquid securities and builds models with multiple entry and exit points. The bulk of assets are in the contrarian strategy, which as a liquidity provider, generally executes at more or less the theoretical price.” Given that average trade periods on the futures side have recently been 5-6 weeks, Kumar does not think that probable savings from developing in house co-location would warrant the costs. FORT is nonetheless keeping abreast of automated trading trends and has hired somebody with 20 years of algorithmic trading experience. FORT is exploring potential to make use of brokers’ co-location pipes and algorithms to connect with exchanges.

Equity market neutral: fundamental value

On the equity side, holding periods of one year also reduce the relevance of execution and fundamental value is the main source of returns. FORT diversified its investment universe into single stock equities a decade ago and the models applied are quite different to those used in macro markets. In broad terms, FORT uses accounting data to identify value stocks but the devil is in the detail. Some well-known value investing benchmarks seem to have been in the wilderness for a decade but “value haslagged because it is not correctly defined,” argues Kumar. FORT’s equity market neutral programme also includes quality-related measures and allows more latitude for factor exposures such as market, sector, sub-sector and market capitalisation, which are held constant in many quantitative equity programmes. Additionally, FORT uses index hedges on the short side because “using the same method to identify both longs and shorts doubles the risk,” argues Kumar. Moreover, single stock equity shorts can be subject to financing and security borrow costs, recall risk, and other restrictions, so “we find it more efficient to use our approach to select longs and use a neutral hedge utilising equity index futures,” explains Kumar. The strategy has run for nine years and is the only FORT strategy that uses fundamental data, in the form of financial statements. “The US accounting data from S&P IQ is pretty good, but we further clean and break down the data when it is released,” says Kumar.

Tax efficient for US taxables

Many hedge fund strategies generate short term capital gains that in the US are taxed at a higher rate (ordinary income tax rates of up to 39%) than long term gains (currently taxed at just 15%). FORT’s equity market neutral strategy has been calibrated to optimise tax efficiency. Losing positions are sold within one year to generate a short term capital loss that can be offset against short term gains elsewhere in portfolios, whereas winning positions are sold after one year to ensure that the gains are long term. The net effect is that incrementally an investment in FORT may result in only very marginal additional tax (and under some scenarios it might even reduce overall tax liability). Additionally, futures, which are used on the short side, receive relatively favourable tax treatment irrespective of holding periods: some 60% of gains are treated as long term capital gains with only 40% being taxed as short term capital gains. The standard disclaimer that we are not offering tax advice, and that professional expertise should be sought, applies.

Institutionalisation drive

Throughout its history, FORT has outperformed over multi-year periods, but asset levels have only made a quantum leap over the past few years. A wake up call occurred in 2008 when the firm received redemptions despite good performance. “As institutions replace endowments and high net worth individuals, there is more emphasis on institutional capability, more requests for information, and more operational concerns,” reflects Kumar, who acknowledges that the firm had not hitherto devoted sufficient resources to creating an institutional infrastructure that could appeal to large allocators.

In the early years, on top of shared responsibility for research, Balcer also had oversight of mid and back offices, compliance and legal while Kumar handled the front office, and trading platform technology. As the firm grew these duties were delegated. For instance, the addition of a COO in late 2015 means that Balcer’s oversight of day-to-day operations has diminished greatly and Kumar is also spending less time on trading and technology. By early 2018, the two founders expect to devote all of their working hours to research, long term strategy and talking to large clients.

FORT’s asset growth has been used to reinvest in hiring more staff, with headcount now close to 50. The company recently migrated to larger offices on two floors of the same office building in Chevy Chase, Maryland. The New York office is headed by principal and managing partner, Alan Marantz. It houses 12 staff, including David Barrett, who runs business development. Barrett started the capital introduction business at Morgan Stanley and spent 12 years running the group. “We need to keep on investing in people as investors expect more,” he says.

Risk management

Risk management and its governance framework is one part of the institutionalisation impetus. FORT’s risk management has many layers. At the investment level, there are maximum position sizes for every security hard coded into the system and 24 hour trading capability means alerts can pop up and stops can be triggered at any moment. Actual trades are compared against hypothetical trades. The trading desk staff tell us that they like to “quadruple check everything”. The Operating Committee, comprising of the COO, Deputy COO, CFO, CTO, GC/CCO, Head of Trading Ops and Head of IR, meets weekly and discusses day-to-day operational, legal, accounting, trading and client developments, issues and risks, and anything unusual that the trading desk sees. Then the Risk Committee, including Balcer, Kumar, Barrett and others, meets monthly, to escalate to higher level findings from the Operating Committee, so that the COO or CTO might look at them.

Counterparties are monitored and credit risk is not taken with cash, which is held in Treasury Bills. “We take enough risk with the size and direction of our futures positions. We do not want to try and squeeze a few basis points more. If you want credit risk you should go to a credit manager for that,” says Kumar.

Transparency, risk aggregation and reporting

FORT prides itself on high levels of transparency and clients can access Kumar and Balcer to get detailed attribution (without giving away intellectual property). FORT’s transparency drive was partly a response to three questions that leading investment consultants often ask: are you signed up to the Hedge Fund Standards Board (HFSB), do you produce administrator NAV transparency reports, and do you provide risk aggregation according to Open Protocol Enabling Risk Aggregation (formerly known as OPERA).

FORT was among the early adopters of the HFSB, which has a policy of comply or explain with its standards that compels members to explain how they comply or why they do not. Deputy COO, Drew Keller, says “we have steadily improved compliance with the HFSB.” Keller has participated in HFSB panel sessions in Washington DC, and the annual stakeholder event in New York. “Thomas Deinet does a fantastic job,” says Keller. Administrator NAV Consulting provides transparency reports.

FORT sends portfolio data to MSCI RiskMetrics, which reviews and provides the open source Open Protocol reporting (and some FORT clients also choose to purchase RiskMetrics’ commercial risk aggregation offering). Additionally, some clients request customised reporting from FORT.

Regulatory reporting takes more and more time and uses both internal and external resources. FORT’s CFO and CCO, along with SS&C GlobeOp, oversee quarterly form PF filings while the annual form ADV is done in house.

Asset raising, liquid alternatives and capacity

Asset raising is a multifaceted strategy that does not focus on any one client type, such as institutions, alone. Kumar has been around for long enough to know that there will always be some client turnover so it is important to keep on making new connections. As well as attending capital introduction events, Barrett and his team are talking to high net worth platforms, investment consultants, US pension funds, Sovereign Wealth Funds, and endowments. Roughly half of FORT assets are in managed accounts that some of these investors require.

FORT has also launched UCITS vehicles to diversify its investor base and $700 million has been raised so far, partly with the help of some carefully chosen placement agents. There are two UCITS thus far (FORT Global UCITS Contrarian, and FORT Global UCITS Diversified) with another two in the pipeline. FORT were relative latecomers to UCITS because Kumar “wanted to spend time to understand the moving target of regulations and decide on the

right structure.”

Rather than tying up with a platform, FORT went down the DIY route and Kumar finds the service providers, including directors, in Ireland do a great job at complying with the regulations. Different opinions exist over whether and how UCITS can obtain exposure to commodities. FORT decided to omit commodities, which are not a huge part of its programmes. The exclusion of commodities has led the UCITS to slightly outperform the strategies that include commodities but of course this tracking error could operate in either direction.

FORT is among a number of managers retained as sub-advisors for two multi-manager ‘40 Act vehicles, run by Jaffarian’s Efficient Capital (who have contributed articles to The Hedge Fund Journal) and by Equinox. “We do not contemplate setting up our own ‘40 Act as it would entail extra complexity in terms of staff, regulations, legal, compliance and distribution,” says Barrett.

FORT is at peak NAV, peak assets and peak staff levels. Kumar reckons FORT is currently ranked as the twelfth largest CTA globally by assets of $4.2bn, but could run twice as much assets and aspires to be in the top five or six globally. “We would like to be in the top ten managers so that most mandates give consideration to our strategy,” says Balcer.

FORT’s principals and staff “eat their own cooking” by investing in the fund and their internal holdings are disclosed to investors on a daily basis. Kumar and Balcer have 100% of their liquid assets (excluding residential property) in FORT strategies, and invest on the same liquidity and leverage terms as external clients, paying all fees and costs bar management and performance fees.

Kumar thinks that fee pressure is the natural consequence of a maturing and consolidating industry. When he first arrived in the US, in Chicago in the 1980s, Illinois had a different bank on every street corner. Now six big names dominate retail banking and Kumar expects continued consolidation in the hedge fund industry. But he does not envisage being part of it. Kumar and Balcer are confident in FORT’s continued organic growth, which is very well deserved based on the consistency of its outperformance.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical