This survey has highlighted the inroads that technology has been making, and will continue to make, at hedge funds. By no means is this an indication that people are not important and don’t have critical roles to play throughout a fund’s organization. However, roles and responsibilities are shifting. Across the front, middle and back office, individuals are spending less time performing routine tasks and are being redeployed to analytical and other strategic assignments. The amount of data available to front office analysts is exponentially larger than in years past. Analysing investment theses requires an awareness and ability to interpret this data, as well as to contemplate how others, including computers, may be doing the same. Middle and back office team members need to understand their technology solutions to be able to identify and investigate non-routine transactions, errors or reporting irregularities as well as to be able to more comprehensively analyse financial performance to add value to strategic business decisions. These individuals can be more focused on delivering “operational alpha” rather than checking every single transaction. These developments have changed the type of talent that hedge fund managers require, as well as how they retain these individuals despite significant competition from hedge funds and other industries.

Talent management

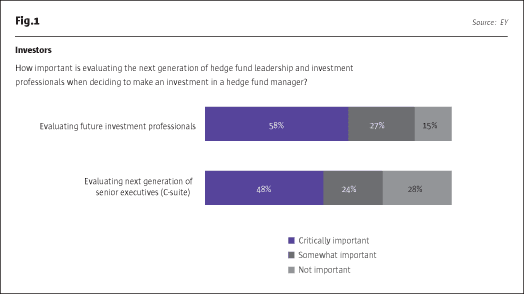

Investor confidence in future talent is critical in the decision to invest

Talent management and developing future leaders is far from an issue that is only an internal matter for hedge fund managers to contemplate. Investors increasingly are evaluating not just the current team in place leading their managers, but also the future professionals who could succeed and be the firm’s future leaders. Eighty-five percent of investors indicated that it is important for them to evaluate the future investment professionals as part of their investment due diligence, with almost 60% stating that this was a critically important consideration. Almost of equal importance to investors is assessing the next generation of business executives. Investors are not satisfied knowing just that the investment team is in good hands. They want to validate that other C-suite roles can be suitably filled when leadership transitions occur.

The due diligence process at one point was limited to evaluating the current firm leadership — that is no longer the case. Being able to attract and develop the next generation of executives is critical as investors contemplate issues such as succession and key man risk at their managers when deciding to invest.

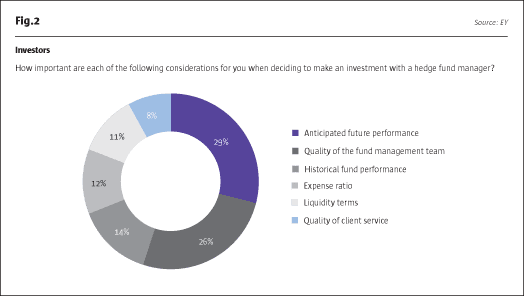

Over half of the investment considerations are based on the quality of people on the management team

A number of factors play into an investor’s decision to allocate to a manager. Terms, liquidity and strategy offering all influence the decision. However, the top two responses noted by investors were anticipated future performance and quality of the management team, with an average weighting of 29% and 26% respectively. Both of these considerations are directly attributable to the quality of people that the manager has employed to lead the business.

Anticipated future performance will be driven by both the current and future front office professionals responsible for the investment process. One should not be surprised that this is the top factor; however, it is more than double in importance relative to historical performance and demonstrates that investors are more forward-looking and need confidence that the people and processes are in place that will drive future success rather than rewarding past performance.

Investors also recognize the importance of having the right talent leading the business operations. While fund executives will include front office roles such as the CIO, investors want to see the right COO, CFO and other operational roles filled with individuals able to help navigate an increasingly challenging business environment.

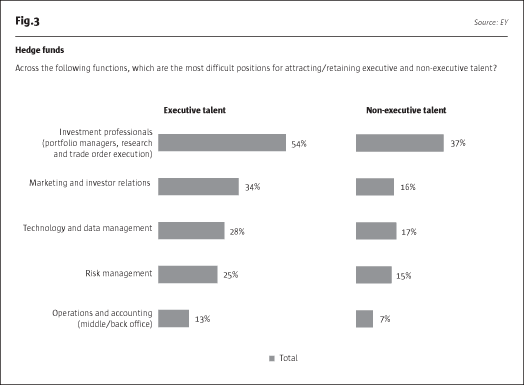

Competition and evolving needs of talent are leading to challenges in attraction and retention

The competition for the right talent is a key strategic issue facing hedge funds, particularly in the front office where over half of managers struggle to attract and retain executive investment professionals and over a third have difficulty in attracting non-executive investment professionals.

Managers are no longer competing solely with other investment managers. As technology and quantitative skills become ever more important, the range of competitors for top talent extends to FinTechs, technology giants and an ever increasing number of innovative technology

start-ups.

In years past, fund managers could count on talented individuals emerging from the banking industry to transition into hedge fund leadership roles. Years of regulations that led to asset management divestitures among the banks reduced that traditional talent pool. More than ever, hedge funds are needing to look internally, which means they need to attract and retain their best and brightest.

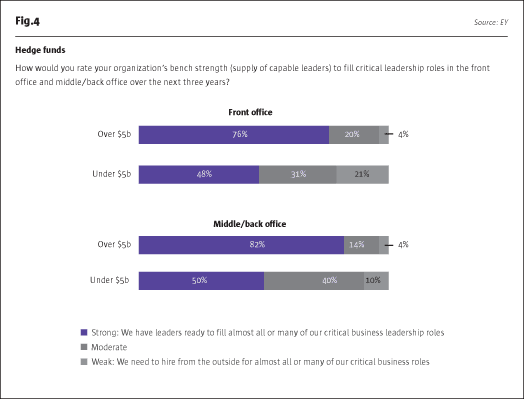

Half of managers with less than $5b in assets under management (AUM) are not confident in their bench strength

To exacerbate the talent challenge, a high proportion of managers with less than $5 billion under management are not confident in their ability to fill critical leadership roles from within the firm. As the industry continues to mature and more of the hedge fund pioneers exit the industry, it is imperative that the next generation is prepared to take the reins.

The largest managers appear most confident that they have individuals in place to succeed in the event of a planned or unplanned leadership opening. These organizations generally have more personnel and have been strategic in implementing internal mentoring programs, cross-rotational assignments, external coaches and other exercises to promote a seamless transition.

Midsize and smaller managers have been less active in implementing such programs. It is understandable to a degree as they have likely been focused on growing their business around several key individuals. However, development of capable talent is critical for managers of all sizes – both to serve as an attraction for potential future hires and motivation for current employees, but also to instill confidence in investors who increasingly are demanding robust talent programs that create organizational leadership depth.

Some managers are responding by implementing formal talent management programs, but the industry still has a long way to go

Managers have historically relied on brand, track record and ability to pay to attract and retain talent, but in today’s environment this is no longer enough. Other industries can offer combinations of outsized compensation and work environments that today’s professionals find personally and professionally compelling. Hedge funds need to be more strategic to compete.

We are seeing traction in this area as a number of managers have recognized this trend and taken action in building out talent management programs that are responsive to their employees’ (and prospective employees’) needs.

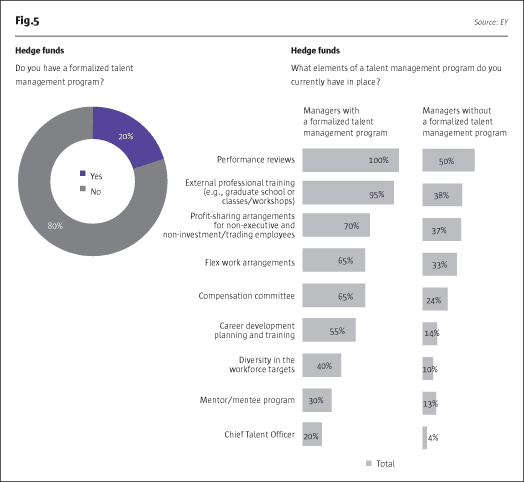

Although most have components of a talent management program, only 2 in 10 managers say they’ve implemented a fully developed formal program. Those that have comment that the formal program allows them to demonstrate to employees that they are committed to developing personnel in a meaningful way. It also helps the manager identify which elements of their overall compensation and culture offering are resonating with employees… and which are not.

Though most conduct formal performance reviews and many offer professional training, far fewer have implemented a compensation committee or formal career development as part of their talent management strategy.

The differences in approach are far more telling when comparing the 20% of managers who have a formal talent program against the 80% who do not. Those with a formal talent program are taking far more actions to demonstrate that they are, and continue to be, an employer of choice for top talent in the industry.

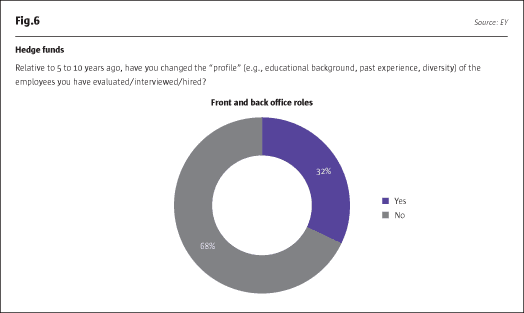

The talent profiles that are sought by managers are changing

As managers react to changes in the business environment and the competitive landscape for talent, many are evolving the profiles of the individuals who they are looking to hire. In addition to hiring in new competencies, managers are looking for a greater diversity of professional and educational backgrounds and are more focused on cultural alignment.

Not surprisingly, the 20% of managers who have implemented a formal talent management program have recognized and responded to this issue the fastest. Fifty percent of those with formal talent programs responded they have changed the profiles for which they are hiring from. The most stark change appears to be a desire to hire individuals who have an advanced understanding of technology and data analysis. PhDs, computer programmers and individuals with degrees in computer sciences are just some of the more sought-after individuals. Naturally, competition for these backgrounds is fierce, as these same backgrounds are also sought after in Silicon Valley and in the FinTech community.

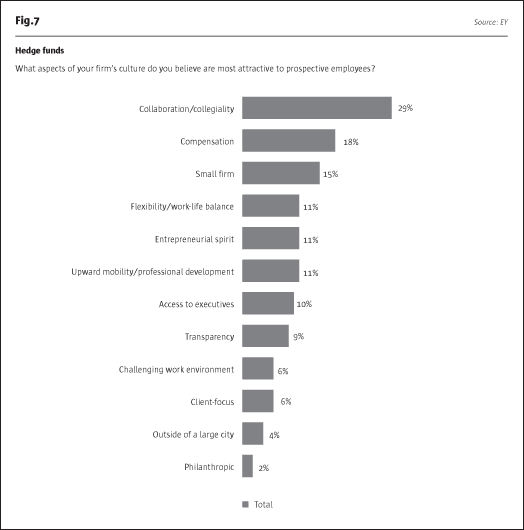

Managers recognize that factors other than compensation are critical in attracting talent

It would be naïve to write off compensation as a key factor in the overall retention and career satisfaction that managers are looking to foster. However, hedge funds are evolving in recognizing the importance that employees, particularly younger generations, place on the quality of their experience in the office with their co-workers. Funds are placing an emphasis on attempting to drive collaboration and teaming that puts employees in situations to work together to solve complex issues.

Forty-five percent of managers have taken steps such as formally surveying or employing consultants to understand what employees are looking for in the workplace. Many managers think they know what is important, but are finding that newer generations have far different needs and expectations which tend to be focused on culture, collaboration and work-life balance.

Future landscape

Managers and investors alike see a number of risks that threaten the industry

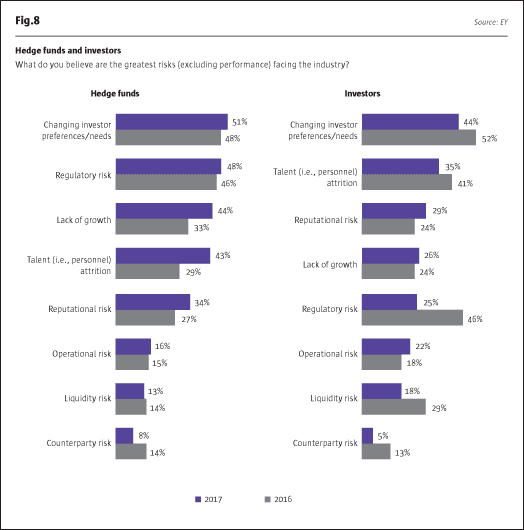

Hedge fund managers and investors once again are fairly well-aligned with their respective views on the risks facing the industry. Changing investor preferences remains the top risk for both. Each group recognizes that as investors continue to re-examine how they allocate assets, managers are forced to re-evaluate their business model and how they can continue providing sought-after investment solutions.

Managers continue to feel the brunt of regulations and the risk of non-adherence is top of mind. Every year seems to bring new onerous requirements, this year being no different with MiFIDII effective January 2018.

Talent attrition remains a high alert for both groups as well. This issue continues to receive increased focus for several reasons. Once again, this past year witnessed several high-profile fund closures. These events are always followed by the question of where the next generation of hedge fund stars will come from. Additionally, competition for these next leaders, in roles throughout the organization, is significant both from within the industry, as well as from others outside of financial services.

Investor confidence in hedge fund performance remains strong

Hedge funds by design are not solely supposed to generate absolute outperformance. And in fact, the number one response from investors as to why they invest in hedge funds is their ability to provide uncorrelated returns. However, invariably, performance is always a significant part of the conversation in both assessing individual managers as well as the industry as a whole.

Many managers have and continue to deliver on their value proposition. However, many are also finding it difficult to compare their returns to those generated by other asset classes, particularly during this record-setting equity bull market.

The positive news is that investors continue to express high confidence that their hedge fund managers will outperform returns that they are obtaining from their own trading, other active managers and as passive investments. However, as investors increasingly utilize these other investing channels alongside their hedge fund investments, it is only natural that areas such as performance, fees, client experience and others will be compared and contrasted.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical