It is often easy to assume that macroeconomic indicators are not helpful in predicting the course of markets – the stock market, so the argument goes, is a better barometer. However, research can show that these factors move side by side and can be used to inform the asset allocation decisions a fund takes.

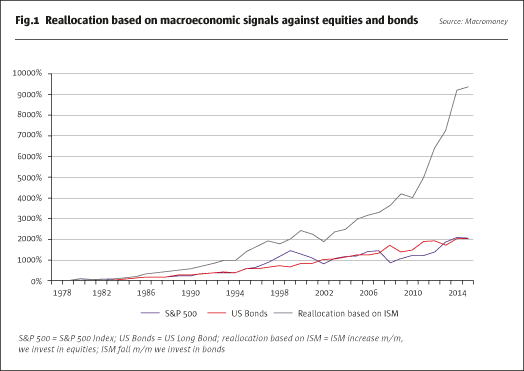

At Macromoney we conducted an exercise in which we allocated assets between S&P 500 equities and US Treasury bonds, based on the acceleration or deceleration of the ISM index, a survey conducted by the Institute of Supply Management. We bought the S&P 500 when the ISM increased against the previous month (e.g. from 50.4 to 50.7), and bought Treasury bonds when the ISM fell against the previous month (e.g. from 50.7 to 50.6).

We reallocated capital at the beginning of each month using back-tested ISM results, assuming foreknowledge of the ISM results. This produced a return that beat US bonds and the S&P 500 over a 1978-2015 time period scenario by more than 4.5 fold [see graph].

Hence, we have built a proprietary asset allocation model that is informed by macroeconomic indicators, helping us to identify the different stages of the economic cycle that will in turn indicate which asset class should be allocated to.

Our model draws on a number of momentum signals:

- While a standard momentum strategy is based on the prices of different asset classes, our signals use the momentum of macroeconomic indicators;

- Our model draws on key macroeconomic data, including GDP, interest rates, inflation, unemployment data, the ISM index, industrial production and retail sales;

- We also draw on other sources, like Federal Reserve Economic Data (FRED) from the St Louis Fed;

- The length of the time series since 1978 is also important;

- Finally, we look at investment decisions based on forecasts from the above mentioned economic data and the Model Vector Autoregression (VAR) in the statistical program.

The results are used to determine the optimal choice of asset for each stage of the business cycle. It is important to emphasise that the model is not trying to forecast future economic indicators but instead is intended to monitor the change of speed of the key indicators: when these data are accelerating, a buy signal is generated, when they are decelerating a neutral signal is generated, and a sell signal occurs from contracting data.

Allocation between asset classes

Using signals generated from the model allows funds to be allocated between different asset classes. For buy signals most of the assets are allocated to a carefully selected equity portfolio. The fund is not allowed to allocate net short positions in the equity portfolio, and maintains an average equity exposure of between 50-120% of NAV. The portfolio is periodically hedged using volatility futures and options with an exposure of up to 20% of the NAV.

For neutral signals the fund is restricted to no more than 100% of NAV in net equities exposure, with average equity exposure of between 0-50% and with the fixed income component averaging between 0-100%. Again, the portfolio is hedged periodically with volatility futures and options, with exposure up to 20% of NAV. Net short positions are taken in stock indexes and up to 60% of the portfolio can be composed of short positions in single name stocks.

For sell signals the fund no longer can maintain net long positions in equities, and instead maintains a 50-100% weighting in fixed income government bonds. It may implement volatility futures and options strategies with exposure of up to 20% of NAV. Net short positions in stock exchange indexes and specific stocks can account for up to 100% of NAV.

The investment process revolves around which signal has been generated: the model performs the role of an internal benchmark against which the fund is measured on an annual basis. This also represents the target the management team needs to beat.

In practical terms, using real market scenarios, the long term macroeconomic model generated a buy signal in the first quarter of 2015. From April slowing macroeconomic data signalled a retreat from equities. At the same time, our short termmodel, which tracks volatility, indicated in July that there was a potential upcoming – and significant – spike in volatility. In response to these signals, we opened out of the money put options on the S&P 500. The initial total position in options in July was only 1.5% of NAV, but it generated a 15% net return in August.

In conclusion our model looks at the economy and at capital markets from the perspective of the mid-term business cycles. This attitude helps not only to grow capital during a bull market but also to preserve capital in downturns. While in a long term uptrend the model results are in line with the S&P500, its strength is shown in a full cycle and especially during prolonged market contraction.

The results of the fund itself, which are a combination of macroeconomic model signals and alpha generated by Macromoney’s investment team, show that it is possible to outperform the stock market in the long term with a disciplined and repeatable investment process backed by thorough research.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 113

Embracing Macroeconomic Indicators

How macroeconomic data can drive asset allocation decisions

MACIEJ WISNIEWSKI, PIOTR KAWALA AND RADEK PSZCZÓŁKOWSKI, MACROMONEY

Originally published in the April | May 2016 issue