In this Q&A, Sir Michael Hintze, Chief Executive and Senior Investment Officer of CQS, presents an update on the risks and opportunities he sees in markets in 2016 and beyond.

Q: It has been a decent first half in performance terms for CQS in what is proving to be a volatile and challenging year for markets thus far. At the end of 2015 you expressed caution. Are you still concerned?

A: I continue to be cautious and mindful of ‘potholes’. There are uncertainties created by global geopolitical turbulence, rising populism, and political uncertainty in the US ahead of November’s Presidential elections. In Europe, the UK voted to leave the European Union (EU). Looking into 2017, there is a pretty heavy electoral calendar in Europe, including German parliamentary and French presidential elections, as well as Czech, Hungarian and Norwegian elections, all of which are likely to add to the debate around what kind of Europe EU citizens want. Across Asia, the macroeconomic picture is weaker. China’s growth rate is moderating and its economic structural adjustment is ongoing, while the government has to balance concerns around possible unemployment, social unrest, rising debt levels, forex outflows, and tension around maritime issues. In Japan, Prime Minister Abe received a resounding new political mandate, but growth remains constrained by an economy and stock market that have been slow to respond to progressive monetary easing. It now looks like Japan’s government will undertake further fiscal policy responses to stimulate the economy. In contrast, the US economy appears to continue to grow, labour markets are tightening and the Fed is considering a more hawkish monetary policy.

Offsetting geopolitical and economic uncertainty from a market perspective is that monetary policy, particularly Quantitative Easing (QE), is supportive of valuations, especially in developed markets. Emerging markets (EM) have benefited and while it has not been drained from the system, in the absence of renewed stimulus, its effect on EM appears to be diminishing. Add to that, the US dollar has shown renewed strength of late. Credit easing in China and QE from Japan and other parts of Asia clearly helps, but it is not as universally supportive as US QE.

With the world’s major economies slowing, central banks globally are likely to err on the side of caution and monetary policies should generally continue to be supportive.

I believe that in such an environment, the ‘P’ part of ‘P/E’ is unlikely to rise and the ‘E’ part seems more likely to flatten or decline. Consequently, I think equity markets will find it challenging to make much headway from recent valuations. Conversely, in a lower growth environment, I favour spread product and I like corporate credit.

Q: How do you see the rest of 2016 shaping up?

A: To look forward, you need to look back. What happens in the past informs future outcomes. At the beginning of the year there were concerns about systemic risk resulting from a weak oil price combined with a China slowdown and ‘debt bubble’, and their effect on the natural resources complex.

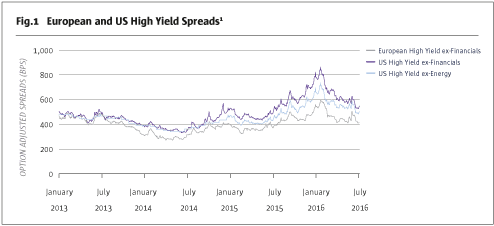

As Fig.1 illustrates, from mid-2014 credit spreads had been widening and this accelerated in December 2015. It could well be that there is more fragility inthe system and there is certainly more volatility as banks’ ability to allocate capital to proprietary trading desks to absorb volatility has diminished materially. However, at the beginning of February markets, and in particular corporate credit, bounced back sharply.

The key driver of this was an understanding on the part of investors that the world hadn’t ended; that the decline in the energy complex didn’t mean a collapse in the US high yield market; that continued QE by the ECB, Bank of Japan and credit easing by the People’s Bank of China meant that a benign environment was to continue; and, importantly, that China looks less like a bubble about to burst and more like an unwind. There will be volatility and potholes which will create opportunities. To be effective, asset managers will need to price risk, to be nimble and to capture volatility, as well as ensuring the liquidity held in a portfolio matches the portfolio’s liquidity terms.

Q: What are negative yields telling us? What does it mean and should we be concerned?

A: Negative rates and yields are mainly, though not exclusively, a European and Japanese issue. I believe there’s a massive distortion caused by highly motivated, price insensitive central bank buyers out there. There are those who say it reflects investor concern about European and Japanese economic growth and confidence. There is an element of that sentiment, however, I believe the aberration is largely caused by central banks. The ECB may extend QE beyond March 2017, but I believe it may be extended well beyond this date, should economic conditions in the EU remain relatively weak. In Japan, stimulatory measures will, I believe, continue. Conversely, the US is experiencing stronger growth, and its asset purchase programmes have ended for the time being. The consequences of this will be played out in the currency markets and I expect the yen to weaken appreciably against the US dollar. I also sense there could be deflationary tendencies as QE seems to encourage investment into financial assets rather than into the real economy via capital expenditures.

Q: What does that mean for corporate credit?

A: I’m constructive on credit, although I am expecting rising default rates. Nevertheless, the current environment is challenging and my present focus is on shorter duration exposures, typically of less than two years. There is significant volatility and markets are buffeted almost weekly by geopolitical events, and these dynamics are further complicated both by central bank and government intervention.

In such an environment, sticking to your investment philosophy and to a disciplined investment process are all the more important. Detailed and rigorous credit work should enable us to identify the right credits or asset pools, and trade the right asset class in the right geography at the right time. Sizing one’s positions for ‘surprises’ is an important part of risk management. This approach enables us to retain conviction to hold our positions, increase exposures when we see opportunity in a volatile market and in some cases reduce hedges.

Increased volatility provides trading opportunities and one needs to be nimble and have a flexible mandate from investors. The current environment lends itself to a multi-asset approach to credit investing, by allowing us to allocate to different parts of the credit spectrum as and when the prices of credit sub-asset classes swing.

Q: How do you see the relative value and opportunity set in US vs. European credit?

A: I believe that the overall global search for yield favours US credits given current spread levels.

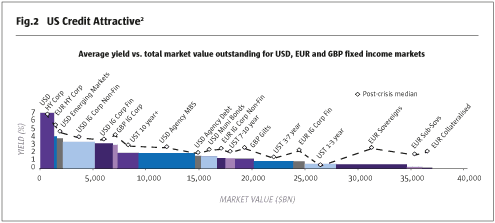

The Fed has brought its QE asset purchase programme to an end for the time being, whilst the ECB’s is in full swing. Consequently, there has been substantial yield compression in EU credit. If you look at Fig.2, you can see that relative value playing out.

The ECB’s Asset Purchase Programme (‘APP’) has changed the context of investment in EU corporate credit. It has resulted in €4tn of negatively-yielding debt (which includes sovereign and corporate), or a 48% share of the market and 10.7% of EUR corporate bonds. It is interesting to me that heightened geopolitical risk, in particular Brexit, has resulted in expectations of further stimulus and monetary easing, especially in the EU. The search for yield remains strong and in this context we are currently finding better relative value in US credit.

Q: You touched on default rates. Where in the default cycle do you believe we are?

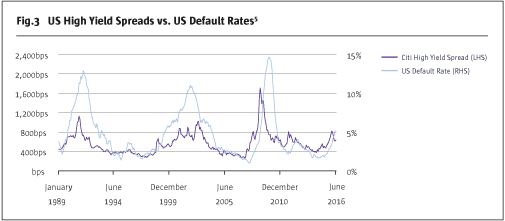

A: It is worthwhile recalling that spread = the probability of default x the loss associated with default + a liquidity/volatility premium. As can be seen in Fig.3, spreads in the US had already widened in anticipation of a distressed cycle. In the US, the distressed cycle is very much under way with default rates reaching six year highs at 5.1%3. The default wave, however, has thus far been driven by the natural resources space and we estimate that more than 75% of defaulted debt will come from the energy and metal & mining sectors4. Contagion has been fairly limited as a function of a benign macro backdrop and accommodative fiscal policies.

The situation is different for Europe. The broader economy has struggled to grow since 2008/9 as the EU continues to fight hard to cope with sovereign, financial and corporate debt burdens which in many instances are tightly interlinked and inter-owned and as a result cannot be tackled stand-alone. Corporate leverage (especially in the midcap space) remains high, with most corporates amending and extending their debt incurred prior to the 2007/8 market crash, rather than seeking to reduce it through a restructuring process. As a result, Europe remains home to many zombie companies which are barely cashflow positive and continue to survive simply because they are on life support courtesy of QE. If and when that stops, we anticipate the overall breadth and length of the European distressed cycle will be significantly more pronounced than the US one.

Q: …and where do you see the investment opportunity for distressed credit investors?

A: My sense is that overall the distressed market has been lulled into a sense of security by central bank-administered liquidity. That said, tension in the global system has been building for some time, with leverage ticking up as a function of aggressive forward assumptions, valuations and cheap financing. Similarly to the 2007/2008 burst of the leveraged buyout bubble, if and when liquidity dries up and financing costs increase, we could see companies that are burdened with cheap but inappropriate financing structures looking to restructure. This would usher in the next global distressed wave.

Q: Where do you see the best relative value?

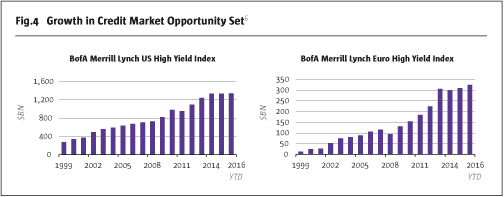

A: Taking a step back and reviewing the overall context is important. There is no change to my view that there is a secular change and a structural opportunity due to the combined effects of regulation and central bank intervention. Bank disintermediation is here to stay and it will continue to provide an illiquidity premium for more patient capital. Fig.4 illustrates the growth in the US and European high yield markets. Since 2008/9, there has been an increase in the number of issuers and diversity of investment opportunity.

We have continued to find value and opportunity resulting from dislocations and distortions associated with regulation and central bank intervention. I believe that in the US, the B and BB space continues to be attractive as a result of the banks’ inability to hold lowly-rated assets due to the risk weightings mandated by Basel III. But you do need to do the homework and analysis.

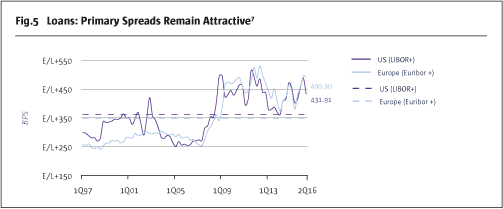

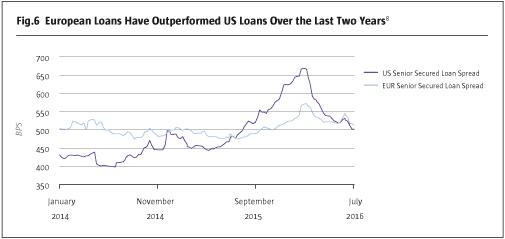

More specifically, we prefer high yield over investment grade bonds and we favour US over European high yield for reasons I mentioned earlier relating to the ECB’s APP. We also continue to like senior secured loans, but after two years of outperformance by European loans, we believe US loans currently provide better relative value.

In addition, we continue to like CLO mezzanine and equity tranches in both Europe and the US, and other parts of the ABS market including UK non-conforming RMBS.

In Asia, we find selective value in investment grade subordinated bonds in Japan. The negative yields in Japan are encouraging investors to allocate to credit names with relatively attractive yields, especially those issued by well-known Japanese corporates, and we expect this trend to continue. Overall, we are avoiding almost all investment grade bonds in Asia. We are cautious on most benchmark B and BB high yield bonds in Asia, although we are constructive on several event names in the high yield space. In equities, certain Chinese corporates listed in Hong Kong and on the mainland bourses trade at relatively cheap valuations while showing good earnings growth.

I also believe the convertibles market is attractive mainly because of the ability to extract value due to greater volatility in single names. Fig.7 shows the value of convertibles globally. Valuations have cheapened and I believe they are now attractive. There are also ongoing corporate actions and, importantly, convertibles are not a crowded space. We are finding value both in arbitrage and long-only strategies.

Q: What other risks do you see out there?

A: I have commented on the risks surrounding QE, tensions in the South and East China seas, Russia and Daesh recently so I won’t delve further into these risks here. Clearly, it is a complex world and one that is more concerning than I have seen for some time. There are very big and important issues out there. From an investment perspective one needs to focus on transmission mechanisms into economies and markets. Terrible things happen, things that are a stain on humanity, but they may have no effect on global economies and markets. For example, initial reports in late 2002 and early 2003 suggested some 34 people had succumbed to SARS. This led to an immediate impact on travel, tourism and trade not only regionally, but globally. The economic effect was believed to have been between $30 and $50bn. (Ultimately, SARS fatalities in 2002/3 were closer to 750). In contrast, the Ebola outbreak in West Africa led to c. 11,000 deaths between 2013 and 2015, and yet its global economic impact was negligible in comparison with the SARS outbreak.

Looking at today’s world, there are several potentially disruptive geopolitical events. Europe is high on the agenda, brought about by Brexit. However initial soundings, following Prime Minister May’s recent return from her visit to Berlin and Paris, have brought some encouragement. Even the EU’s most ardent supporters acknowledge the European project is in need of reform. In the Standard & Poor’s report that was published on 26 July, the rating agency says the current structure is unsustainable and calls for either greater integration or a “looser form of political and economic federation.”

However, examples of the Eurozone’s structural challenges continue. For example, the Italian banking system is struggling to find ways to recapitalise itself. While the Italian government is willing and able to provide help, EU regulation makes this difficult. If a sensible solution is not found, I believe there is a risk that contagion could spread far beyond the EU and it could have a material effect on the global banking system. The transmission mechanism here is clear. Other EU peripheral countries face both economic and fiscal challenges as well as possible referenda on EU membership. Further instability and a potential break-up of the euro cannot be discounted as a zero probability and would in my view also represent material risk.

The terrorist threat is another. The growing spread of awful terrorist activities is beginning to weigh on the psyche of people in many towns and countries, but as yet, not on economic activity. That could change, should there be a terrorist event that was to paralyse a major city.

Turkey is a source of concern, but the transmission mechanism into the global economy is less obvious to me. If some commentators’ views prove correct, that President Erdogan’s aim is to gain such a stranglehold on power that it would alter the very foundations of Turkish identity, stability, its secular statehood and the structure of government, this could threaten its role within NATO and there would be myriad other consequences; large flows of people across borders could be one and this is a worry. This is a complex situation and one which will play out over an extended period of time. We have sought to protect portfolios through sovereign CDS and currency hedges. It is important to keep a close eye on developments.

We also need to keep an eye on the growth of populism, primarily in the West. If a state is unable to deliver the aspirations of its people, especially young people, disappointment could result in a further polarisation in Western political systems. While it is not clear to me at this moment in time how this could develop and what responses are needed from policymakers and leaders, my sense is there is change and we need to think carefully about the future shape of our society and the direction it takes. The outcome of such movements could alter the positioning of a country and impact its economy. It is a subject all of us would do well to reflect upon.

Conclusion

We are in an environment where growth globally is slowing, geopolitical events are taking centre stage and where central bank interventions and regulation are creating market anomalies and volatility.

I am excited about potential investment opportunities this presents to us in credit and other markets. I believe our focus on a disciplined, fundamentally-driven investment process will enable us to position portfolios to take advantage of opportunities, to position funds to mitigate risk and to deliver the risk-adjusted returns our investors expect from us.

On behalf of everyone at CQS, I would like to thank our investors for their support and look forward to updating you again in the months ahead.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 116

CQS Insights

Mid-Year Review 2016

SIR MICHAEL HINTZE, CHIEF EXECUTIVE AND SENIOR INVESTMENT OFFICER, CQS

Originally published in the September 2016 issue