Campbell & Company (“Campbell”), founded in 1972, is most renowned for its veteran CTA, trend-following and macro strategies in futures markets across multiple asset classes, but has been trading and developing equity market neutral strategies, in cash equities, since 2001. These resided in multi-strategy trading programs until 2017 and will continue to do so. However, Campbell now feels the time is particularly opportune for rolling them out on a standalone basis as well.

Equity market correlations have reached 0.7 or 0.8 for some long/short equity indices and some managers are heavily invested into richly valued growth, technology and momentum plays such as FANGMAN stocks (Facebook, Amazon, Netflix, Google, Microsoft, Apple, Nvidia) in the US, and the BAT complex (Baidu, Alibaba and Tencent) in Asia, both of which are perceived to be relatively crowded trades.

“The vast majority of long/short equity is discretionary, and a lot of beta and factor risk has been driving returns. This has worked well for many years, but we now believe there will be a rotation to equity market neutral. In our opinion systematic approaches more accurately and efficiently constrain betas and factors, to focus on the idiosyncratic risk,” says Campbell Managing Director of Client Solutions, Joe Kelly. A team of 40 people, based in Campbell’s Baltimore head office, are involved with the infrastructure and research that supports the equity market neutral strategy. “We expect this to be a large part of our business going forward,” says Kelly.

Campbell Quantitative Equities is distinguished by a whole host of features: a constant volatility target; constant alpha group weightings; an investment universe trading equities of all market capitalisation sizes; an evolutionary and collegiate research process; by how it defines, measures, and applies its own factors; and by netting to reduce transactions costs.

Volatility: the one constant

“We believe that systematic managers target volatility in a different way from the discretionary world. Systematic strategies vary leverage to meet the volatility target, whereas in the discretionary world, market volatility often determines portfolio volatility,” observes Kelly. Campbell’s latest white paper looks at the relative merits of targeting leverage and volatility. In it, Campbell Director of Cash Equity Strategies, Dr Brian Meloon, examines the widely followed approach of maintaining constant portfolio leverage in quantitative strategies, known as “constant leverage” (CL). Instead, Campbell prefers Volatility Targeting (VT) for its QE program. “CL portfolios have a very tight distribution of leverage and a wide distribution of realized volatility, while VT portfolios have a wide distribution of leverage and a tight distribution of realized volatility,” the paper states. Campbell acknowledges that CL is simpler, and has somewhat lower turnover, but their simulation finds that transactions costs under CL are only marginally lower. Overall, Campbell’s research showed that CL tended to produce inferior risk-adjusted performance, mainly because strategy volatility should be commensurate with strategy Sharpe expectations. In broad terms, VT runs at leverage inverse to market volatility, so that forecast volatility is constant; realised volatility does fluctuate somewhat around the forecast, but volatility is much steadier than with CL. This is explored in more detail, in Campbell’s White Paper Series, “Challenging the Constant Leverage Paradigm”, published in January 2018 and reproduced on pages 56–61 of this issue of The Hedge Fund Journal.

Constant leverage can lead a strategy to over-shoot its volatility target in a year like 2008, and under-shoot its volatility target in a low volatility year like 2017. “Some strategies where investors may expect volatility of 6% have realised volatility of only 2 or 3% last year,” points out Kelly. Leverage for Campbell Quantitative Equities could range from below one times each side in late 2008 (as they experienced based on its design structure in their Statistical Arbitrage portfolio), to a maximum of four times in late 2017/early 2018, and was around three times in mid-February 2018. “It is based on the volatility available in the market,” says Meloon.

Maintaining multi-dimensional diversification

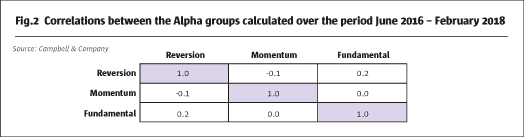

One of the big debates in systematic, quantitative and factor investing is whether factors and alphas can be timed. Campbell maintains equal risk allocations to its three alpha groups (mean reversion, momentum and fundamental), as Campbell argues it is hard to reliably time factors, given the limited amount of historical data. The strategy also keeps constant regional weights: currently 50% US, 30% Europe and 20% Japan, though the geographic reach has grown and will continue to expand further. For instance, Asia is only Japan for now, but Campbell is in the process of adding Hong Kong, Australia, South Korea and others.

Campbell’s Quantitative Equities is diversified by strategy, style, time frame (typically 1-2 months for mean reversion, and 3-6 months for momentum and fundamental), and geography – into 14 countries in the US, Japan, Europe and South Africa, across four continents. The investment universe is 4-5,000 stocks, of which the portfolio has exposure to 3,600 at any time: 1,800 longs and 1,800 shorts. Each position is fairly small so that large moves in securities have not historically impacted the portfolio.

All singing, all caps

Whereas many quantitative equity market neutral strategies trade mainly, or only, large caps, Campbell trades across the cap size spectrum (subject to liquidity and cost constraints). “Mid-caps are the sweet spot. Typically, we have most in mid-cap stocks, because the optimiser is cost aware and small caps can be expensive to trade,” says Meloon.

Campbell envisage strategy capacity of around USD 1 billion, including a sub-allocation from the firm’s multi-strategy portfolios. Given the capacity limits, there are no plans for a ’40 Act or UCITS version of this strategy (other Campbell strategies are available in ’40 Act and UCITS formats, on the Equinox and Goldman Sachs platforms, respectively). Campbell seems conservative on capacity and runs around $3.6 billion as of Feb. 2018 at the firm level.

Building, honing and refining the models

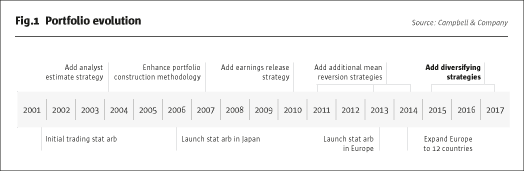

The Campbell Quantitative Equities strategy has been sixteen years in the making and continues to develop. Campbell has been trading equity market neutral strategies, initially in the form of statistical arbitrage with proprietary capital in 2001; and has since expanded with analyst estimates added in 2004, earnings releases in 2010, and additional mean reversion strategies between 2001 and 2014, with diversifying strategies added in 2015 and 2016.

Indeed, the equity market neutral strategy has been evolving for many years before being spun out as an independently investible strategy. Meloon has both expanded and refined the original programme, incorporating fundamentals, diversifying it over faster momentum signals, and trading mean reversion over longer time frames – of multiple weeks rather than one week. “We believe this will result in a better signal to noise ratio, exposure to less crowded trades, better execution through netting, and a more all-weather return pattern,” says Meloon. There have been some possibly counter-intuitive results. While momentum and mean reversion are conceptually opposites, when traded over different time horizons, the two can both contribute over the same time periods.

Meloon has a PhD in math from Cornell and his first taste of big data was working in biotech on DNA as a scientist, analysing 20-30,000 genes. This painstaking process developed Meloon’s stamina for the less glamorous parts of research. “We need to systematize what is being looked for, and scan and clean the data using high-throughput techniques,” he says. Meloon has been with Campbell since 2004 and been head of the cash equities group since 2008.

Reflecting on the past fourteen years, Meloon says “there have been big periods of stress, including the financial crisis, the Quant meltdown of 2007, the Japanese earthquake of 2011, and 2010’s flash crash. We have maintained a consistent methodology throughout”.

Peer-powered research

Campbell Quantitative Equities draws on Campbell’s seasoned and thorough research process. “A really important part of our process and culture is the peer review process. There is a two-way flow of ideas between the cash equites and futures teams,” says Meloon.

For example, “normalising cross sectional and time series valuation ratios improves the power of the signal. This is an example of a non-traditional quant signal which came up in the peer review process. A futures researcher suggested that it could be a good check for stability”.

This peer review process culminates with a formal presentation and approval from the investment committee. Notably, Meloon does not sit on the six-person investment committee, and this is deliberate. “Meloon cannot independently make parameter changes. The investment committee, co-chaired by Head of Research, Kevin Cole, and CEO, Will Andrews, meets daily at 8:30am and provides a guiding hand for a deep robust process, offering checks and balances around the robustness of the research process,” explains Kelly.

Broad based attribution

“Performance attribution comes mainly from idiosyncratic, stock-specific, risk,” says Meloon. Sector tilts are a minor contributor, as they arise only from one of the momentum models, and do not tend to exceed 2-5% of gross market value. Country and currency bets are not taken at the holdings level.

Some 20 distinct, and intuitively plausible, investment theses feed into Campbell Quantitative Equities, under the three alpha group umbrellas: mean reversion, momentum and fundamental. Correlations between the three Alpha groups have averaged between -.01 and +0.2.

Sources of alpha

Mean reversion models have been enhanced, partly because the Sharpe ratio from classic statistical arbitrage, pair-trading baskets of peers using only price data, has plummeted over recent decades. One of the mean reversion sub-strategies now qualifies the pure technicals with some fundamental conditioning data to distinguish the random price “noise” from price moves that are backed by fundamental data. The starting point is still whether a stock is fairly priced versus statistical fair value.

However, if a stock rallies 20% on no news it may be a short candidate – but might not if an earnings report or change to analyst estimates explains the move. Consensus estimates are used as Campbell has not identified much value in ranking individual analysts. Merger and takeover activity is filtered out.

The mean reversion alpha group cannot be viewed in isolation as it benefits from “netting” with the other alpha groups. “Mean reversion is a stable and robust alpha source, but difficult to capture as one needs to be careful with costs,” observes Meloon

Momentum signals are also tailored to observed market behaviour, based on academic studies. “Cross-sectional momentum signals are lagged by one month, to avoid mean reversion which degrades the signal. In contrast, sector momentum focuses on aggregate returns, which wash out the idiosyncratic mean reversion, so there is no need to lag the signal,” explains Meloon. The average holding period is 3 to 6 months but it varies by sub-strategy. Standard GICS sector classifications are used, and all stocks in a sector are traded. Campbell contemplated using sector ETFs, but created its own, synthetic sector baskets, partly to facilitate efficient netting with other strategies in the program.

The fundamental alpha group goes long stocks that score well on Campbell’s proprietary “value”, “quality” and “growth” metrics, and shorts those with the reverse attributes. The data used include forward earnings estimates, which are adjusted when analysts change estimates or when financial statements are reported. “The earnings data can be US GAAP, IAS GAAP and/or proforma numbers, and differs by region,” says Meloon.

Avoiding overcrowding

Campbell defines, measures and applies its mean reversion, momentum and fundamental concepts differently from other managers. “We avoid the overcrowding that can come from generic models and optimisers,” says Meloon. Campbell’s proprietary signals are not well explained by the corresponding generic factors.

Execution and netting

Portfolio construction is initially carried out at the sub-portfolio level, for each strategy group within each region. This adds up to dozens of sub-portfolios. The optimisation engine considers returns, risks, and costs, subject to constraints on individual position sizes, sector, country and risk factor exposures.

The lowly correlated nature of the strategies, combined with their different time frames, opens up potential for netting. To minimize costs, the sub-portfolios generate desired orders (“sub-portfolio orders”); and offsetting sub-portfolio orders are netted to create only one order that is generated for execution in the market. “We avoid the market where possible and minimize explicit or implicit transaction costs, for a significant number of sub-portfolio orders” says Meloon. Thus, where strategies produce opposite signals, the sub-portfolio orders are netted before one order is generated to be executed in the market. This avoids duplication of costs, which include commissions, bid/offer spreads, and any market impact. In practice, the netting typically results in 5-10% of Mean Reversion sub-portfolio orders and 20-30% of Momentum and Fundamental sub-portfolio orders being netted out internally before final orders are generated for execution in the market. Execution uses a mix of broker algorithms, often tailored to order types. Campbell has long-standing relationships with brokers such as Morgan Stanley and UBS.

The Campbell culture

Campbell’s corporate culture differentiates the firm from some other asset managers. Alignment and incentives at Campbell are clear: the employees are collectively the second largest investors in the strategies – and are the 100% owners of the firm. In terms of ownership, succession planning includes a programme for employees buying back equity from the founder while other staff can also access phantom equity. In terms of human resources, succession planning has also been demonstrated by Dr. Kevin Cole replacing Dr. Xiaohua Hua as Chief Research Officer, in a measured handover process that took several years.

Campbell is a QPAM (Qualified Professional Asset Manager) which is a US designation for managers of ERISA assets (making up around 10% of Campbell’s assets). It underscores that Campbell, which is regulated by the SEC and CFTC, is a mature organisation.

Campbell is among the most active quantitative managers leading with product innovation – with their core mission rooted in continually enhancing and expanding offerings wherever alpha lies. This, along with their renowned risk management skills have helped the firm thrive for nearly half a century. Campbell’s quantitative equities strategies have been embedded in their operations for more than a decade. It’s these factors that primes Campbell for their next program in the marketplace.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical