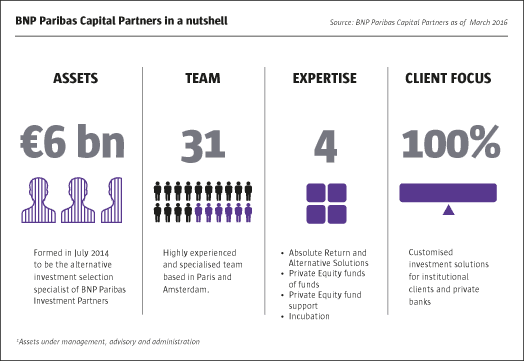

BNP Paribas Capital Partners (BNPP CP) selects and monitors absolute return and alternatives in UCITS hedge funds, offshore hedge funds, private equity funds, and opportunistically in real estate funds, and distressed and private debt funds, across most geographies and strategies. BNPP CP’s acumen can be accessed through service models ranging from one-off due diligence reports and advisory buy lists to traditional, discretionary investment management via managed accounts or comingled funds of funds. BNPP CP also advises on an affiliate’s seeding and incubation of investment managers and funds, and provides administration and infrastructure for private equity funds.

Customised solutions

BNPP CP are of the opinion that for absolute return and hedge funds managers, traditional, one size fits all, funds of funds are insufficiently flexible for many clients, while direct investing can be too labour intensive for others. Therefore customisation, through bespoke advisory and managed account solutions, is sought after and fee structures are flexible enough to accommodate a wide range of budgets. Advisory mandates could cost from EUR 200,000 for a buy list and increase to EUR 250,000 with some ongoing monitoring. All managers on BNPP CP’s advisory buy lists are allocated to by the group’s discretionary mandates. Where BNPP CP is also carrying out portfolio construction and rebalancing, an asset-related performance fee can be added. For a fully-fledged fund management remit, both management and performance fees apply but are not likely to be 1 and 10 nowadays. “A performance fee of 10% can still be obtained, but tends to apply above a hurdle rate which might be 3%” says BNPP CP CEO Gilles Guerin. But whichever level of service is chosen, BNPP CP takes pride in “open and transparent communication and we are an extension of our clients’ investment teams” he stresses. Guerin also thinks that BNPP CP “are more flexible and client-specific than some larger and more generalist shops”.

Top quartile performance

BNPP CP has 31 staff, of which 19 are in research with 11 in hedge fund research and eight in private equity research. “We are a specialised shop and our core competence is looking at hedge funds and private equity funds. We have built a competitive track record” says Guerin, who claims that BNPP CP performance is “first quartile for absolute return mandates and funds, with annualised returns of 4-5% over the past few years, pretty decent in this environment”. Similarly BNPP CP’s first three private equity fund of funds focusing on emerging managers and sectors such as technology and healthcare have been top performers throughout the various vintages.

Guerin estimates that two thirds of the added value comes from bottom-up manager selection with one third from top-down asset and strategy allocation, on average. But at certain points of the cycle top down selection might account for the majority of outperformance. Conversely, in late 2016 Guerin is more excited by the growing levels of dispersion between and within markets, which increases the focus on manager selection.

Smaller managers

Some of the alpha has come from smaller managers: BNPP CP has a strong appetite for allocating to smaller managers where Guerin sees stronger potential returns and also more risk. “A specialist manager selection group can add value in picking smaller funds” he argues. BNPP CP’s due diligence process, which typically takes 2-3 months, is adapted for smaller firms. “We cannot apply the same criteria to a small firm of 10 that would apply to a large firm of 50 staff” Guerin explains. “We are not any less stringent but we need to understand that there are different answers to the same problems” he goes on. For instance on compliance, BNPP CP needs to clearly understand if some individuals are wearing multiple hats, or if the firm is outsourcing parts of the compliance function to specialised law firms or compliance outfits.

Seeding

In addition to recommending and allocating to smaller managers, BNPP CP researches the potential to participate in the business models of asset managers, where BNPP CP has an advisory mandate from BNP Paribas Investment Partners (BNPP IP). This business segment pursues incubation from multiple angles. It can take minority stakes in management companies, make third party investments in funds, assist with distribution, and there are even plans to start a seeding club. Some managers could set up a vehicle on BNP Paribas’s 50% owned managed account platform, Innocap, which has grown its assets to $4.3bn as of December 2015.

One publicly disclosed incubation deal, announced in January 2016, was a stake in Hong Kong-based Orion, which manages Asian real estate and private equity funds. BNPP had distributed Orion products for 10 years before the deal, which plugged a gap in BNPP IP’s coverage. Models for deals could be a straightforward gross revenue share (GRS), or could entail equity stakes. “With equity stakes there is more control, but also more potential for conflicts and challenges over how to exit and realise value” Guerin observes. BNPP CP judges each seed deal on a case by case basis. “There are pros and cons to both models, it depends on individuals, who they are, how old they are, what wealth they have, and why they are in the business, and their intentions” he adds.

Experienced team

BNPP CP are confident about investing in, and taking stakes in, smaller managers partly because they have been on the other side of the table. Guerin takes pride in his team “all having had 10-20 years of first-hand experience as managers inside hedge funds or private equity funds, allowing them to bring deep knowledge to the table. They really appreciate what fund managers are going through”. BNPP CP also has focused expertise of value for selecting quantitative funds. “Quant funds need more digging. I am an engineer and worked with Andrew Lo and AlphaSimplex during my time in the US” says Guerin.

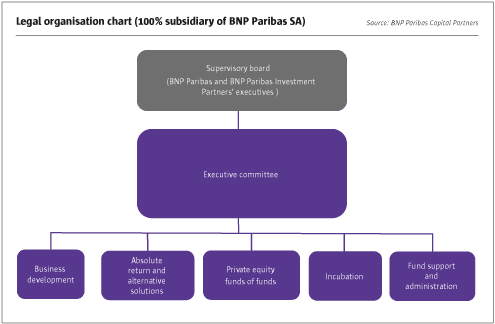

Guerin spent 10 years in the US, including a spell at Natixis (then called Ixis) where he started as Head of Sales and Business Development in 1998. Based in Boston, Guerin built up a distribution company to raise assets for all of the Natixis boutiques. Leaving Natixis in 2006, he wanted to focus on a single hedge fund manager and did so at AlphaSimplex. Guerin’s next episode was at HDF, where succession issues quickly led to another move. When he arrived at BNPP, Guerin decided that having manager selection within BNPP’s asset management group Théam could create confusion in the market place and would be better off being housed in a dedicated separate entity. Therefore BNPP CP was created in 2014 as the group’s centre for alternative manager selection, sitting in a separate office. Except by specific client request, BNPP CP would not recommend funds run by other parts of BNPP Paribas Investment Partners (which runs over EUR 530bn in total).

BNPP CP structure

BNPP CP’s assets under management, advisory and administration total around EUR 6 billion. In hedge fund manager selection, BNPP CP runs EUR 726 million in bespoke mandates, allocating to 30 managers. The advisory and manager selection business advises on around EUR 2.5 billion. BNPP CP’s advisory mandate from BNPP IP on the incubation side is worth EUR 275 million. BNPP CP manages $410m in four private equity funds which contain 75 investments in 60 managers and over 1,000 underlying investee companies, with a focus on Europe, technology, niche industries and smaller managers; there is also EUR 468 million in feeder and in house funds. The private equity fund support unit administers EUR 1.8 billion and helps with management company set ups, tax, accounting, spin outs, compliance and cash-flows.

The private equity units do not overlap with BNPP CP’s hedge fund selection mandates but they do share a common philosophy regarding the value of selecting smaller managers and applying a strict and documented selection process, with team members from both enjoying long personal track records.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical