Have commodities had a capitulation moment? Several banks (Barclays, Deutsche Bank, JP Morgan) have ceased making markets in them, multiple funds have shut down, and some investors have also thrown in the towel. Yet some of the most seasoned commodity market traders have a more constructive outlook: “You do not need another boom and bust period like the one we saw from 2001 to 2011 to find compelling investment opportunities,” says Ballymena’s lead Portfolio Manager Oliver Kinsey.

Ballymena is an actively managed agricultural commodity hedge fund, which trades opportunistically on the long or short side. At the present time, however, Kinsey views commodities – even from a long-only angle – as relatively attractive. Kinsey reckons “the chances of heightened volatility in traditional asset classes (equity and fixed income) is certainly rising and we may even see an equity market correction. There are only two instances in history of a longer bull run for the S&P 500 without a 20% correction. One ended in 1929 and the other when the tech bubble burst in 2000. We are not necessarily predicting an implosion of traditional asset classes but feel they inevitably see much greater two-sided volatility in the future, a scenario where macro and commodity specialists could do relatively well.”

It may have gone somewhat unnoticed but commodity long-only indices were up in 2016 and the tide could certainly be turning for this space.

Kinsey sees scope for CTAs and long/short discretionary commodity trading funds to generate “crisis alpha”. But commodities can also thrive in more benign financial markets and could perform well even if equities continue melting up. “Equities are on a sugar rush after Trump, but if the reflation story is true, then that is very good for commodities in general,” Kinsey argues.

The new US administration has increased inflationary expectations, and inflationary periods have provided the best returns for long positions in commodities. “Cotton reached its highest ever levels during the American Civil War while sugar, cocoa and coffee had tremendous runs in the 1970s and 80s,” notes Kinsey.

This is not the base case for Ballymena however. “In normal inflation climates, commodity prices show mean reversion back to, and even below, marginal costs,” Kinsey observes – hence the preference for a flexible, long/short approach. Since 2008, Ballymena have watched the markets they trade go through feast and famine cycles. Coffee shot up to $3/lb on rust disease before circling back to $1/lb, while sugar hit 35 cents/lb on the eve of a four-year bear market and has still not scaled that peak during its recent bull run. Cotton had its own trough after China flooded its warehouses with supply. All of these episodes were isolated to the individual markets and not part of any inflationary or deflationary macroeconomic megatrends.

Idiosyncratic markets

Indeed, the four soft commodities that Ballymena trades – coffee, cocoa, cotton and sugar – plough their own furrows in terms of price action. “Our commodity subsets are completely unique,” enthuses Kinsey, drawing on his career and study of agricultural economics. Cocoa staged an impressive surge in 2002, a recessionary bear market, and was the best performing commodity in 2015, when the oil-heavy commodity indices were dragged down by crude. Vice versa occurred in 2016, when renewed optimism about the global economy bolstered many commodity prices – but cocoa was the worst performer.

Kinsey explains how slow supply responses are one important differentiator for softs: “Whereas oil spigots can be turned on andoff daily – cocoa, coffee and sugar have multi-year production cycles – up to 20 years for cocoa trees for example. Cotton’s cycle is one crop per year per hemisphere. Hence there are big delays in getting supply responses to price signals.”

Though cotton has some substitutes on the demand side, the other softs have minimal price elasticity of demand – “only salt demand is less price sensitive than coffee consumption” points out Kinsey.

If the interaction of steeply sloping demand and supply curves coils the spring of volatility then output concentration only adds flames to the cocktail. “Some 70% of cocoa is grown in French West Africa which faces weather risks such as droughts and winds, and political climate risks. Brazil makes up 50% of Arabica production while sugar is dominated by Brazil and India,” Kinsey illustrates.

ECOM: infrastructure platform and informational edge

The specificity of these markets places a premium on high quality bottom-up information but there may be a dearth of expertise. “Most commodity investment managers are multi-asset groups and you can count the number of soft agricultural specialists on one hand,” Kinsey observes.

Ballymena is backed by global commodity trader, ECOM Agroindustrial Corp Ltd. (ECOM), which is taking a somewhat contrarian approach to the opportunity set for investing in commodities. With many standalone hedge funds (eg Clive, Vermillion, Krom River) and those associated with commodity houses (eg Cargill Black River, Trafigura) having shut down, ECOM sees a gap in the market and has the people and resources to exploit the opportunity set. Ballymena has grown out of the ECOM family. Ballymena’s CIO, Henry Dunlop, was head of coffee and cocoa trading at ECOM for many years. He sits on several ECOM committees but has no ECOM day-to-day responsibilities, and Kinsey finds him an invaluable resource as a sounding board for trade ideas. The two of them discuss everything in great depth and detail. Kinsey started his career at ECOM and both of the analysts were hand-picked from ECOM’s commodity trading group. Each specialises in two of the soft commodities that Ballymena operates in. ECOM has a stake in the Ballymena management company and provides office space, back & middle office support under a Service Level Agreement (SLA) fee.

Ballymena’s competitive advantage comes partly from ECOM’s ubiquitous presence in softs. ECOM, a private firm with a 167-year history, is the world’s second largest coffee trader, active everywhere that coffee is traded, produced, imported, and exported. ECOM also ranks within the top four global traders in cotton and cocoa (having acquired Armajaro’s cocoa trading business) and is a name to conjure with in sugar. ECOM pursues a style of trading that complements, rather than competes with, Ballymena’s approach. “ECOM is a traditional, transactional merchant that views its physical business as a source of optionality. It uses derivatives for true hedging. ECOM is looking to trade the differential basis of time and geographic arbitrages, whereas Ballymena wants to take on primarily directional market risk mainly using derivatives,” Kinsey explains.

This is important because Kinsey has, during his career, observed competition for alpha, which can be manifested most obviously in CFTC position limits being insufficient to accommodate both trading businesses and funds that sit under the same regulated entity umbrella.

Information walls between ECOM and the fund naturally exist both for regulatory reasons and because the two are following different strategies. Nonetheless, “Ballymena benefits from ECOM’s global information, which provides a real advantage over peers in the public equity space”, according to Kinsey. For instance, “ECOM has been in Brazil for over 80 years and along with year-round crop assessments also derives warehouse data that provides us with the most efficient insight into the size of the Brazilian coffee crop. Shipping, consumption and warehouse data can be used to infer production with very low error,” Kinsey explains.

Elsewhere, ECOM’s offices on the ground in West Africa can measure cocoa tree and farm conditions to indicate the size, quality and condition of the upcoming crops. ECOM’s sales offices can also be useful in feeding back information about demand and commercial trends.

Weather is another potential source of informational superiority where public data is not always granular enough to be useful. Taking Vietnam as an example: “plenty of information and data is publicly available in coastal areas but there is a lack of weather stations in the highlands of Vietnam and it is these microclimates that are relevant,” Kinsey notes. “Yet weather is only one factor and optimal weather does not always lead to a good crop, as technology, disease, maltreatment and husbandry are also relevant,” he caveats.

Thought leadership research in commodities

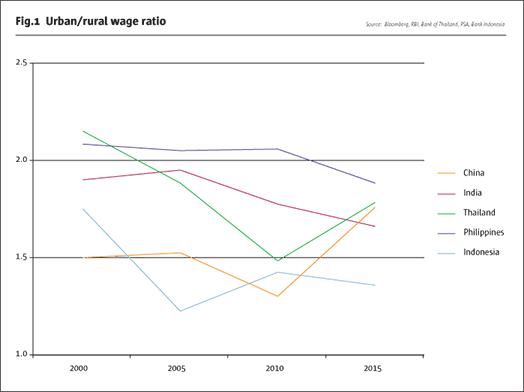

Lateral thinking within ECOM can also inform research, with insights from one food market having implications for another. In a January 2017 research paper “East Asia Pacific Credit Trends and Commodity Opportunities”, Perennial examines how interrelated megatrends of urbanisation, credit spreads, and industrial production, are likely to impact demand for commodities. The declining urban to rural wage ratio, as shown below, has been associated with a slower pace of urbanisation since the global financial crisis, which in turn is linked to industrial production being at decade lows. If the pace of urbanisation picks up again, then these dynamics could reverse, which bodes well for commodity prices.

The dollar index and East Asia Pacific cost of credit have a high explanatory power for industrial production, which, in turn, is a leading indicator for commodity prices. Right now the group sees urban wage ratios in East Asia improving once again, which they see as a lead indicator to stronger industrial production and in turn more robust commodity demand in the medium term.

ECOM’s other commodity fund(s)

During his stints at Bunge and Noble Group, Kinsey traded grains and oilseeds, but he has no plans to do so at Ballymena partly because ECOM also has another commodity trading fund – Perennial Management’s Agricultural & Livestock Program, which trades grains (corn, oats, wheat, ethanol); oilseeds (soybeans, soybean meal, soybean oil, rapeseed oil); and livestock (live cattle, feeder cattle, live hogs). Perennial’s founder and portfolio manager, Jay Cassidy, has over 20 years of experience in the space with 13 of them as a portfolio manager. Perennial shares a similar approach to markets, risk and analytics, and leverages the same infrastructure and relationship with ECOM. “Perennial and Ballymena see real value in being sector specialists, focused on bottom-up fundamental analysis to obtain a huge informational edge,” Cassidy enthuses. He continues, “We believe Perennial and Ballymena combine the trading agility of a hedge fund with the insight and fundamental advantages of a major agricultural merchant, ECOM.” ECOM may one day launch a third commodity strategy but this would not involve energy or metals; the firm would stick to its core competence in softs and grains.

Multi-factor quantitative modelling

“The primary focus of analysis is fundamental supply and demand modelling to arrive at an implied price,” says Kinsey. But Ballymena is among a growing number of discretionary, fundamental houses that make extensive use of quantitative techniques – all part of their Analytical Platform. Multiple inputs feed into multi-factor modelling in a dynamic quant process where factor weightings can change daily. Macro, seasonality and weather are three inputs that are filtered in different ways. “Macroeconomic factors are scored on a daily basis. A seasonality overlay is applied to order flow. Weather comes in at the last stage of the process and we can make quick assessments of how new information should affect prices,” Kinsey explains. Roll yields are most relevant to exchange traded funds, or long-only strategies, but are of course factored into Ballymena’s analysis. “If you do not have a huge footprint then the shape of the curve is useful information with backwardation typically bullish, while contango implies higher storage costs and so incentivises current consumption,” Kinsey has seen. He further observes that “coffee is in contango most of the time so it is expensive to sit there and be long as the implied roll cost is high. It is very hard to invert the coffee curve without the extraordinary problems seen in 2011.”

Ballymena are first and foremost fundamental traders but they are very cognisant of how technical forces, such as key price levels, positioning and consensus opinion can drive prices. For example, “in tight markets, fundamentals have the heaviest weight but in loose markets technicals are greater price drivers.” Ballymena are keenly aware of several key market participants that are technically oriented. “Index long-only funds add buy side liquidity and add temporarily to demand; systematic trend followers are very prevalent in the space, adding momentum to the market and extending trends for longer than they should continue,” Kinsey observes. “They also create more two-way volatility when trends end,” he adds.

Fundamental macro traders are another group that Kinsey keeps an eye on. Cross-currents can ripple from other asset classes whereby macro traders are reading through from emerging currency moves to commodity markets. During nervous market situations, such as 2015 and the 2011-2012 European crisis, Kinsey has also noticed correlations between commodities and other asset classes spiking. High frequency traders, however, are the least relevant, as “their co-located servers essentially trade ahead of anticipated orders in the same way that guys in the pit once did,” Kinsey reckons. He stresses that “we are sector specialists rather than macro economists or macro traders but we are very attuned to the motives, drivers and signals of other market participants. Macro market growth cycles and commodity cycles can run in parallel, or dove tail one another, but we closely follow all patterns.”

Opportunistic risk-taking and sub-strategy rebalancing

Though Ballymena are not trend followers, the reality is that a persistent price trend in either direction does tend to provide the best opportunities for outsized returns. The challenge is partly staying in the game while awaiting these home runs so that enough dry powder remains to seize the sweet spots when they come. Kinsey is opportunistic in expanding the book to avail such compelling markets “like the structural, cash-driven, bull-run seen in coffee and cotton in 2011-2012.” The Ballymena strategy has returned great outperformance in past years. In choppy markets, they will absolutely reduce exposure and dial down volatility to prioritise preserving capital. Hence risk and volatility in 2014-2016 has been less than half of what it was in 2011-2013.

Over time, “directional trades will average 60% of risk and return but in early 2017, the fund has kept 60% in relative value trades, including time spreads and geographic arbitrages, because directional ones have notbeen so rewarding,” Kinsey reveals. These relative value trades can include Robusta versus Arabica coffee, or the premium spread of white sugar against raw sugar.

Liquidity and scalability

To maintain the agility to expand and contract the book, and rotate around trade types, Ballymena needs to stay nimble. Adroitness is at a premium in these soft markets, only partly because of exchange position limits (which may be applied to commodity derivatives across more worldwide exchanges as part of MiFID II regulations from 2018 onwards). The scalability of liquid soft commodity strategies that trade derivatives is naturally limited by the size of those derivative markets.

“Sugar is the largest of the soft commodities in terms of open interest and volume, but less than grains or oilseeds,” points out Kinsey, who observes that “at some point the size traded can make you omnipresent and well known in the market, so people can see what you are doing. That could in turn lead to concentration and style drift, and would not suit our trading styles and personalities.”

Consequently, Ballymena would contemplate returning some capital to investors if a run of very high returns grew assets beyond optimal levels, which Kinsey currently estimates to be somewhere between $200 and $250 million. The strategy currently runs around $110 million between the fund and managed accounts, and has a range of institutional investors.

Ballymena trades seven contracts (Arabica and Robusta coffee; US and European cocoa; white and raw sugar, and cotton) on two ICE (Intercontinental Exchange) markets – ICE US and ICE London (formerly LIFFE). When choosing venues – liquidity, transparency and predictability are the priorities for Kinsey, who feels confident in the reliability of the reference prices used by the major US and European exchanges. He monitors, and has researched, various regional commodities exchanges in emerging markets but they are not currently ideal for the Ballymena strategy.

The Ballymena fund retains the option of trading physical markets in exceptional circumstances and this is an advantage of partnering with a real world commodity trading house. “Being part of ECOM gives access to warehouse space, execution and logistics teams that are needed to trade physical,” points out Kinsey. But the opportunities for locking in arbitrages between physical and futures markets are few and far between. Kinsey has only observed these special situations when certain constraints in the commodity trading ecosystem are hit. If key participants are already maxed out in terms of position limits, and/or a limit-up market temporarily prevents trading of futures, there may be opportunities for nimble and swift traders to structure genuine arbitrages – in the original sense of the word. Investors in the fund would be informed of any physical trading activity while most of those with separately managed accounts preclude it.

Trade analytics examples: Ethanol parity and Trump border tax

Kinsey gave us some brief insights into the data points and thought processes that the team apply; investors can get more colour from Ballymena’s newsletters, research papers and updates. Like all commodity markets, sugar can overshoot in either direction. Kinsey recalls how “in October 2016, sugar reached highs of 24 cents with very long speculative participation, and then it backtracked to ethanol parity.” This concept is most important in Brazil, where Kinsey explains in broad terms “at certain points during the season, sugar mills can switch production dynamically between sugar and ethanol, according to the relative profitability of each”. As usual, other factors are also relevant. Brazil’s high interest rates and high mill debt loads also need to be heeded as ethanol involves cash payments whereas sugar is mostlysold on forward payment terms. The cost of the gasoline that Brazil imports also enters the equation.

Kinsey declines to opine on the merits of any Trump Border Tax (TBT) but is acutely aware of the potential for it to drive a wedge between the price of US and non-US commodities. No matter how remote the risk of a TBT may be, the possibility means that Ballymena will only trade certain arbitrages in one direction. The fund took a tactical position long US cocoa and short European cocoa (which would be subject to any TBT) but has now taken profits on this. Ballymena may revisit the long US, short Europe stance if spreads return to compelling levels. “Such trades are very difficult to assign probabilities to, but being binary outcomes the opportunity is in its own right an attractive one,” Kinsey sums up.

Portfolio construction and risk

Trade construction is viewed at portfolio level, with a mix of position sizing and option protection intended to manage risk. Ballymena calculates two types of Value at Risk (VaR) measures: individually per commodity, and at portfolio level using Monte Carlo simulations taking account of correlations. The four main markets traded usually show low correlations but Kinsey is “alert to the risk of higher correlations when fundamentals take a back seat.”

Ballymena’s internal VaR measures are corroborated against metrics calculated via a third party risk package, and Kinsey is pleased that the “tracking error has been very low for the past three years.”

He feels comfortable with realised volatility that has ranged between 5% and 10% and is of the opinion that “much higher volatility is not a sustainable business model for asset management.” At the same time, Kinsey is confident that the fund’s VaR framework still allows ample headroom to augment risk in search of outsized returns when the opportunities arise. That said, he is well aware of the range of viewpoints on the usefulness of VaR measures, and has been in the markets for long enough to caution that “extreme single day risk could be much worse than the VaR figure.” Of course, given that commodities, CTAs and the Ballymena track record have a positively skewed return profile (unlike most asset classes and strategies), it could be positive returns that send the strategy’s volatility shooting back up towards the higher end of the range.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical