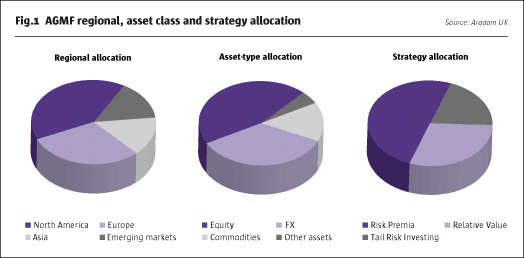

Arqaam Capital UK Investment Management Limited, which launched the Arqaam Global Macro Fund (AGMF)* on March 1 2017, pursues an eclectic, multi-strategy approach that capitalises on Chief Investment Officer Areski Iberrakene’s 20-year track record managing global trading teams and proprietary trading desks at investment banks. AGMF aims to capture multiple risk premia, and other market inefficiencies, covering in broad terms three strategies: Risk Premia, Relative Value and Tail Risk – with a current concentration across Equities, FX and Commodities. The manager has sought to combine strategies that are not merely lowly correlated – but many which have historically been negatively correlated – to obtain the holy grail of hedge fund investing: an ‘all weather’ return profile that is itself lowly correlated to conventional asset classes.

The objective is to deliver returns around 12% with volatility below 8%, equating to a Sharpe ratio of near 1.5 at current levels of interest rates. This is no mean feat as none of the major hedge fund strategy indices have sustained such levels of risk-adjusted returns through a full cycle or a multi-year period. Yet the AGMF strategy has attained its targeted risk-adjusted returns during the running of a recorded paper portfolio and benchmark portfolio. An independent third party recorded 6,000 hypothetical trades, generating annualised returns of 10.55% with annualised volatility of 3.43% between July 2013 and February 2017. The first 22 months of this track record were validated by an audit firm while the next 22 months used AGMF’s systematic models.

Hybrid systematic/discretionary

AGMF would ultimately fall into the category of systematic global macro, however it is to some degree a hybrid. A systematic analytical framework sees AGMF’s PRISM, its portfolio optimisation tool, determine theoretical strategy weights monthly, and on a daily basis rebalance and re-hedge the portfolio. As with many systematic strategies, certain discretionary elements are applied to management of hedging, weighting and overall implementation of the model.

Edge from technology and team

An advanced technology platform, developed over several years at Areski Capital – a firm founded by Iberrakene, and Marc Salaun, provides a powerful resource for the AGMF strategies. Salaun – now Chief Technology Officer at Arqaam UK, was also previously a Partner and Head of Credit IT at BlueCrest Capital Management LP.

“With our technology, we have natural scale, managing a larger universe of underlyings and therefore a greater footprint across global markets,” explains Iberrakene, who has previously been MD & Global Co-Head of Equity and Credit Derivatives at Dresdner Kleinwort, managing a team of 250 professionals across New York, London, Frankfurt, Hong Kong and Tokyo. Before that he was Global Head of Currency Derivatives at Barclays Capital and has also held roles at Deutsche Bank, Bankers Trust, Commerzbank, and Societe Generale. Other PMs are Yves Renno, with previous positions including Head of Sales Trading for Equity Exotic Derivatives at Commerzbank; Chetan Swarup who spent most of his career with Arqaam in Dubai before moving to London to work on the fund; and most recently Mohamed Mughal, a commodities expert, with positions previously held at Morgan Stanley and CIBC world markets, among others. Systems Architect William Lewis also works across technology and development. COO, Noel Hanrahan, has held similar roles across multiple asset class at RBS, Credit Suisse, Barclays Capital and time spent with Iberrakene at Dresdner Kleinwort.

The team is substantially smaller than Iberrakene’s former global teams, but over the past generation technology has made great strides. Arqaam UK maintains the global perspective that has defined its team members’ careers, trading opportunities in the US, Europe and Asia. The AGMF team keeps abreast of financial market innovation and trade sub-asset classes, such as dividend futures and volatility, some of which did not exist in the early days of Iberrakene’s career. Synthesising these aspects, technology at Arqaam UK is used “to data mine, scan markets continuously, identify all opportunities and build portfolios,” explains Iberrakene.

Back testing and regime identification

Indeed, Iberrakene elaborates, “every strategy that AGMF pursues is extensively simulated and back-tested, right down to the position level. The process is to identify opportunities, data mine, and then test.” Investment theses are tested over extended lookback periods and repeated on a quarterly basis.

AGMF characterises market cycles into four types of market regime, each conducive to the different strategies. The most prevalent market regime is defined simply as ‘normal’, and sees steady, low volatility, low correlation between markets, low risk premiums and high momentum. The polar opposite regime is defined as ‘shocked’, but only occurs about 5% of the time, when realised volatility, implied volatility and risk premiums all spike higher. Such shocks can often be followed by ‘stressed’ markets where volatility remains high. Finally, mean reversion sees volatilities, skew, correlations and risk premiums all declining together as markets normalise.

The Arqaam UK framework aims to identify the prevailing regime and then tilt the fund towards the best strategies for each. The tail risk strategy is only expected to make money in ‘shocked’ and ‘stressed’ markets while, conversely, the risk premia strategy produces profits during ‘normal’ or ‘return to normal’ regimes. Relative value, in contrast, can be attuned to profit from different regimes.

At the top level, the three big strategy umbrellas have relatively stable weightings with risk premia averaging approximately 50%. As markets shift between regimes, the weightings can vary. Within each strategy, there is more rebalancing and rotation amongst the sub-strategies with Risk Premium trades having the widest range of potential holding periods, across short and medium term.

Risk, liquidity and transparency paramount

Risk management is multi-layered. Stop losses apply at the strategy level and portfolio limits are monitored in real time with the aim of flagging up early warnings. Liquidity is an over-riding self- imposed risk constraint. “We like to stay super liquid and transparent in our choice of markets,” states Iberrakene. The team trades the developed market currencies and the top emerging market currencies, the major US and European Equity Indices, as well as some of the most liquid sector ETFs, and commodities including precious metals, energy and agriculture markets.

Dynamic risk premia

AGMF’s risk premia strategies are timed by assessment of exposures to the market cycles and applied to a broader spread of asset classes than some managers. Arqaam UK’s programme includes volatility risk premia with a focus again across equities, FX and commodities. They also cover momentum risk premia, and correlation risk premia, amongst others.

Relative value

Relative value can take several forms. It could entail mean reversion or model arbitrage, for related or correlated securities. “We view relative value

globally over asset classes and strategies. We search for the most correlated securities and the best candidates with the most mean-reverting properties, and make sure that the relationships have stood the test of time,” Iberrakene explains.

Tail risk

AGMF’s tail risk strategy seeks to anticipate regime changes and profit from market dislocations. While most tail risk strategies are mainly or entirely focused on equity markets, and have a US bias, AGMF’s approach looks for dislocations across all asset classes and geographies, an important differentiator according to Iberrakene. “With capital preservation inherent across all elements of the AGMF framework, the tail risk programme is naturally an area of supreme interest for us, and a core focus of research and development efforts,” says Iberrakene. See the section devoted to tail risk on the previous page.

Institutional framework

Iberrakene’s eponymous firm Areski Capital obtained approval from the UK’s FCA regulator, but the group did not launch the fund under that structure, with the co-founders ultimately deciding to partner with a larger firm. Arqaam Capital was a good fit for both parties.

“We wanted a larger firm to build the business, and roll out products,” says Iberrakene. “They were in turn impressed by the product and platform, and keen to strengthen their alternative offering, to provide investors a breadth of solutions, in all market environments.” Arqaam was set up in 2007 and has carved out a niche as a go-to investment bank in emerging and frontier markets. They operate out of three hubs: the Dubai International Financial Centre (DIFC), Johannesburg and Cairo, whereas the macro fund team are all based in London. The firm offers a wide suite of services across sales & trading, investment banking, alternative investments and asset management. In line with normal market practice, Arqaam UK of course makes use of external providers.

Arqaam will oversee business development for the product throughout MENA, with the London team covering other territories. Iberrakene foresees a regime change, following a period of low volatility – which will bring with it expanded trading opportunities for funds like AGMF. Macro allocations are also again on the rise he cites. He therefore envisions a dynamic time for the fund going forward, and is confident the combination of the two firms will provide great synergy.

AGMF Tail Risk Framework and Bespoke Solutions

AGMF seeks to be reactive to adverse shocks, but also avoid the costs and setbacks suffered by typical protective strategies in quiet market regimes.

The team has produced extensive research on downside protection, ranging from optimal delta protection in order to achieve a specific downside risk profile, to CPPI-like investments to protect investors’ capital, and derivatives based strategies with intraday volatility forecasting. “In the current market environment, with expensive traditional asset pricing and the perception, almost a consensus, that such assets are in bubble, tail risk strategies have been in high demand,” says Iberrakene.

Arqaam UK, cites Iberrakene, “also offers bespoke tail risk solutions, alongside the programme implemented as part of AGMF’s core framework. With every investment strategy having its own risk characteristics, the objective is to propose a modified target risk profile, to suit the investor’s risk aversion, regardless of the fund’s initial characteristics.”

Research and events

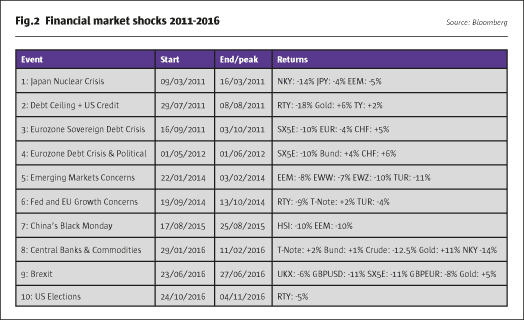

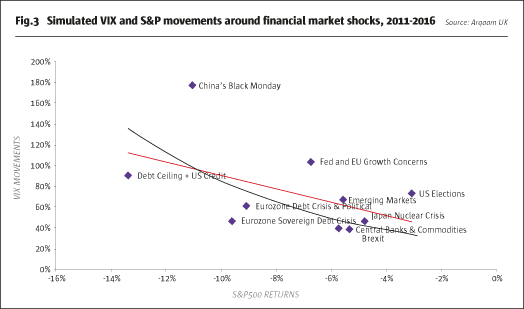

The firm details in Fig.2 significant shock events over the last 6 years, in particular those characterised by large equity drawdowns. Ten key events are detailed, including their date ranges (quantitatively defined around the VIX index local extrema), and subsequent market impacts.

In detailing the S&P correction versus the VIX surge across these events, the obvious and well understood strong negative correlation between volatility and equity returns is demonstrated. Further to that, the nonlinear nature of the relationship between returns and volatility is exhibited. The price risk inherent to the S&P 500 is distinct from the convexity risk inherent to the VIX index.

“After identifying historical shock scenarios, and exploring the relationship between volatility peaks and returns during such events, we are better able to illustrate the requirements for an effective strategy, as well as likely pitfalls of those that are traditionally applied,” explains Iberrakene.

Tail risk: Traditional and bespoke strategies

Traditional

Iberrakene argues that traditional tail risk strategies are too expensive, amongst other potential downfalls of such programmes: “traditional strategies used in tail hedging often include simply the systematic or recurrent purchase of put options on Equity Indices such as the SPX500, or for more advanced practitioners the purchase of call options on Indices such as the VIX. Undoubtedly these strategies can at times offer effective protection to a long only portfolio, but equally they suffer from large costs and therefore ultimately impose a burden which is too significant. Further to that, as referenced earlier due to the potential breakdown/change in correlation, and the nonlinear relationship between equity returns and volatility, either simple strategy in isolation can be ineffective. “We can demonstrate that it is not economical, or effective at all, to enter into these programs in the long run, and that in absence of a more sophisticated strategy, the case could be made that it is better to maintain a long asset portfolio unhedged.”

Proprietary

Arqaam UK has devoted much time, experience and technology to identifying the best candidates for a tail portfolio, and to combining securities and underlyings, to construct an effective and robust tail risk portfolio – seeking out structures with the best pay-out to investment ratio. Within AGMF’s proprietary framework various indicators are used, with those that are volatility-based playing a dominant role in driving the activation and deactivation of the tail risk hedging program. Examples of indicators, embedded within Arqaam UK’s global regime signal indicator include: volatility momentum, volatility structure, volatility of volatility and skew, with work then turning toward forecasting indicators across a decent horizon. They stress their indicators are purely derived from their trading experience, having remained unchanged since they began running their paper portfolio. Avoiding the pitfalls of overfitting, has always been paramount to their investment philosophy, Iberrakene reinforces.

Performance

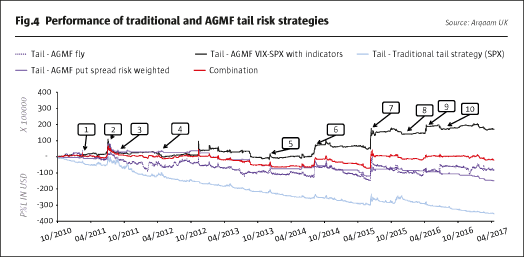

Performance of traditional strategies, as well as AGMF proprietary strategies, are depicted in Fig.4, with the historical events from Fig.2, overlaid from 1-10. “We have normalised both traditional, as well as proprietary strategies, in this instance to ensure they offer the same level of protection on average throughout the various historical events chosen. Each is calibrated to return 5% on average across the various shocks described,” explains Iberrakene.

“Unsurprisingly the traditional hedging strategy performs very poorly, costing in excess of 10% per annum – or twice the targeted benefit. Our internal strategies, while offering on average the same level of protection, have an annual cost which is minimal,” he points out.

*Arqaam Capital Global Master Fund Limited

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical