Investors seeking exposure to fixed income and credit can select from a wide variety of strategies and vehicles, ranging from passive index-tracking products, such as ETFs, to benchmark-conscious long-only funds, absolute return funds, total return funds, hedge funds, structured credit vehicles and even private equity funds.

Algebris manager Alberto Gallo argues that “a relatively unconstrained approach, with flexibility to express macro views and invest long or short across a wide range of liquid rates and credit asset classes, is essential for the macroeconomic and financial market landscape of early 2017 where government bonds offering very low or negative yields are clearly a source of huge negative convexity.”

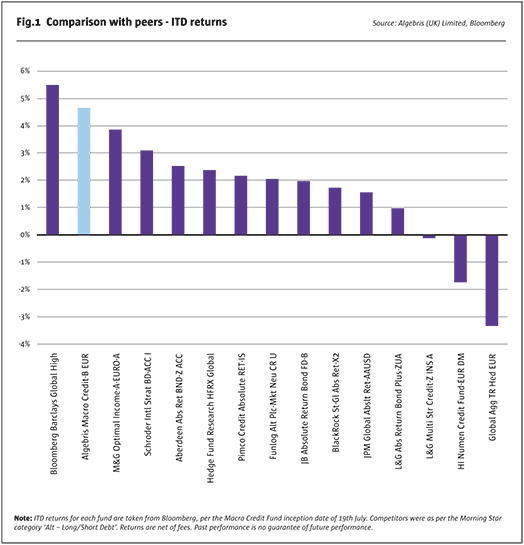

Indeed, Gallo’s UCITS fund, which has so far raised $400 million, is up 5% since inception in July 2016 and has already profited from a core 2016 theme of shorting government bonds, before rotating to reflation trades this year. He thinks that a traditional, long-only, benchmark-constrained strategy (that can only over-or under-weight sectors or securities) would be a straitjacket. Such semi-active strategies, subject to tight tracking error constraints, have been dubbed “closet trackers” and face competition from passive tracker products, such as ETFs, which Gallo views as “cheaper, but vulnerable to herd behaviour and low returns.” Therefore he envisages that “only low-cost or genuinely active strategies with many degrees of freedom over asset allocation and security selection will survive.” Performance to date, versus peers identified by Algebris, is shown in Fig.1.

A melting pot of ideas

Given these convictions, and upon resolving to make his move to the buy side a year ago, Gallo was only prepared to join an investment manager with whom he could see eye-to-eye. Algebris, which has doubled its assets from $3 billion to $6.5 billion, as of 31 January 2017, and forms part of The Hedge Fund Journal’s Europe 50 ranking of Europe’s largest hedge fund managers, was a natural fit. During his many years on the sell side, Gallo always had a good dialogue with Algebris, which was founded by fellow Italian Davide Serra, with backing from another “Europe 50” manager, Chris Hohn’s The Children’s Investment Fund. Like Gallo, Algebris CIO and CEO Serra came from the sell side, having previously headed European bank research at Morgan Stanley. In 2010 Serra featured in The Hedge Fund Journal’s inaugural edition of the biennial Tomorrow’s Titans survey, sponsored by EY.

The first Algebris strategy, launched in 2006, was financial equities, which, some years later, spawned Algebris’s first UCITS fund. The largest Algebris strategy is now long-biased credit, in which the firm runs $5.1 billion, as of 31 January 2017. The firm was also a pioneer in starting a fund trading the new asset class of contingent convertibles, or “CoCos” (this fund was profiled by The Hedge Fund Journal in 2011). Algebris also manages $600 million in private debt and is currently fundraising for the second close of their NPL (non-performing loan) Fund II, targeting a total fund size of between €700 million and €1 billion.

Gallo’s macro credit strategy is the newest. The macro team partners with the other teams at Algebris, which has 18 staff doing investment and trading, and 30 on the non-investment side. Gallo’s team to some extent specialise in geographies and sectors. For instance, Gallo will focus on the US and Europe; Aditya Aney on Latin America, Eastern Europe and Africa; and Tao Pan on Asia. “But offices in London, Milan, Boston and Singapore mean we have eyes and ears in many different places and a 24-hour flow of ideas,” Gallo enthuses. Ideas are neither siloed nor secret and all teams have sight of all portfolios within Algebris. Common threads may run through strategies but there is no requirement to hold the same positions. “We do not want the same risks all over the firm,” Gallo explains.

A hybrid of credit and macro

Gallo’s fund is an Irish UCITS, which charges management fees of 0.9% with performance fees of 15% (for the institutional, I and Id, share classes) and so far has euro, pound, Swiss franc, US dollar and Singapore dollar share classes. He aims to generate average returns of 6-7% per year over a five-year period, but of course the standard disclaimer applies that says no assurance of achieving such returns can be offered. The return target is similar to typical high-yield bond returns through the cycle – but with lower volatility and less correlation to credit markets. The fund, and Gallo’s RBS research track record, have shown correlations to conventional long-only asset classes (i.e. treasuries, emerging markets, euro and US high yield debt, euro and US investment grade debt) of between 0 and 0.34.

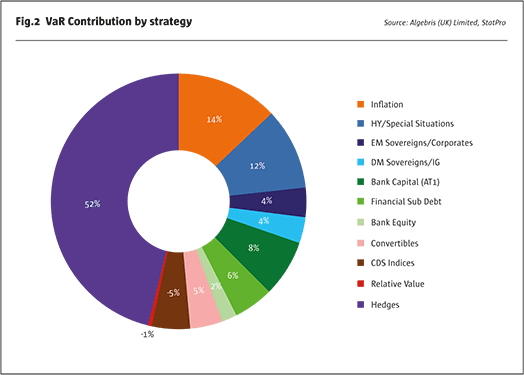

In addition to correlation, risk management conducts stress tests for macro, tail risks, and drawdowns. Value at Risk (VaR) is of course capped at the standard UCITS metric of 20% at the 99%, 20-day level; since inception the 20-day VaR has been well within this, reaching a maximum of 6%. The fund has additional, internal concentration limits that are somewhat tighter than some of the UCITS levels: exposure per issuer is subject to a 5% ceiling, and per sector is capped at 20%. Though subject to the usual UCITS constraints on liquidity, risk and investible assets, Gallo’s fund trades a far wider menu of instruments than do many fixed-income or credit UCITS. His investment universe includes corporate bonds, financial paper, credit default swaps, equities, options, convertibles, mortgage securities, indices and bespoke index baskets. A current snapshot of trade types appears above.

The fund pursues three core strategies. The first is buying yield for positive carry across corporate, bank and sovereign paper, on a risk-weighted basis, factoring in volatility, correlation and liquidity. This bucket essentially competes with other unconstrained fixed income funds, but Algebris adds a second bucket: macro hedge overlay, so that a macro fund and a credit fund are combined within the same wrapper. Though the carry bucket is typically 70-130% net long, there is flexibility for the hedge overlay to tactically take the fund to a net short position. The third strategy draws upon the repertoire of relative value trades within, between and across geographies, sectors and credit sub-asset classes that made up the majority of Gallo’s recommendations as a sell-side strategist at RBS.

RBS track record

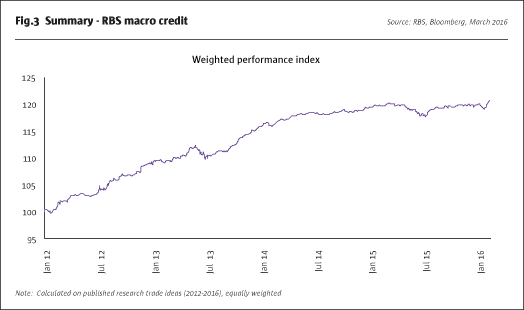

Gallo’s credit macro team includes Aney and Pan from his team at RBS, which was ranked as one of the top three in Europe, four years in a row. Gallo’s published recommendations as Head of Global Macro Credit Research at RBS, between 2012 and 2016, have been time-stamped with hypothetical performance from 97 trade ideas calculated (shown in Fig.3). The track record and rationales for trades can be reviewed by investors.

Gallo’s “hit rate”, or percentage of profitable trades, was 75%. Most of his research ideas were relative value trades, often within corporate capital structures or sectors, and/or between geographies. Intra-sector trades included selling protection on Morgan Stanley and buying it on Goldman Sachs. International trades may have involved buying European credit versus shorting Australian credit, or selling European banks while buying US banks. Some trades were both intra-sector and international, such as short Spain’s Santander against long Italy’s Intesa. But the team also made some strong directional calls, particularly around the European crisis. “We started bearish but steadily recommended longs in Greece, Spain and Italy as ECB action became clearer,” Gallo recalls. He also made a short call on Brazil during the so called “Caipirinha Crisis” in 2015 and a subsequent long on Argentina. Other outright calls were made on sub-asset classes, including European bank senior and subordinated debt; European corporate hybrids; Austrian banks, and “Yankee” bonds. Portfolio hedging recommendations sometimes used indices such as iTraxx Crossover and iTraxx Senior/Subordinated Financials.

Big picture macro view

The Silver Bullet report that Gallo writes is still published regularly on the Algebris website and provides an extensive explanation of his macro outlook. Here, we highlight a few key themes. While Gallo is optimistic about cyclical reflation in 2017, his multi-year macro view is that long term, structural economic growth rates will remain subdued. An ongoing debt overhang is one reason. Granted, the US economy may have slightly de-levered post-crisis, but Gallo’s calculations (based on aggregating household, corporate, bank and capital market debt) suggest that debt percentages of GDP have risen to 274% in China, 304% in Europe, and 374% in the UK, with the US still high at 349%. For Gallo, the next credit cycle downturn could be hard to handle, but he does not see a hard landing in China. Gallo expects that China’s FX reserves and extra government borrowing can roughly counterbalance potential capital outflows and losses on NPLs at perhaps around 15% of GDP. Gallo views China’s recent uptick in growth as temporary and expects that it will revert to steadily and naturally decelerating growth, in line with the typical pattern for countries of its GDP level.

Indeed Pan, who was in Asia when we visited Algebris in London, says “China’s slowdown risk could resurface in 2017, given fading stimulus effects, uncertainty over the top leadership reshuffle in October and November and potential tit-for-tat trade disputes with the Trump administration. The bottom line is more yuan depreciation, hurting Asian credits which currently trade at record-tight levels. Hence we avoid Asian credits, where we think valuations don’t fully compensate the risks.” As the fund is not constrained by any benchmark tracking error target, there is no need to maintain an “underweight” stance in Asian credit – Algebris can have virtually zero exposure.

Gallo laments that QE has deprived the world of Schumpeterian “creative destruction”, arguing that “as QE prevented bank and corporate restructuring, we now have too many zombie institutions, and this is why labour productivity growth has been slow, flat, or even negative in economies such as the UK.” Gallo, who contributes to the Financial Times and the Wall Street Journal, is authoring a book on central banks and QE, and thinks the associated resource misallocation has artificially prolonged the life of “zombie” banks and corporates. If QE softened the blow of the recession, it would also result in a shallower recovery. Neither QE nor NIRP can continue forever, in Gallo’s view, and banks plus insurers will benefit most from higher rates.

Bond bubble bursting

Gallo contends that “the constructive solutions to slower economic growth all involve investment in education and training that is very long-term.” Shorter term, a range of outcomes is possible. Gallo’s best-case scenario would see “a Fillon or Macron win promoting reform in France; a similar agenda in Italy; a credible Juncker plan for the EU, and Germany spending more to stoke at least modest inflation of 2%, which would result in less ECB stimulus.” A worst-case scenario would see more populist politicians, such as Le Pen, winning power; beggar-thy-neighbour devaluations, mounting protectionism and inflationary spending. A base case projection involves “muddling through” with a small pickup in inflation and growth. Gallo can envisage several economic scenarios but expects all of them would be bad for government bonds. “The low-for-long era is over. Central banks, fiscal activism and populism pricked the bond bubble in 2016. 2017 will be a lot worse for bond investors, and the aftershocks of the burst will spread across many other assets,” he forecasts. On US presidential election day, Gallo’s fund was running negative duration of around eight years, in a mix of US and EU government bonds. He claims that “no traditional bond fund was short at that time, even though it has now become a consensus trade.” The short bond sleeve has shifted from an emphasis on US Treasuries last year to Gilts, Bunds, French OATs and Italian BTPs this year.

But this long inflation view is only one of the baskets of trades illustrated earlier. Gallo opines that pure macro bets are too binary, particularly in risk-on/risk-off markets, so the strategy also has some single-name positions in emerging markets and high yield. Gallo views carry as the foundation of returns and covering management fees, and aims to add alpha on top.

Reflation trades: especially in Europe

If last year the fund was “a high-yield bond with negative duration,” Gallo describes his portfolio in January 2017 as “a kind of convertible bond that has very short dated or flat duration; long inflation upside, long default risk and [that is] hedged for spread volatility.” Some fund managers are open about their desire to “front run” central bank asset purchases and have bought, or continued to own, negative yielding assets in the hope of further appreciation. Gallo, in contrast, is avoiding the richly valued beneficiaries of central bank purchases and focusing on assets that gain from the firm’s macro views and meet its bottom-up criteria. The investment process blends top-down macro analysis of politics, business cycles, and monetary and fiscal policy, with bottom-up micro analysis of companies, balance sheets, and dialogue with management.

Credit stock picks are geared towards names that can benefit from rate rises, such as bank debt, floating rate paper and debt collectors that buy and recover bad credits. The fund is also long selected European consumer names that offer wide spreads versus US peers. Gallo found some post-Brexit bargains in the UK but has also had some shorts in UK consumer discretionary, in Gilts and the pound where disposable incomes could be squeezed by inflation. Long energy E&P is obtained through convertibles. Gallo has opportunistically swooped on names that sold down on adverse news-flow – he bought debt of both Fiat and Deutsche Bank after they got fined.

Mispriced and wrongly-rated sovereign debt

All trades must have an 8/10 conviction score to enter the portfolio, and Gallo is highly selective in terms of the EM sovereigns he wants to own. “Many markets in Africa, Latin America, Asia and Eastern Europe have become over-valued, being viewed as DM bond proxies, and lower energy prices will lead to higher debt to GDP ratios in the Middle East,” he says. Gallo still holds some Argentina paper, though it was a much bigger trade two years ago. In early 2017 Gallo has scaled back EM exposure in response to the rally but Aney still argues that “in a post-populist Kirchner era and with a fragmented opposition, Macri still has some room to push through reforms. Argentine credit offers good value, having underperformed the EM rally while being relatively insulated from a potential China slowdown.”

Gallo also perceives mispricing in Europe, suggesting that “short-term debt in Greece is yielding 8-9%, which is as much as in deep emerging or frontier markets such as Ghana, Zambia or Mongolia.” Gallo is cognisant of election risks in Greece, but expects that reform, privatisation and more disbursements of bailout funds will occur, pointing out that “the entire Greek economy is the same size as the economy of the German city Dusseldorf.” Gallo views CCC credit ratings for Greece as wrong, as “the agencies are slow to update their ratings” – though Cyprus has been upgraded to single B after bolstering its banks’ capital ratios and getting NPLs under control.

European banks

TCW, which manages one of the world’s largest active bond funds (TCW Total Return Bond Fund, which has lost around 5% between July 2016 and January 2017 since Gallo started his fund), has reportedly exited European bank debt. Differently, Algebris find selective value in the segment. Gallo views Europe as the largest source of mispriced credit because “everyone thinks Europe is un-investible partly due to politics, so investors are ignoring Europe.” The continent’s beleaguered banks are despised by many investors but Algebris identifies value. “Additional Tier One [AT1] paper, including CoCos, issued by Italian banks Intesa or Unicredito, could benefit from a steeper yield curve, more issuance, and the resolution of Monte Paschi,” argues Gallo, who also favours issues from Spanish banks Santander and BBVA, and French bank Societe Generale. Gallo does not like Portuguese banks, however. Portugal’s BES bail-in surprised some, and caused losses for many investors. Gallo believes that the sovereign “only stays investment-grade with DBRS because it is eligible for ECB QE.”

Equity sleeve

Though 90% of the fund will typically be in credit (both fixed-income and floating rate), there is space for some equities, mostly in option form, either to protect from downside risk or to buy upside. For instance, Gallo judges some bank valuations to be attractive at 0.7 times book value, with scope for tailwinds from higher interest rates, a steeper yield curve and higher inflation. He constructed option spread trades on a number of banks. Option spreads were chosen because a steep skew meant that the cost of a near-the-money call option structure could be substantially defrayed by selling more distant call spreads, allowing Gallo to capture upside between 5% and 20% with moderate net outlay of option premium. As bank stocks rallied, Gallo has taken profits and lightened up the position.

Diversification and liquidity

Diversifying among asset classes is partly designed to tap into more pockets of liquidity, and Algebris’ analysis suggests that the fund would be much less liquid if it was restricted to the high-yield bond markets. “We combine multiple strategies to avoid being tied to the technicals or illiquidity of one market,” Gallo says. Algebris estimates that most of the book could be liquidated within three days. The fund can take positions in areas such as tier-one debt that might not be large enough for the biggest funds to build a meaningful position, says Gallo, who estimates that his fund’s capacity is between $1 billion and $2 billion.

Macro Activism

Activism is most often associated with investing in listed companies, but can also apply to macro investing. Paul Singer’s Elliott Management is famous for its investments in Argentinian sovereign debt, “holding out” and arguing for a higher offer that did eventuate, and for his tenacious legal pursuit of debtors, such as the government of Peru. But this is not the Algebris style of macro activism. Algebris seeks to offer inputs into macroeconomic and financial regulatory policymaking and Gallo has participated in two working groups on financial stability, at the European Central Bank (ECB) and European Securities and Markets Authority (ESMA). The ECB group focuses particularly on financial stability and non-performing loans. Algebris also engages with policymakers on a more ad-hoc basis. For instance: “If Greece needs to reform, we will talk to the government, publish our views, and try to create a win-win situation,” Gallo says. This interest in policymaking matches that of Davide Serra, who received the Young Global Leader designation from the World Economic Forum.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical