After many years playing the role of Cinderella, European equities began to get net inflows in 2017. The asset class is amongst the least efficient global equity markets, with a higher proportion of active long-only managers outperforming indices than in other regions. Small and mid-cap stocks in Europe may exhibit even greater inefficiency, given little or no sell side analyst coverage, and limited buy side following. The AC Tiger Value Fund, which is available on Aquila Capital’s Associated Manager Platform, is a long/short AIF strategy mainly trading small and mid-cap stocks, which have outperformed the broad, large cap dominated, indices since 2009.

Alpha and asymmetry

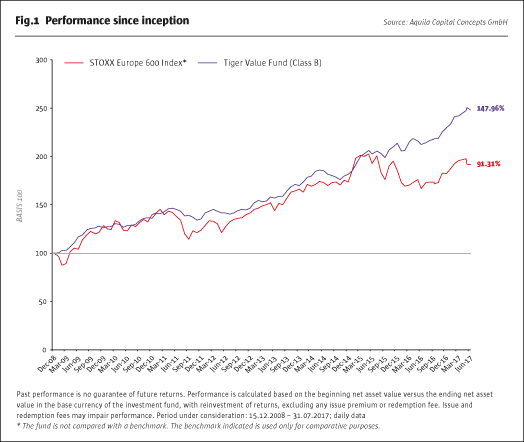

The past eight years of rising markets have provided some tailwind for any net long strategy. But the fund’s Investment Advisor – Tiger Asset Management – is not a beta jockey and nor does it use leverage to enhance returns. When The Hedge Fund Journal met with the fund in June 2017, the gross exposure was at 84% and the net long exposure was at 35%. The strategy has outperformed the long only equity indices with low gross exposure, low net exposure, moderate volatility and low market correlation. The AC Tiger Value Fund has annualised at over 11% while maintaining volatility below 7%, as shown in Fig.1.

This implies substantial alpha generation as the net exposure has fluctuated in a range between 20% and 60%, and the strategy has outpaced a 100% long exposure to equity index benchmarks. Moreover, an estimate of beta-adjusted net exposure (calculated for internal purposes) often turns out to be lower than the raw figure. Tiger Asset Management does not publish this metric because its Head of Research, Peter Irblad, has been around for long enough to know that “historical beta is not a good guide to the future. For instance, stocks can become more volatile when they get overvalued and then their beta really explodes.” Irblad’s objective is for the volatility of the strategy to come from idiosyncratic news-flow relating to specific companies, and not from general market movements. The AC Tiger Value Fund’s historical correlation to the Stoxx Europe 600 of -0.02 confirms low sensitivity to equity market movements.

Of course, some participation in market upside is desirable and downside volatility is what needs to be controlled. In broad terms, if a hedge fund manager can capture two thirds of the equity market upside but only suffer one third of the downside, they will usually beat the market over time and show much lower volatility. The Tiger Value Fund has done even better than this, with an asymmetric ratio of upside to downside capture. If we look at the fund’s rolling three-month performance around the ten best and worst months for the Stoxx Europe 600, the strategyhas participated in 58.7% of the upside but only 14.9% of the downside.

Manfred Schraepler, Head of Financial Assets at Aquila Capital, recognised early on that “the AC Tiger Value Fund’s asymmetric risk-return profile makes it an attractive investment proposition for investors who are seeking to add absolute return strategies to their portfolio.”

Shorting and hedging

Modest gross and net exposure are two reasons for the strategy’s low volatility. A further three factors are single stock shorts, index shorts and portfolio hedges. Tiger Asset Management’s hedging overlay of put options on indices has helped to curtail or avoid drawdowns. When the increasing delta of puts kicks into action, it can swiftly reduce the strategy’s net exposure: down from 40% to 15% in summer 2016 for instance. But “shorting is not just for hedging or smoothing out portfolio volatility. The short book is intended to generate absolute returns,” stresses Matthias Rutsch, Portfolio Manager and Co-Founder, and it often has. “We generated positive returns on our short book in 2011,” he recalls. While 2011 was a year that saw negative performance in European equities, absolute profits on the short book (which includes hedges and shorts) in three other calendar years: 2014, 2015 and 2016, are more remarkable as these years were positive for European equities.

Irblad is not afraid to look for ‘terminal shorts’, which could involve bankruptcy or fraud risk while others may be overvalued companies with foreseeable triggers for derating. Renewable energy, including solar and wind, has been an important short theme based partly on AC Tiger Value Fund’s accurate anticipation that subsidies would be scaled back. Tiger Asset Management does not usually disclose short names publicly. Very seldom has the fund surpassed the European disclosure threshold of a 0.5% short position in a company; shorts of 0.2% or more are privately reported to German regulator BAFIN.

Different flavours of ‘value’ Investing

Considering that Tiger Asset Management are value investors, the strong performance of the strategy might seem surprising. Many generic value benchmarks have severely underperformed for the past decade, and value traps have been legion for both long and short trades. But Tiger Asset Management do not indiscriminately buy every stock meeting a simple criterion, such as price to book value ratios below the market median (or short expensive names). They are running a highly selective, concentrated book, and they need to see catalysts on both the long and the short side. “We do not jump in without realising why the stock might travel down the roadmap. We categorise catalysts into strategic, operational and financial. Catalysts could include results, a CEO roadshow, new product lines, or a takeover bid,” explains Rutsch.

Focused investment universe

The potential investment universe numbers 1,500 stocks but the actual universe is currently a proprietary database of around 600 stocks, which is very different from the STOXX Europe 600 constituents because the AC Tiger Value Fund frequently invests in firms too small for the STOXX Europe 600 – and is quite focused in terms of geography and industry. The country purview – emphasising Germany, Austria and Switzerland – is partly based on Tiger Asset Management’s professional experience and networks, but also prizes the stable macroeconomic and fiscal conditions in these countries. The mandate allows some latitude to invest in companies that have strong links and connections with the so-called DACH countries, but might be domiciled or listed elsewhere. For instance, a Finnish-domiciled company, Ferratum, is headquartered in Berlin, listed in Germany and has a CEO in Zug. An Austriancompany listed in the UK could also be researched.

Whilst the AC Tiger Value Fund is sector-agnostic, it historically has found the best investment opportunities in media and retail; autos and transportation; industrials and materials; real estate and financials, including insurers; utilities and renewable energy; telecoms; healthcare and technology (but not biotechnology). And within these industries, Tiger Asset Management needs to have met management and carried out fundamental analysis to determine that something could be sufficiently mispriced to warrant closer monitoring. The universe of 600 stocks that Tiger Asset Management has researched is whittled down to a watch-list of nearer 200 stocks, of which only between 30 and 60 will find their way into the portfolio.

Small and mid-cap alpha

Many positions will be smaller companies. Though the strategy can allocate across all market capitalisations, some 35% of the long book is in firms with market capitalisations below EUR 500 million. Single stock shorts will tend to have market capitalisations above EUR 500 million. Primary company research, involving face to face meetings and site visits, is essential to get under the skin of the entrepreneurs and corporate managers who run these companies in Europe. The Tiger Asset Management team has roughly 300 company meetings a year and has met at least 700 companies over the past 15 years. The annual number is not so far away from the cumulative number because Tiger Asset Management builds up strong relationships and dialogues, revisiting the same firms at regular intervals. “We take notes at every meeting and record who said what. We see the same people many times and realise that some of them are too optimistic while others are overly cautious in their guidance,” says Irblad. Rutsch’s global network runs into the thousands. He keeps in touch with private equity firms and local brokers in Germany to work out which sectors and regions are in favour. “We find the CEOs of small companies are more useful than the investor relations manager from VW,” says Rutsch.

A small world

The Tiger Asset Management team fuse highly complementary skillsets. Both Rutsch and Marc Schädler, Portfolio Manager and Co-Founder, have a vast network of corporate contacts in continental Europe while Irblad is a highly analytical deep-diver. Rutsch started his career investment banking at Credit Suisse First Boston in London and Frankfurt, and in 2002 moved to what was then the largest European private bank: Sal Oppenheim. Having written his university thesis on valuation, he became head of valuation within the M&A team, advising private equity and hedge funds. Rutsch later moved to the buy side and initially obtained a German regulatory licence before moving to Switzerland. Prior to founding Tiger Asset Management, Mr. Schädler was Portfolio Manager at Nordinvest, responsible for small and mid-caps as well as for international growth stocks. He managed the EuropGrowth and WorldGrowth funds, was awarded ratings by leading agencies and also worked in the equity analysis division at Vereinsund Westbank.

In 2006 Rutsch met Irblad (a Swedish national), who has a strong and deep background in equity research. Irblad had been an equity analyst covering capital goods, IT and internet at Alfred Berg (which was later bought by ABN Amro). He then joined Deutsche Bank initially as a sales analyst (before Sarbanes Oxley rules forced him to leave the trading floor), and later focused on analysing Nordic mid-cap TMT stocks. By 2005, Irblad moved to the buy side where he met Matthias and by 2009 he had also moved to Switzerland, working for another hedge fund before joining Rutsch in 2012. The team is supported by the risk management, trade execution and portfolio management team of Aquila Capital.

Scoring and position sizing

The team synthesise a whole range of fundamental, accounting and qualitative analysis into a proprietary ten-point score. The process might start with a ‘Porters Five Forces’ analysis of clients, suppliers, competitors etc. but it goes much further and also involves talking to former employees. The criteria include companies’ position versus competitors and suppliers; their return on invested capital; and the predictability of earnings based on long term contracts, subscriptions, or recurring revenues. Alignment of interests between management and shareholders is also examined in terms of whether management are incentivised to increase the share price, return on capital or perhaps to build an empire. Shareholder structures can help to determine not only free float and liquidity but can also be pivotal in permitting a change of control, for instance if a large blocking stake is disposed of. Tiger Asset Management also monitors a range of valuation metrics versus peers, estimates intrinsic value, and keeps abreast of sell side analyst estimates. Potential to hedge part of a position’s exposure may justify a larger position size.

Ultimately the most important factor is the risk/reward. “We need to see a ratio of two times upside to downside,” says Irblad. That ratio can come down due to either share price appreciation or deterioration in the score. In either case, a drop in the estimated risk/reward may prompt scaling down the position. Tiger Asset Management may steadily slice top positions as they appreciate in value and “our scoring process takes the emotion out of the process,” says Rutsch. The score does not dictate position sizes in a completely mechanical way, but a decline in a score certainly requires a review. And if a score falls by enough, a long can become a short. Once the scoring spreadsheet is built, it can be updated in a matter of minutes in response to changing share prices, results and other news-flow.

Case Study: MLP

Frankfurt-listed MLP provides a good example of a high conviction long position that illustrates the AC Tiger Value Fund’s contrarian streak. “MLP is an ideal long candidate that we scaled into in 2016. In 2000 the stock was part of the blue chip DAX 30 index but had been a serial decliner ever since. Today it is not even in the MDAX index of mid-caps, but should soon re-join the SDAX index of small caps. Only one broker has a buy rating on the stock,” says Rutsch. Going forward, there are at least six value drivers: restructuring, a spin-off, an acquisition, corporate pension reforms, other pension changes, and the stake in FERI AG.

A restructuring has reduced annual costs by EUR 15 million. The spin-off of a banking division relieves MLP of a banking license and releases EUR 1 per share of cash that can be returned to shareholders. “MLP has made a highly accretive acquisition of a non-life insurer, which might add EBIT of EUR 20-30 million per year, doubling MLP’s profits in a few years and opening up opportunities for cross-selling general insurance,” expects Rutsch. If recent regulations banning commissions have been a headwind that is already factored into MLP’s valuation, future regulations, such as the pension reform, mandating corporate pension provision from January 2018, should be a strong tailwind. Another challenging regulatory force has been ECB QE, which has inflated insurer’s liabilities as yields fall far short of guaranteed interest rates on pension products, “but in future it is possible to sell products with fewer or no guarantees,” says Rutsch. MLP owns asset manager FERI AG, which is Germany’s leading allocator to hedge funds. FERI AG has been profiled in The Hedge Fund Journal and runs UCITS strategies including one (FERI OptoFlex) that received a ‘UCITS Hedge’ award from The Hedge Fund Journal. Given that many bond-heavy German investors have little or no exposure to alternatives of any kind – but clearly need to find new sources of returns due to ultra-low and negative interest rates – FERI AG is well positioned to capitalise on Germany’s asset management industry moving into the 21st century.

The AC Tiger Value Fund started accumulating MLP stock at a share price of EUR 2.50 to 4.00 where it was a maximum sized 6.5% position. As the stock has appreciated, the sizing has already been sliced back to 4.5%, though the fund has short term price targets of EUR 8-10 and long-term price targets of 20, roughly triple the current share price of EUR 6.50. Rutsch recognises that, like most financials, MLP could be vulnerable to a financial market crash or crisis, but the AC Tiger Value Fund put option hedges would profit in that scenario.

Active trading and risk controls

MLP is a relatively recent buy. In contrast the AC Tiger Value Fund has owned some stocks since the fund started seven years ago, but the position sizes have moved around. A core long might be 3-4% but it could have ranged in size between 1% and 7% over the nine years of running the strategy. Tiger Asset Management will rarely cut and reverse from long to short, or from short to long, immediately, but they can sometimes do so. For example, a placing can lead to a long being swivelled into a short as they wait for the seller to place a block trade. Such block trades and capital increases can motivate opportunistic, shorter term short positions, as opposed to more fundamental shorts based on expected negative catalysts.

Once a position reaches its full target weighting, hard stop loss rules apply. A 10% loss may prompt selling half of the position while a 20% loss may trigger further selling. For positions below their maximum size, there can be more flexibility. A profit warning will not necessarily force selling of a small long position, as Irblad may decide to average down and scale into a larger holding. If shorts quickly depreciate, the AC Tiger Value Fund may take a quick profit – but then return for ‘another bite of the cherry’ a few months later if the share price recovers. “To use baseball language, we are looking for singles and doubles to get to first base, not home runs,” Irblad explains.

Tiger Asset Management are also tactical and opportunistic in trading options. When options are relatively cheap the AC Tiger Value Fund is more likely to buy them. When implied volatility is at elevated levels, the strategy has sometimes sold put options as a way of entering long positions. The delta-adjusted position size will be calibrated to the same level that would apply if the strategy was instead in a cash position. This sizing is determined by how much stock the AC Tiger Value Fund would feel happy to own if they were put into it by a share price decline.

Cautious market outlook

Currently, the AC Tiger Value Fund owns some put options. Though Tiger Asset Management recognise that the global and European economy is strong, Irblad still feels that “given valuations are on the high side, rock bottom interest rates and QE ending, it is hard to envisage a fantastic ride into the sunset market. We think that volatility could return at some point.”

Consequently, the fund has some high conviction shorts in stocks at all-time highs, and tail hedges that could kick in if markets fall by 10% or more. The prospect of a sharp market correction is in fact something that Irblad relishes. Keeping a low gross exposure in normal market conditions is partly about making sure there is dry powder to take advantage of dislocations. “We can profit from market turmoil by adding risk when others reduce it,” says Rutsch. For example, in early 2016, the gross exposure briefly expanded to 120% (due to the ballooning delta-adjusted exposure of put options) and then stabilised around 105% as Tiger Asset Management took advantage of chances to buy beaten down stocks.

The best of both worlds: Aquila Group’s AIFM and UCITS platform

Aquila Capital is versatile enough to accommodate a variety of fund structures, including AIFs and UCITS. Rutsch and Irblad sit in Pfäffikon, which is one of Switzerland’s leading hedge fund hubs, being home to managers including an office of Europe’s largest activist fund, Cevian Capital. There is one administrative support staff member in Switzerland and trading, handled by co-investment advisor, Marc Schädler, takes place from Hamburg. The four-strong team may seem relatively small but they leverage the infrastructure and support of Aquila Capital, which has operations mainly at its Hamburg headquarters and legal structures in Luxembourg. Aquila Capital are strong advocates of Luxembourg as a domicile and Aquila Capital’s Manfred Schraepler (who has worked in Luxembourg in previous jobs), has contributed an article to The Hedge Fund Journal entitled ‘Luxembourg – The Better Compromise. The case for the Grand Duchy’ in December 2016.

Aquila Capital, which was founded in 2001, has dedicated staff responsible for areas including risk management, legal and compliance, administration, client relationships, investor relations, investment operations, trade execution and risk management. Drilling down into the detail of these areas reveals how much work and expertise is required and we touch on a few examples in each sleeve. Legal and compliance involves prospectuses, contracts and contract management. Product administration entails various regulatory reporting deadlines and shadow NAV calculations. Trading administration includes capital calls, complaints and other administration. Investment compliance and operations may involve pre-trade compliance, eligibility criteria, regulatory strategy, order management, trade reconciliations, broker set up, EMIR trade reporting and clearing. Sales operations provides data to providers and platforms, and helps with NDA and KYC routines. Risk management includes oversight, reporting, consulting, customised risk and portfolio reviews. Investor relations includes marketing, RFPs, DDQs, competitor analysis and client reporting. Aquila’s client advisory network is global. Corporate communications promotes managers through international PR, marketing and graphic design.

The Tiger Value Fund operates under the umbrella of Aquila Group’s AIFM, following the Group’s popular Associated Manager model. Tiger Asset Management is based in Switzerland and Hamburg/Germany and can access other EU markets through Aquila’s AIFMD passport. Aquila Group can also offer UCITS via the Alceda platform.

A taste of Aquila Group’s UCITS selection criteria

Though the Tiger Asset Management team has not chosen a UCITS structure, Aquila Capital believes that UCITS is an attractive distribution route for many managers wishing to diversify their investor base. UCITS is particularly appealing for US managers who may find that other distribution avenues (such as the AIFMD passport, national private placement regimes (NPPRs), and reverse solicitation) can be more onerous. UCITS can be distributed via the UCITS passport and/or NPPRs, which Aquila Capital are experienced at obtaining from national regulators.

But Aquila Capital is not seeking to persuade every manager to set up a UCITS. “We want to ensure an easy fit into UCITS without sacrificing performance, and have developed a quantitative and qualitative scoring model that includes other criteria,” explains Schraepler. A pattern of stable, through-the-cycle returns, based on a theoretically and empirically plausible, transparent and repeatable, process, is sought. The total expense ratio or ongoing charge ratio of the fund should also be acceptable. Operational due diligence (ODD) hurdles also need to be surmounted. ODD is carried out by an independent, external consultant, looking at issues including operations, legal matters, accounts, business stability, business recovery, and strong service providers.

Capacity, assets and structure

The AC Tiger Value Fund has half of its assets locked up and “we are popular with longer term investors such as family offices and wealth managers,” Rutsch points out. The fund structure is also a Luxembourg AIF partly for legacy reasons. “When we set up the fund with seed investors they thought that an AIF would offer more flexibility than a UCITS structure,” recalls Rutsch. Inflows have accelerated over the last 18 months but there is still much more capacity available. The strategy’s nine-year track record is already well in excess of the three years that many institutions like to see and assets are also above a common comfort level. “In USD terms, we have already passed the magic $100 million figure,” says Rutsch. Capacity for the strategy is estimated at roughly $500 million, which seems appropriately conservative for these Teutonic managers.

Main image (clockwise from top left): Marc Schädler Portfolio Manager and Co-Founder, Tiger Asset Management; Matthias Rutsch Portfolio Manager and Co-Founder, Tiger Asset Management; Manfred Schraepler Head of Financial Assets, Aquila Capital; Peter Irblad Head of Research, Tiger Asset Management.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical